For the second week in a row, Investors Intelligence bulls were just under 65 percent. As elevated as this reading is, we are in a seasonally favorable period. If bulls are to take advantage of this, they would have to have buying power to continue to defend 3580s and 3640s on the S&P 500.

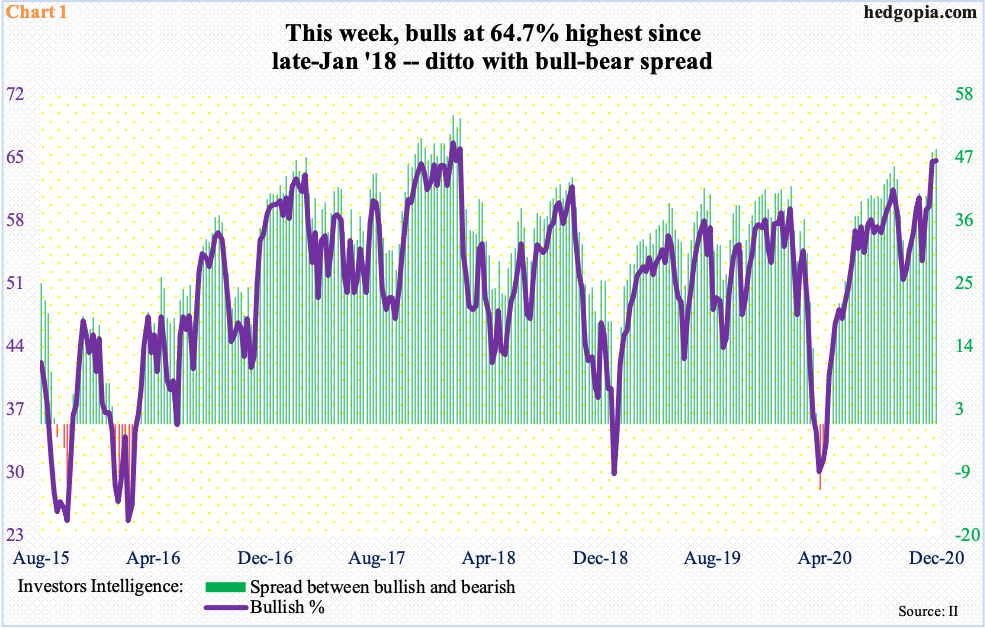

Investors Intelligence bulls continue to kick up dirt. This week, their count edged up one-tenth of a percentage point week-over-week to 64.7 percent, which is the highest since late January 2018. Bears were down five-tenths of a percentage point to 16.7 percent – a 12-week low. The bull-bear spread as a result rose to 48 percent, which too is the highest since late January 2018 (Chart 1).

Sentiment is elevated. Historically, bulls tend to hit 55 to 60 percent when equity indices hit new highs, which is the case now. This at the same time can reflect fully invested positions. Therein lies the rub.

This phenomenon is also evident among professional money managers, whose sentiment is captured by the NAAIM Exposure Index, which printed 106.4 last week, and 106.7 before that. (This week’s number will be out today.) The index represents the average exposure to US equities by National Association of Active Investment Managers members. Readings north of 100 are rare. Going back to July 2006, there have been 22 100-plus readings, six of which occurred in the past four months.

For contrarian investors, risks are rising. The only thing is, we are in a seasonally favorable period. As a matter of fact, newsletter writers surveyed by Investors Intelligence – or, for that matter, professional money managers represented by NAAIM – could very well be positioning for this.

The question is if bulls can continue to keep up the pressure even though sentiment is already extended. It has happened in the past. Before peaking in late January 2018, Investors Intelligence bulls registered 60 percent or higher for 17 consecutive weeks. This week’s 60-plus reading is the second in a row, and third in last six.

Encouragingly for bulls, they have maintained their bullish posture even though indices have been giving out signs of fatigue.

On September 2, the S&P 500 retreated after tagging 3588.11. Five weeks later, on November 9, post-positive vaccine news from Pfizer (PFE), the large cap index eclipsed that high by tagging 3645.99 intraday but only to finish at 3550.50, for a shooting star session. This was followed by a three-week sideways action. This Monday, the index (3669.01) came under slight pressure, but bids were ready at 3590s, just above the September 2nd high. Tuesday, it posted a new intraday high of 3678.45, with both the open and low in 3640s. Wednesday, early weakness was once again bought at 3640s. In other words, bulls are stepping up in defense of both 3580s and 3640s (Chart 2). As long as this continues, the path of least resistance is higher, regardless how overbought the daily chart is. A loss of these levels has the potential to negatively impact sentiment and swing momentum to bears’ favor – at least near term.

Thanks for reading!