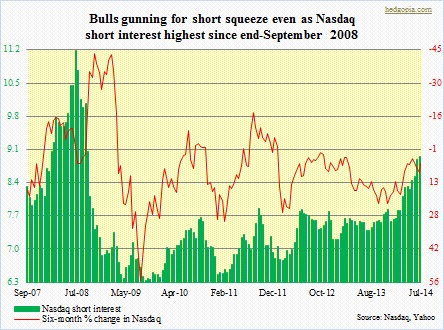

Short interest continues to inch up. By June-end, Nasdaq’s went up 0.6 percent period-over-period to 8.9bn – highest since end-September 2008 – and NYSE’s edged up 0.7 percent p/p to 14.6bn. What is going on in the Naz in particular is interesting in that shorts have consistently added to positions this year. While on one hand this is indicative of conviction on the part of bears, this also has the potential to act as rocket fuel provided bulls can force a short squeeze. What are the odds of that happening? Macro-wise, despite the 2.9-percent shrinkage in U.S. GDP in 1Q14, growth expectations for the next three quarters are in the three-percent range. These are lofty expectations, and have probably been priced in. The index is up six percent year-to-date. The risk in 2H is clearly to the downside – that these high expectations do not get fulfilled. From the point of view of potential buying power, margin debt is already near all-time highs. And we have been hearing about inevitable bond selloff a while now, but every time the 10-year yield nears three percent, buyers show up; in recent weeks, bond bulls have been stepping up to the plate near 2.65 percent.

Short interest continues to inch up. By June-end, Nasdaq’s went up 0.6 percent period-over-period to 8.9bn – highest since end-September 2008 – and NYSE’s edged up 0.7 percent p/p to 14.6bn. What is going on in the Naz in particular is interesting in that shorts have consistently added to positions this year. While on one hand this is indicative of conviction on the part of bears, this also has the potential to act as rocket fuel provided bulls can force a short squeeze. What are the odds of that happening? Macro-wise, despite the 2.9-percent shrinkage in U.S. GDP in 1Q14, growth expectations for the next three quarters are in the three-percent range. These are lofty expectations, and have probably been priced in. The index is up six percent year-to-date. The risk in 2H is clearly to the downside – that these high expectations do not get fulfilled. From the point of view of potential buying power, margin debt is already near all-time highs. And we have been hearing about inevitable bond selloff a while now, but every time the 10-year yield nears three percent, buyers show up; in recent weeks, bond bulls have been stepping up to the plate near 2.65 percent.

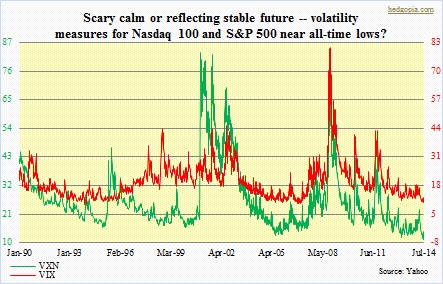

Last but not the least, 2Q14 earnings-reporting season is getting underway. When it is all said and done, 1H14 earnings would have probably grown three to four percent. But get this. 2H14 earnings-growth expectations are in the 10 percent range! Once again, risks remain to the downside. Share buybacks have been a big help – they totaled $160bn in 1Q14. It is possible buybacks slowed considerably in 2Q. Increasingly, corporations are getting a smaller bang for their buyback buck, as stocks persistently rise. They have been funding their buybacks through both cash flow and debt. The problem is that there is a limit to reliance on the latter as too much of it will end up hurting balance-sheet metrics. If all these factors – and perhaps more – have convinced Nasdaq shorts to stay negative/add to positions, they are probably not wrong in their analysis. Here is the thing, though. They could have come up with the same analysis, let us say, a year ago, be right about it on facts, but still be wrong in the market. Why? The Fed clearly wants higher stock prices. What then is the guarantee that these shorts do not encounter the same fate? None whatsoever. As a matter of fact, markets are betting on continuation of the prevailing stability. The suppressed VIX is just an example. But as Hyman Minsky told us, stability breeds instability. The longer the fear index remains suppressed, the higher the odds that sooner or later it explodes higher. And this is exactly an outcome these shorts are betting on.

Last but not the least, 2Q14 earnings-reporting season is getting underway. When it is all said and done, 1H14 earnings would have probably grown three to four percent. But get this. 2H14 earnings-growth expectations are in the 10 percent range! Once again, risks remain to the downside. Share buybacks have been a big help – they totaled $160bn in 1Q14. It is possible buybacks slowed considerably in 2Q. Increasingly, corporations are getting a smaller bang for their buyback buck, as stocks persistently rise. They have been funding their buybacks through both cash flow and debt. The problem is that there is a limit to reliance on the latter as too much of it will end up hurting balance-sheet metrics. If all these factors – and perhaps more – have convinced Nasdaq shorts to stay negative/add to positions, they are probably not wrong in their analysis. Here is the thing, though. They could have come up with the same analysis, let us say, a year ago, be right about it on facts, but still be wrong in the market. Why? The Fed clearly wants higher stock prices. What then is the guarantee that these shorts do not encounter the same fate? None whatsoever. As a matter of fact, markets are betting on continuation of the prevailing stability. The suppressed VIX is just an example. But as Hyman Minsky told us, stability breeds instability. The longer the fear index remains suppressed, the higher the odds that sooner or later it explodes higher. And this is exactly an outcome these shorts are betting on.