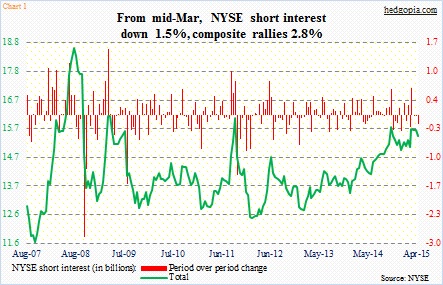

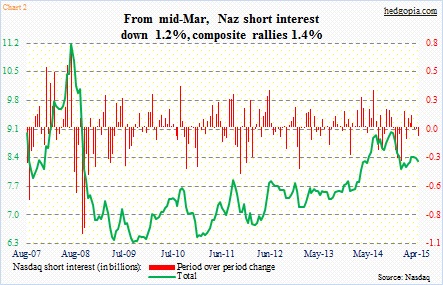

In each of the past three reporting periods, short interest has dropped on both the NYSE and Nasdaq. Not a whole lot. But it is a decline nevertheless. Since the middle of March through end-April, it dropped 1.5 percent on the NYSE (Chart 1) and 1.2 percent on the Nasdaq (Chart 2). During that time, the NYSE rallied 2.8 percent, and the Nasdaq 1.4 percent. (The S&P 500 was up 1.6 percent in those six weeks.)

If shorts cover in the face of such a trivial rally, what would happen if these indices manage to break out of the range they are in? What are the odds of that happening? Makes you wonder.

The NYSE has been going sideways since last June. There was a brief breakout two weeks ago, but bulls were unable to build on/hold on to that. The Nasdaq briefly bolted out of 5000 three weeks ago, but that did not last either. And the S&P 500 has been going sideways for nearly three months now.

So the potential for a squeeze is there. But for that, indices need a breakout, which is going to be a feat in and of itself, given signs that momentum is weakening. Small-caps, in particular, do not act well.

Money is flowing out of U.S. equities. In April, $13 billion came out of SPY (courtesy of FactSet). The antidote to that is buybacks.

In April, large U.S. corporations authorized a record $141 billion in buybacks – a monthly record (courtesy of Birinyi Associates). Last year, $680 billion was spent in buybacks. So far this year, $398 has been announced; at this pace, another record year could be in the making.

This is no news. Longs are aware of this – a primary reason why they are not selling in the first place. But knowing this why do shorts continue to have an elevated level of bearish bets? Yes, they cover here and there, but short interest remains elevated.

Stubborn, yes, but this perhaps also speaks of their level of conviction. For shorts to be this persistent, they have to believe that a breakout is not looming. And/or should there be one, it will be fleeting. Time will tell. One possible benefit of the elevated short interest is that pullbacks/corrections can be shallow, as has been the case for a while now.