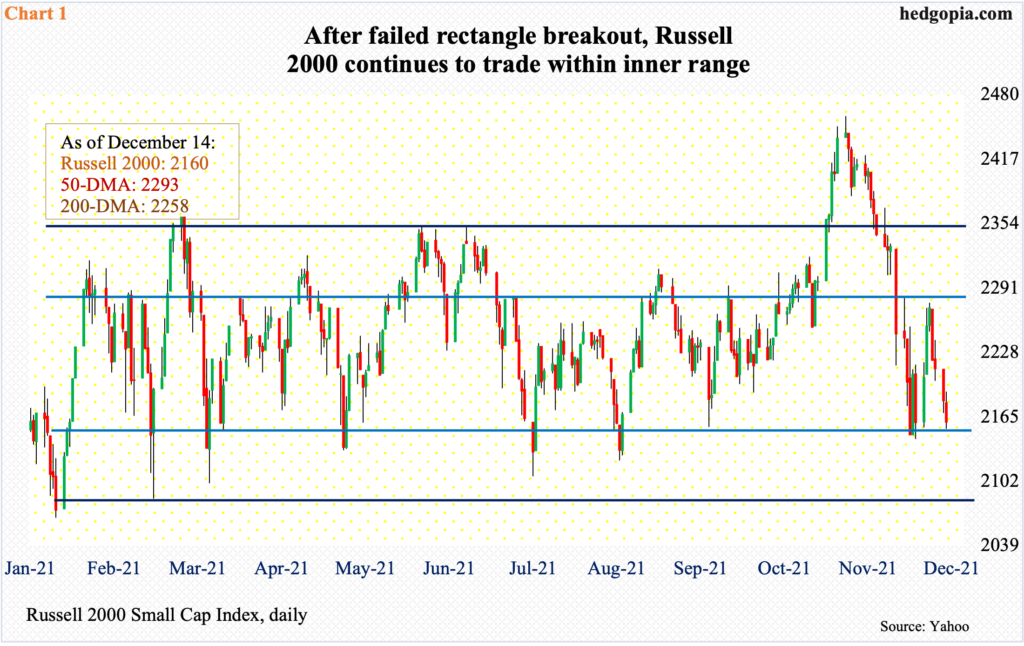

The Russell 2000 has been going back and forth within a rectangle for a while now. Selling the rip and buying the dip within this box has worked. Once again, the index is at/near support.

Traders continue to sell the rip and buy the dip within a well-established rectangle on the Russell 2000. For nine months now, the small cap index has been rangebound between 2350s and 2080s, and between 2280s and 2150s within this box (Chart 1).

Early this month, bulls defended 2150s for three straight sessions before rallying the index hard. By the 8th, they were testing 2280s resistance, where selling picked up. On Tuesday, it again tested the support, with a session low of 2153 and close of 2160.

As things stand, if bulls are unable to save 2150s, it is unlikely they will lose 2080s, or 2100, right at this moment.

Early last month, the Russell 2000 broke out of the box and rallied as high as 2459 by the 8th but only to then lose momentum. Breakout retest failed, and by the 19th (last month) it was back below the upper end of the range.

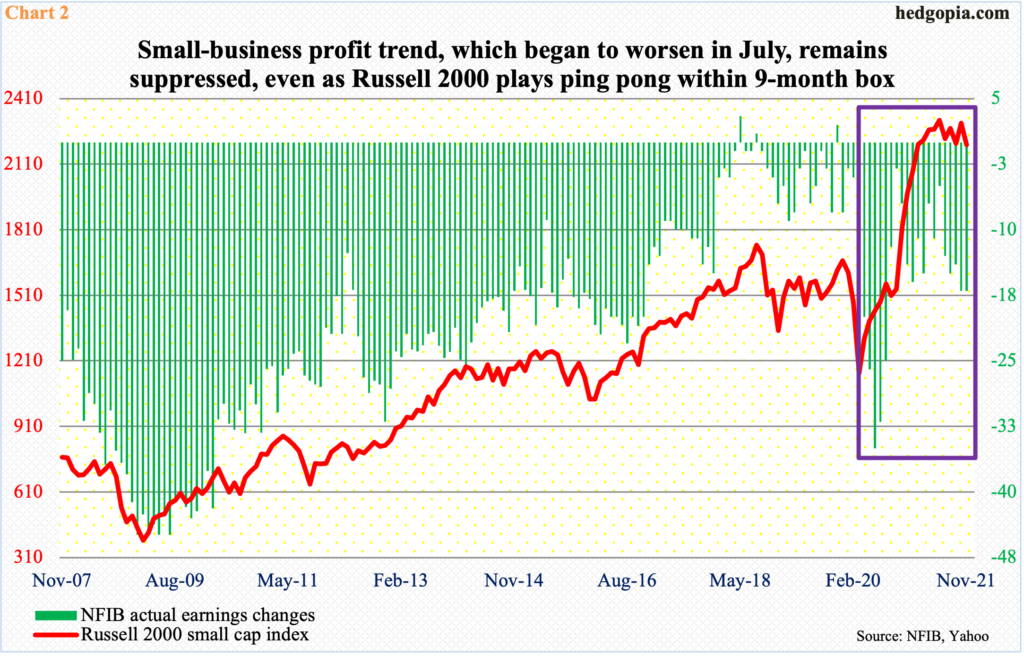

The rangebound action has gone on amidst a deteriorating small-business profit trend since July this year.

