Medium- to long-term, both margin debt and foreigners’ purchases of US stocks need to cooperate for the S&P 500 to rally to a new high. Near term, the daily is itching to go lower.

Bulls Tuesday were denied at trend-line resistance from late July when the S&P 500 large cap index peaked on the 26th at 3027.98. Since that high, there has now been a pattern of lower highs – 3021.99 on September 19 and 3014.57 on Tuesday.

Tuesday’s reversal preceded signs of fatigue last week, when a couple of dojis as well as a spinning top appeared on the daily. Immediately ahead, the area of interest remains 2940s (violet horizontal line in Chart 1). The 50-day moving average lies around there, and a rising trend line from early June draws to just north of 2900.

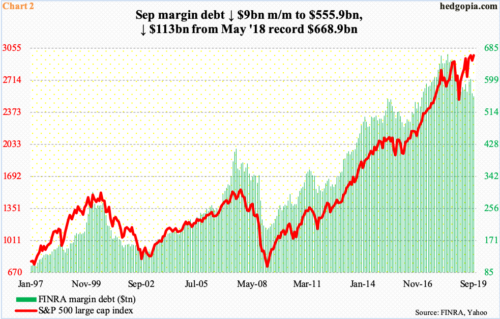

For the month, the S&P 500 (2995.99) is up 0.65 percent, which represents quite a reversal from early in the month when the index tagged 2855.94. This follows a 1.7 percent rally in September. From this perspective, it will be interesting to see if this gives investors comfort to take on additional debt. They were cautious in September.

FINRA margin debt fell $9 billion month-over-month in September to $555.9 billion. This metric is now clearly diverging from the S&P 500. Margin debt peaked as early as May last year at $668.9 billion. Since then, it has dropped $113 billion, even as the S&P 500 is within spitting distance of its record high from July.

Historically, the two tend to move together. Bulls must be hoping margin debt is not leading.

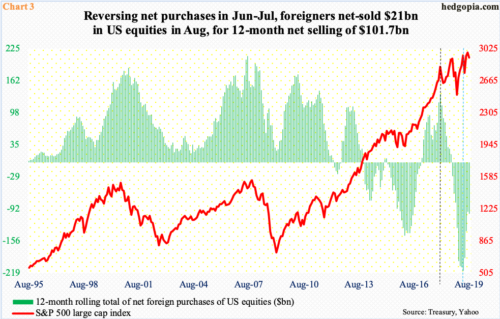

This divergence comes at a time when foreigners continue to reduce exposure to US stocks, although at a reduced pace. On a 12-month basis, their purchases peaked at $135.6 billion in January last year (black vertical dashed line in Chart 3). They continued to cut back, even as the S&P 500 trudged higher. That was until April this year when net selling peaked at $214.6 billion (blue vertical dashed line).

As does margin debt, foreigners’ purchases of US stocks tends to coincide with the S&P 500. Since April, the green bars have moved in the right direction. In June and July in particular, foreigners purchased $50.6 billion worth. Having come after 13 straight months of selling, this ignited bulls’ optimism that a trend reversal has occurred. Then came August, when the S&P 500 dropped 1.8 percent; in fact, at one time it was down as much as 5.3 percent. If foreigners were undergoing a genuine sentiment shift, one would think they would have taken advantage of this drop. But August saw them unload $21 billion worth. Hence the confusing message. September will provide more clues, but it will be three more weeks before numbers are out.

Medium- to long-term, bulls will need both margin debt and foreigners to cooperate. Near term, they will have to deal with overbought technicals. The daily is extended. Our own Hedgopia Risk Reward Index just entered the red zone.

Thanks for reading!