Stocks need fuel to rise. Be it plain-vanilla inflows, be it rotation from other asset classes like bonds, be it corporate buybacks, or be it squeezed shorts. The latter has played a big role particularly since the October 15th bottom in U.S. stocks. Massive squeeze has taken place. And that tailwind is drying up.

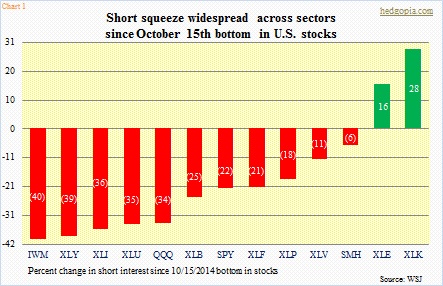

In the latest period ended December, there was more short-covering. SPY rose 3.6 percent in those two weeks, and the ETF’s short interest dropped 4.6 percent. And it is true pretty much across the board, except for healthcare. But even in that sector, short interest is down from the middle of October (Chart 1).

The 11-percent decline in XLV since October 15th is nothing compared to what other sectors have experienced. Short interest in IWM (small caps) is down 40 percent, consumer discretionary (XLY) down 39 percent, industrials (XLI) down 36 percent, and on and on.

These are massive numbers, and should/could have implications for stocks going forward. If you look at a chart of, let us say, IWM, the ETF rallied hard on the 17th (December) and for the next seven sessions it continued to inch higher in low volume. Shorts were obviously forced to cover as the ETF seemed to have broken out, even as there was a lack of genuine buying interest, otherwise it would show up in volume.

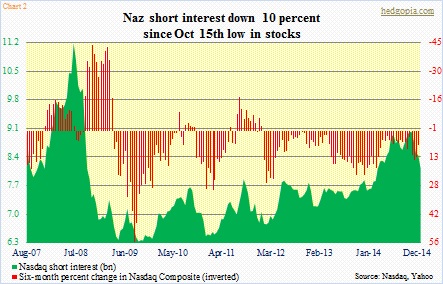

This is also evident in major indices. By mid-October, short interest on the Nasdaq Composite had risen to nine billion, which was the highest since end-September 2008. The past five weeks, short interest has done nothing but go down (Chart 2). It is down 10 percent. The end-December total of 8.1bn is now the lowest since mid-March last year.

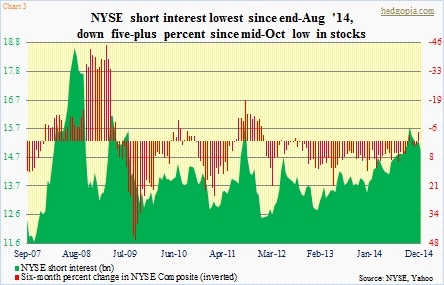

Over on the NYSE, the trend is similar. The end-December count of 14.9bn was the lowest since the end of August last year. Since the October 15th low in stocks, NYSE short interest is down 5.4 percent (Chart 3).

Nothing says short-covering cannot continue. That will be the case if stocks get another leg higher. Historically, short interest on both indices remain high. Stocks do like to climb a wall of worry. At this juncture, for that to happen, buying pressure needs to come from other sources. Barely three weeks ago, U.S. stocks attracted massive $39bn in inflows in the week ended Christmas Eve — biggest since 1992 (courtesy of Lipper). Buying pressure needs to come from elsewhere.