Major US indices experienced minor reversals Tuesday – the Nasdaq 100 in particular. It does not matter if growth lags or leads value. If the top five tech stocks weaken, they will have adversely impacted all the major indices. How they traded Tuesday probably did not boost traders’ morale.

There was some interesting action in US stocks on Tuesday. Major indices rallied hard in overnight futures, opened the regular session strong, stayed strong – until the last half an hour when offers overwhelmed bids.

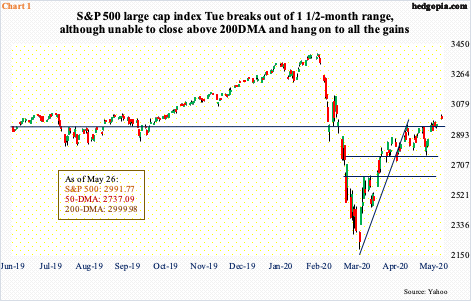

The S&P 500 large cap index (2991.77) at one time was up 2.2 percent, only to give up nearly half the gains to close up 1.2 percent. At the session high of 3021.72, the 200-day moving average at 2999.98 was recaptured but was lost by close. Besides the 200-day, resistance just north of 3000 goes back to last July (Chart 1).

Tuesday was a small victory for bears, but they need to reclaim 2950s to get some traction and take out the 10- and 20-day – between 2900 and 2915 – to gain momentum.

Action in tech was particularly revealing.

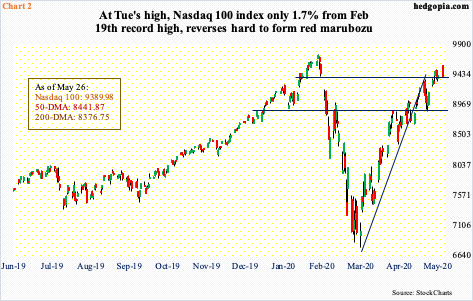

At the session high, the Nasdaq 100 index was merely 1.7 percent from its February 19th record high of 9736.57. Back then, by the time the week was over, a weekly shooting star formed. With three sessions left, we will see how this week evolves, but Tuesday’s action should rekindle bears’ hopes. From up 1.7 percent intraday to down 0.3 percent by close, the session formed red marubozu (Chart 2).

But it is too soon for bears to be high-fiving. The index (9389.98) is comfortably above both its 10- and 20-day (9266 and 9120, respectively). That said, it does not take long before they roll over and cross down.

How the top five stocks – all tech – behave in this regard in the sessions ahead will be a tell.

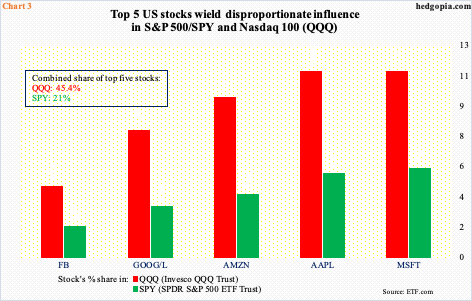

Tech has been a hands-down leader. Of late, there is a lot of chatter about growth giving way to value. If so, growth will lag – at least relatively. Here is the thing, though. The top five – Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG/L) and Facebook (FB) – are so big they will have inordinate influence on all the major indices regardless if growth lags or leads.

The combined share of the top five in SPY (SPDR S&P 500 ETF) and QQQ (Invesco QQQ Trust) is 21 percent and over 45 percent, in that order.

Tuesday, all five stocks experienced intraday reversals. AAPL, MSFT and AMZN reversed from near their all-time highs. MSFT is on the verge of a 10-20 cross-down. FB rallied to a new high but reversed to close down 1.2 percent. GOOG edged up 0.4 percent but was unable to hang on to all the gains, facing gap-down resistance from February 25th.

Tuesday is just one session but could end up being important. Time will tell. The fatigue – if it is that – is showing up at a time when several indicators have pushed well into overbought territory. Here is the percent of stocks above the 50- day on Tuesday – S&P 500, 90.6 percent; S&P 100, 90 percent; Nasdaq, 87.6 percent; and Nasdaq 100, 95 percent. Such elevated readings do get unwound – eventually. Regardless if Tuesday is the beginning of one, a shorting opportunity could be unfolding here. Shorts likely get active once the 10- and 20-day roll over.

Thanks for reading!