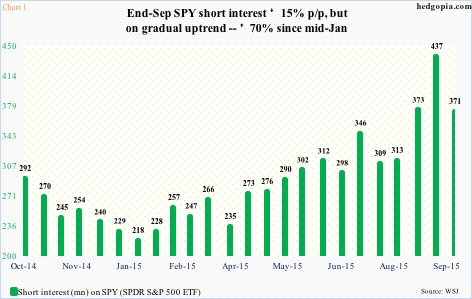

During the September 15-30 reporting period, short interest on SPY, the SPDR S&P 500 ETF, dropped 15 percent period-over-period (Chart 1). This was interesting because the ETF shed 2.9 percent during the period, having just tested the August 25th closing low. Shorts probably covered thinking that low would hold, and they were right.

Since that low, the ETF has rallied eight percent. Just last week, it looked like a great time to be selling puts, and the hypothetical SPY trade initiated last Monday paid off.

With regards to SPY short interest, we are still in the October 15 reporting period, which would not be reported until the 26th, but just looking at the persistence increase over the past several months it is possible the recent spike in the ETF probably caused some level of squeeze. But maybe not a whole lot.

Yes, SPY did rally past $198-$199, but there is a major hurdle looming on the horizon (Chart 2). Last Friday, it tried to take out the September 17th intra-day high, when stocks reversed after the FOMC decision, but was unsuccessful, producing a daily doji.

Daily momentum indicators are now in overbought territory. This is as good a place as any for the ETF to rest near-term at best and at worst go down to test the 50-day moving average ($198.75), which it just crossed.

If SPY rallies past $202, the next level – and a major one – to watch of course is what happens at $203-$204. The way this support was broken during the August sell-off, odds favor shorts will begin to get active around that level. The game changes if bulls are able to force a breakout.

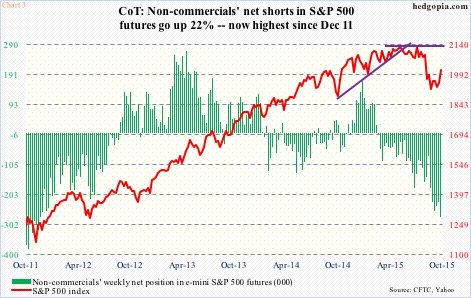

This, however, is not a scenario envisaged by non-commercials. By last Tuesday, they increased net shorts in e-mini S&P 500 futures to 278,179 contracts, up 22 percent week-over-week, and at the highest since December 2011 (Chart 3). Simply put, they are treating the recent rally in the S&P 500 with suspicion.

Regardless how it all pans out in the medium- to long-term, non-commercials are probably on to something near-term. Odds have grown that the S&P 500, and of course SPY, would like to rest, if nothing else just to digest recent gains.

In this scenario, a naked call can either generate income or go short near resistance may be considered. Hypothetically, October 16th 202.50 calls fetch $0.84. If called away, it is an effective short at $203.34. The 200-day moving average lies at $204.34, by the way. Otherwise, it is a nice premium to keep.

Thanks for reading!

Please keep in mind that this article was originally published early today by See It Market, where I am a contributor.