In June, the National Federation of Independent Business’ actual earnings changes sub-index hit minus five, before worsening to minus 17 in October and November.

In fact, as can be seen in Chart 2, the metric tends to correlate well with the Russell 2000 – except the two have gone their own ways recently.

Considering the worsening profit picture, one would think the Russell 2000 would have fallen out of the box by now – to the downside, of course. It is quite possible small-cap bulls are tempted to stay put as they look out into next year’s outlook.

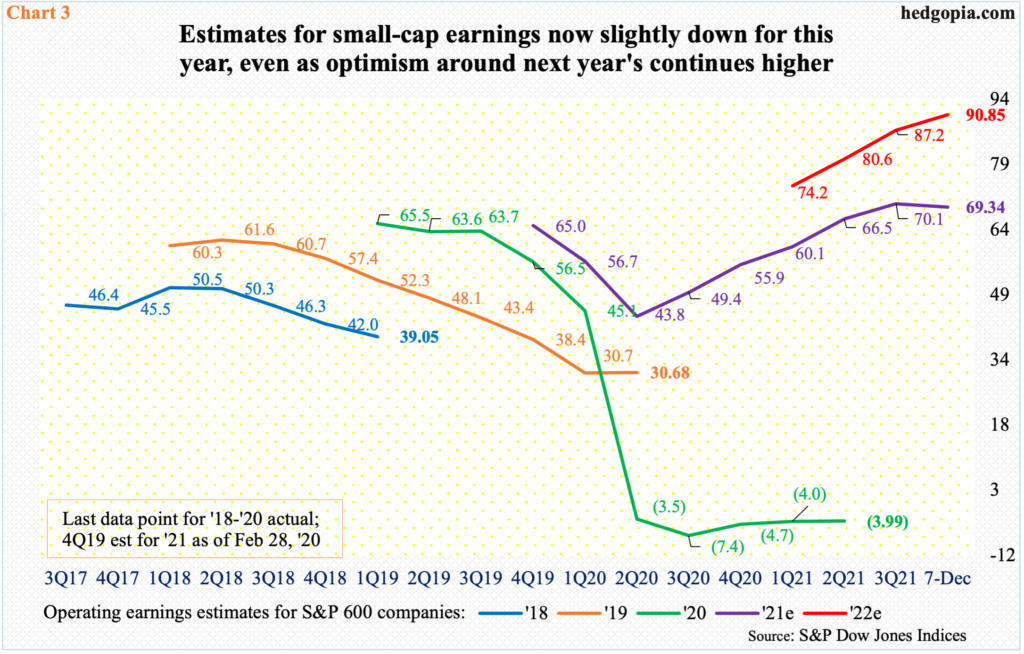

In keeping with the NFIB sub-index, operating earnings estimates for S&P 600 companies have now begun to head lower for this year. In the week to November 3, as more 3Q21 results came in, 2021 estimates peaked at $71.59; in the week to December 7, this stood at $69.34.

Nevertheless, 2022 estimates continue higher, with the latest projection at $90.85. As a result, the gap between 2021 and 2022 estimates is widening (Chart 3). If next year’s estimates come through, earnings would have grown 31 percent.

Small businesses inherently have larger exposure to the domestic economy. So, for sell-side earnings optimism to come to fruition next year, the US economy needs to continue to show this year’s momentum.

Enter the dynamics around the Federal Reserve and its most recent hawkish tilt.

The Fed has a dual mandate of maximum employment and price stability. Post-pandemic, the economy took a severe hit. As jobs vanished, the central bank solely focused on its jobs mandate. Fast forward to now, the economy has recovered, with several metrics at new highs, including nominal and real GDP.

This at the same time put upward pressure on inflation. November’s CPI report, out last Friday, showed headline and core consumer inflation growing 6.8 percent and 4.9 percent year-over-year, which were the steepest increases since June 1982 and June 1991 respectively.

Jerome Powell, Fed chair, recently said he would no longer use the word “transitory” to describe inflation. He also floated the idea of accelerated tapering of bond purchases, which at the current pace of $15 billion a month is set to complete by the middle of next year. This would allow them to begin to hike sooner than previously expected. In the futures market, traders currently anticipate up to three 25-basis-point hikes in the second half next year. The fed funds rate remains zero bound since March-April last year (Chart 4).

There will probably be some color on this later today as the year’s final FOMC meeting concludes, followed by a Powell press conference. Small-caps’ reaction is worth watching. The collective wisdom of markets needs to conclude that rate increases would not be tight enough to begin to hurt demand, thus the economy.

Thanks for reading.