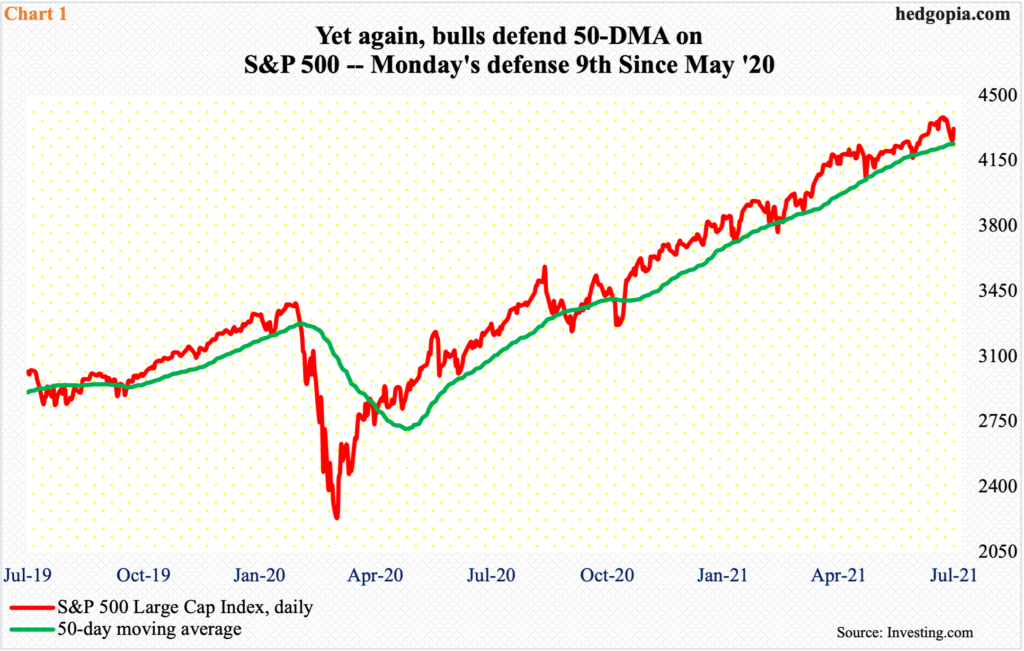

Monday’s selloff was bought – again. Since May last year, the 50-day on the S&P 500 has elicited buying interest nine times. Next week’s June-quarter results from the top six US companies will decide if this trade works this time or not.

No sooner than the S&P 500 lost 69 points on Monday than it vigorously snapped back with a gain of 65 points on Tuesday. From last Wednesday’s all-time high of 4394 through Monday’s (this week) low of 4233, the large cap index dropped 3.7 percent. And that was viewed as a dip-buying opportunity.

Once again, bulls used the 50-day as an anchor. At one point on Monday, the S&P 500 was down as much as 2.2 percent, with the intraday low in slight breach of the average. Then bids showed up; by close, the large cap index ended the session down 1.6 percent to 4258 – right on 4250s support.

This was the ninth time since May last year the 50-day elicited buying interest (Chart 1).

