One of the things that helped propel stocks higher was rising conviction among equity bears that they were headed lower. As the major US equity indices bottomed last October and began to rally, a vicious short squeeze followed. Now, short interest on major ETFs such as SPY and QQQ have fallen to multi-month lows and are running out of fuel to contribute to a rally.

The S&P 500 hit an all-time high in January last year and headed south. From 4819, it dropped all the way to 3492 by October – down 27.5 percent from peak to trough. Around that time, the bears were absolutely convinced that the large cap index was still headed lower.

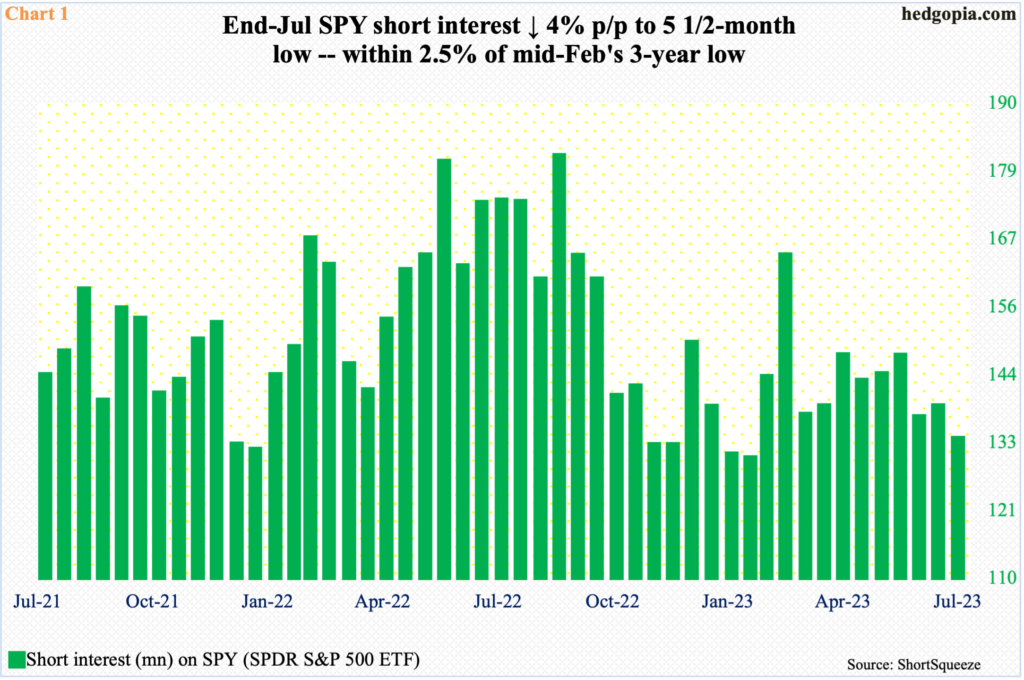

Mid-September last year, short interest on SPY (SPDR S&P 500 ETF) had ballooned to 180.5 million, which was the highest since end-February 2021. Turns out the bears had it wrong. The S&P 500 proceeded to bottom last October – on the 13th, to be precise.

As the index began to rally, shorts scampered to cover. By mid-February this year, short interest dropped to 129.7 million – a three-year low – before shorts rebuilt it to 163.8 million over the next month. After a brief month and a half under pressure, once again the S&P 500 bottomed on March 13. And once again, shorts began to cover.

By July 27, the S&P 500 tagged 4607 before reversing lower in a bearish engulfing session. From the October low, the index was up 31.9 percent by then. Short squeeze obviously contributed to this. At the end of July, SPY short interest stood at 132.9 million, which was the lowest since the mid-February low (Chart 1). This probably also means what acted as a fuel for the rally in the ETF has now run dry.

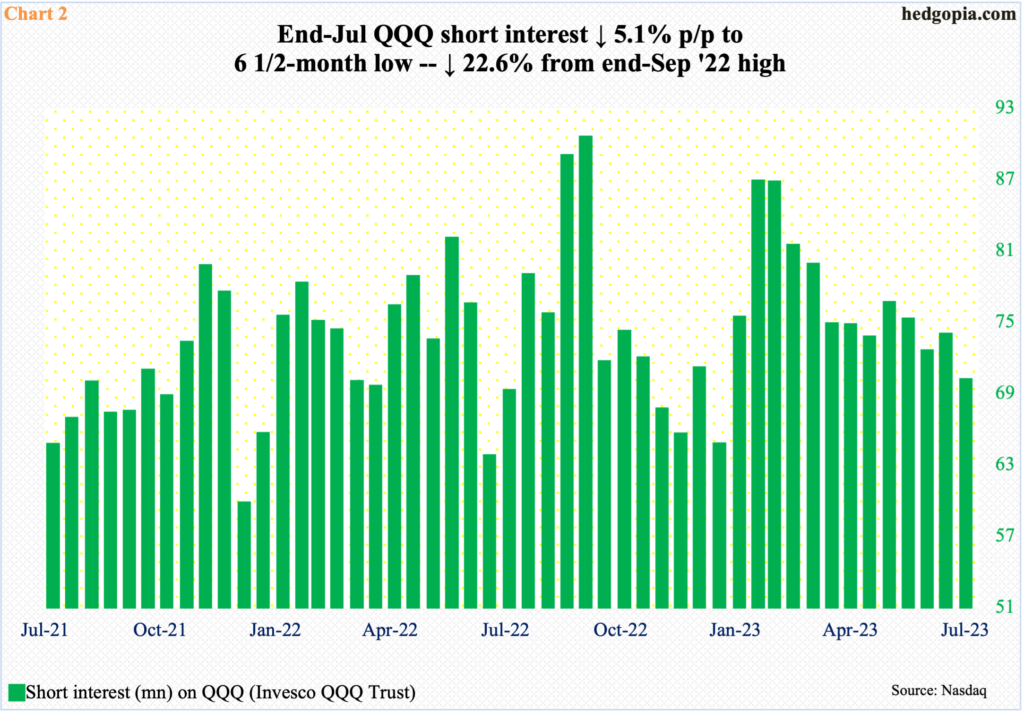

The dynamics are similar in the Nasdaq 100. The tech-heavy index peaked a little earlier, having hit an all-time high of 16765 in November 2021. From that high through last October’s low, it collapsed 37.7 percent. Shorts expected the downward momentum to continue. By the end of September, they were sitting on 90.1 million in short interest in QQQ (Invesco QQQ Trust). In the very next period – that is, mid-October), short interest dropped to 71.2 million, as the index/ETF began to rally.

Fast forward to now, QQQ short interest fell 5.1 percent period-over-period at the end of July to 69.7 million, which is the lowest reading since mid-January this year (Chart 2). The Nasdaq 100 in the meantime surged 52.6 percent from last October’s low through July 19, when it hit 15932 and reversed lower, closing at 15129 on Thursday. It is clinging on to its 50-day (15135), and odds favor a breach sooner than later. Short-covering no longer can be a source of tailwind, as it was earlier. This also applies to SPY.

Thanks for reading!