As talk of potential trade war heats up, attention has shifted to U.S. small-caps. Deserved or too simplistic?

Early last week, the Russell 2000 small cap index tried to take out not one but two levels of resistance – the 50-day moving average plus a 61.8-percent Fibonacci retracement of the decline between the high on January 24 and the low on February 9 (Chart 1). Tuesday, it got rejected hard, followed by another selloff Wednesday. The weakness continued Thursday, except bids started showing up, with the session producing a spinning top candle. In the following two sessions – last Friday and this Monday – the index rallied nicely.

What changed Thursday? President Trump’s trade tweets began to fan fears of a trade war. If indeed the U.S. ends up imposing tariffs of 25 percent and 10 percent on imports of steel and aluminum and our trading partners retaliate, who wins? In the big scheme of things, no one.

But there is also a school of thought that in such an environment because they are domestically focused small-caps get hurt less than their large-cap brethren. Hence the former’s relative outperformance in the past three sessions.

The same domestic focus argument should also apply to tax cuts. The Tax Cuts and Jobs Act of 2017 – signed into law on December 22 last year – reduced the corporate tax rate from 35 percent to 20 percent. Because small-cap companies draw a bigger share of revenue domestically, in theory they should get a bigger bang for the tax-cut buck.

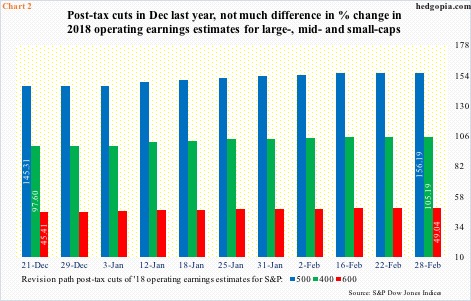

Chart 2 shows how it looks in practice.

The three bars plot the revision trend post-tax cuts in operating earnings estimates of S&P 500 (large), 400 (mid) and 600 (small) companies. Between December 21 last year and February 28, these estimates respectively went from $145.31 to $156.19, from $97.60 to $105.19 and from $45.41 to $49.04. Between the periods, they were revised upward by 7.5 percent, 7.8 percent and eight percent, in that order. The revisions are essentially comparable for all three.

Using the same logic, small-caps should like a strong dollar. Other things being equal, a weak dollar should act as a tailwind for multinationals’ overseas business, as their exports get cheaper, and vice versa. Once again, because they are domestically focused, a weak dollar should have the opposite effect on small-caps. In theory, of course.

In practice, Chart 3 tells us otherwise.

Most recently, the US dollar index peaked at 103.82 in January 2017 (arrow), before dropping to 88.15 on February 16 this year. Between the periods, the Russell 2000 continued higher. There are times when the two have moved together, but taken as a whole there is not much correlation.

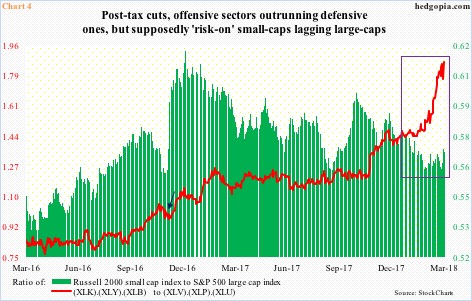

Or let us take the issue of small- versus large-cap performance. Small-caps are traditionally viewed as risk-on. Post-presidential election in November 2016, there was plenty of risk-on feel in the markets, as portrayed by the red line in Chart 4, which is a ratio between offensive and defensive SPDR sector ETF’s. The former is represented by XLK (technology), XLY (consumer discretionary) and XLB (materials) and the latter by XLV (health care), XLP (consumer staples) and XLU (utilities). On November 9, 2016, the ratio was 0.982 (arrow). Monday, it stood at 1.864. During the same time, the ratio of the Russell 2000 to the S&P 500 was essentially unchanged – 0.57 versus 0.568.

As a matter of fact, post-tax cuts last December, the green bars shrank from 0.575 to 0.568. Not much risk-taking, if we measure it by how small-caps are performing. This is also reflected in ETF flows. Post tax-cuts through last Friday, IWM (iShares Russell 2000 ETF) and IJR (iShares core S&P 500 small-cap ETF) lost a combined $4.1 billion. In contrast, SPY (SPDR S&P 500 ETF), IVV (iShares core S&P 500 ETF) and VOO (Vanguard S&P 500 ETF) took in a combined $16.1 billion (courtesy of ETF.com).

The point in all this is simply this. There are lots of clichés in the markets. Some authentic, some just that – a cliché. Should there be a trade war, small-caps may benefit, or may not, as the weight of other influencing factors takes over. This is more than evident in Charts 2/3/4.

It is never prudent to solely hang one’s investing hat on just one variable.

Thanks for reading!