The SPDR Consumer Discretionary ETF (XLY) finds itself at a crucial juncture. And those that are short likely have some decisions to make.

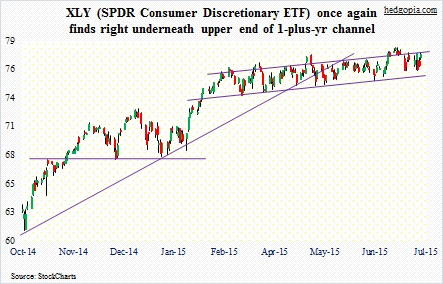

Heading into today, over the past 12 sessions XLY has made a high of $78.31 and a low of $76.14. And last Friday, it rallied 1.5 percent to close at $77.67. In the process, it is once again sitting right underneath the one-plus-year channel it has been in. It is a slightly rising channel, and the upper end has stopped rally attempts for over a year now. There have been two false breakouts – one in April and one in June.

The question is, will there be a breakout again? And, if so, will it be false or genuine?

The medium-term outlook probably sides with the bears, and near-term maybe with the bulls.

Last week, XLY rose 0.6 percent, versus a flat S&P 500 Index. On a daily chart, conditions are oversold on all major U.S. indices. Even a modicum of good news – perceived or real – surrounding Greece in particular can cause shorts to cover. Some of this phenomenon was witnessed last Friday.

Tuesday, retail sales for June will be published, where momentum has slowed down. In the last six months, only three are up month-over-month, although the last three have been up. If the recent momentum continues, that can ignite trader interest in consumer discretionary stocks. The path of least resistance near-term is likely up.

In this scenario, shorts can make use of a short collar, which, while staying short for the medium-term, will participate in potential rally near-term. Weekly July 17th 77 puts are selling for $0.46 and 78 calls for $0.49. A short collar can be established for a debit of three cents (short put and long call combined with the existing short).

In our hypothetical trade that we have highlighted over the past six weeks, this looks like the best options trading strategy right now.

To refresh, on June 1, June 5th weekly 76.50 naked calls were written for $0.47, resulting in effective short at $76.97. If not for the use of options, this trade right now would be down just under one percent. But thanks to $1.20 in premium collected from three weekly short puts, the effective short price has gone up to $78.17.

Another weekly 77 short put effectively raises the short price to $78.63 should XLY rally this week or cover for a profit of $1.63 should it trade below $77. This, however, will not protect the position from a breakout, should it occur. Alternatively, we can simply cover for $0.50.

Given decent odds of strength in XLY this week, the above-mentioned short collar options strategy makes sense – which will take part in upside potential past $78 or close out the position for a profit of $1.14 should it drop below $77.

Thanks for reading!

Please keep in mind that this article was originally published yesterday (July 13th) by See It Market, where I am a contributor.