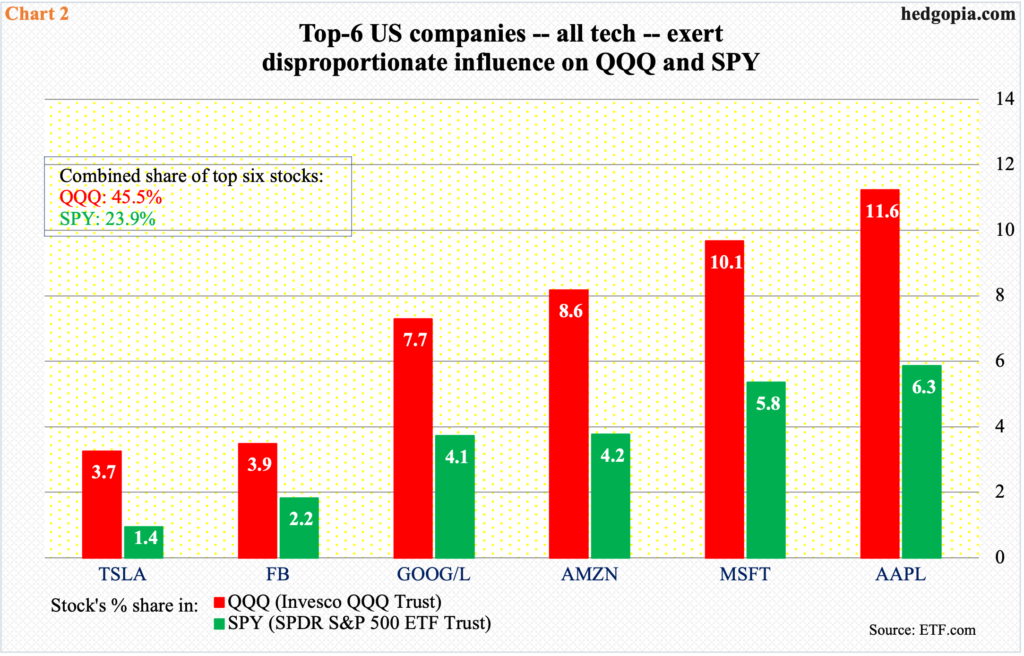

Besides the average, the fact that next week the top six US companies – all tech – report their June quarter also likely piqued bulls’ interest.

Tesla (TSLA) reports on Monday, Apple (AAPL), Microsoft (MSFT) and Google owner Alphabet (GOOG) on Tuesday, Facebook (FB) on Wednesday, and Amazon (AMZN) on Thursday.

They account for a big share of leading equity ETFs such as SPY (SPDR S&P 500 ETF) and QQQ (Invesco QQQ Trust), making up nearly 46 percent and 24 percent respectively. There is truth to as they go so go the S&P 500 and the Nasdaq 100 index.

Currently, except for TSLA, they are all within earshot of their all-time highs. On Tuesday when the S&P 500 rallied 1.5 percent, AAPL was up 2.6 percent and TSLA 2.2 percent, but the remaining four underperformed the market, with MSFT rallying 0.8 percent, AMZN 0.7 percent, GOOG and FB 1.4 percent each.

There is an air of caution out there. Barring TSLA, ahead of the ongoing earnings season, stocks of the remaining five had a strong 2Q. Unless they really hit it out of the park, the odds of 2Q earnings acting as a tailwind are as good as acting as a headwind.

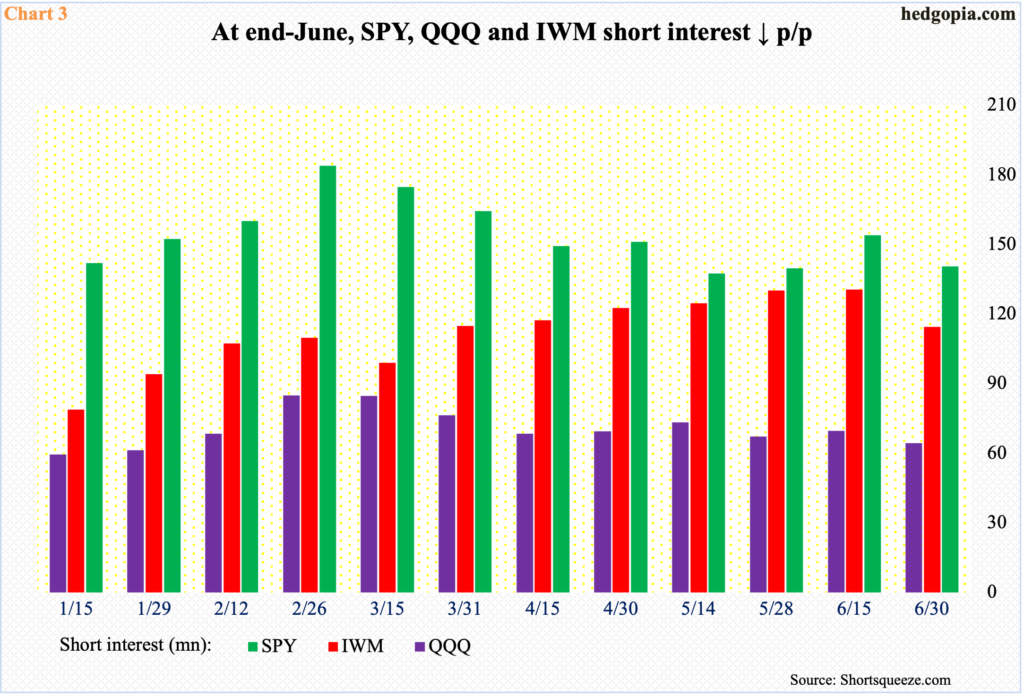

Along the same lines, short interest may or may not come to the aid of bulls. At the end of June, short interest on SPY, QQQ and IWM (iShares Russell 2000 ETF) all dropped period-over-period – by varying percentages (Chart 3).

It is possible more shorts left on Tuesday, as they ended up unwillingly helping the longs. But the fact remains that short interest on both SPY and QQQ remains much lower than their end-February highs. As things stand, squeeze odds are modest on SPY and QQQ. If anything, depending on how next week’s results come out – or are perceived – there is room for short interest to rise.

Thanks for reading!