Intel (INTC) reports later today. This is coming at a crucial time as far as where SMH (VanEck Vectors Semiconductor ETF) is situated.

Texas Instruments’ (TXN) results were received favorably Wednesday, with the stock up 4.8 percent. It accounts for five percent of SMH’s assets. Before this, Taiwan Semiconductor’s (TSM) was received well as well. It reported on the 16th and closed Wednesday at $52.95, up from $49.66 on the 15th. TSM accounts for 12.6 percent of SMH’s assets.

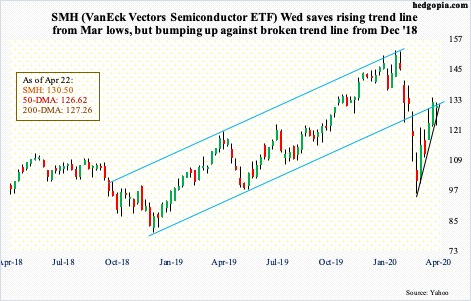

TXN’s results helped pull up the whole sector, with SMH rallying 5.7 percent Wednesday. Tuesday, the ETF had lost both its 50- and 200-day moving averages, which were reclaimed Wednesday.

More importantly, SMH is essentially sitting on a rising trend line from March 18th (black line in chart above). This support was breached Tuesday but reclaimed Wednesday. Concurrently, the ETF is bumping up against the underside of a broken trend line from December 2018. The breach took place in the February-March selloff.

As things stand, bears could be eyeing an opportunity to short. At the same time, should the ETF decisively push up and back into the channel, they likely will be forced to cover. Potential fuel for squeeze is not that elevated, nevertheless at the end of March, SMH short interest was 11.3 million shares – a three-month low. Hence the significance of INTC’s results. It accounts for 10.9 percent of the ETF.

Among the majors, AMD reports next Tuesday (28th) and QCOM Wednesday (29th). They respectively account for 5.1 percent and 4.8 percent of SMH’s assets.

Thanks for reading!