Merely three weeks after successfully testing crucial trend-line support, major US equity indices once again go through a similar experience on Tuesday – successfully but only this time the save was not as clean.

At the end of January, major US equity indices landed right on trend-line support, which bulls forcefully saved. Three weeks later, their mettle was once again tested on Tuesday, and this time they managed to regroup only feebly.

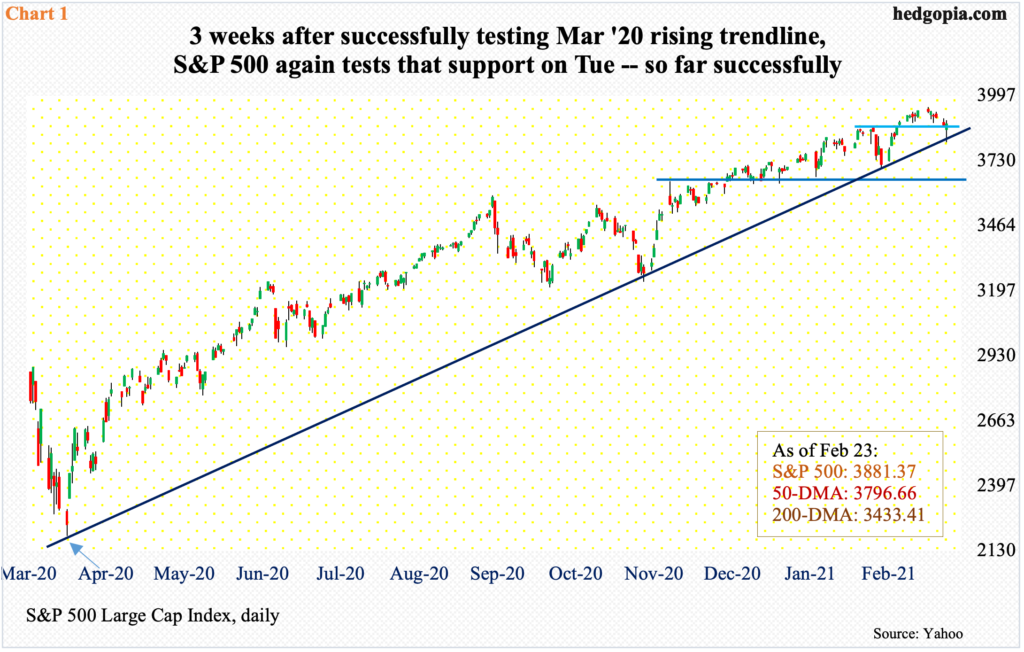

On March 23 last year, after a vicious five-week collapse during which the S&P 500 tumbled 35 percent, the large cap index put in a major low (arrow in Chart 1). (Incidentally, in that very session, the Fed announced unlimited quantitative easing and said it would start buying investment-grade corporate bonds, which in April was expanded to also include junk bonds.)

From that low through the intraday high of 3950.43 set on Tuesday last week, the S&P 500 went on to rally 80 percent. Along the way, one after another resistance fell, even as bids showed up near resistance-turned-support.

In early January, for instance, bulls showed up in defense of 3640s, which was the high on November 9 when Pfizer (PFE) announced its positive vaccine news. Then, at the end of January, the S&P 500 landed right on a rising trend line from the low of last March, and it was defended.

The index has come under pressure since last Tuesday’s high. This culminated in the intraday drop of 1.8 percent on Tuesday (this week) when it tagged 3805.59 but the weakness was aggressively bought, finishing up the session 0.1 percent. Bulls showed up in droves just above the 50-day (3796.66) and the aforementioned trend-line support; in the end, the index (3881.37) essentially closed at short-term support at 3870s.

Small-cap bulls similarly stepped up to the plate where they needed to. On February 10, the Russell 2000 Small Cap Index reached a new intraday high of 2318.09 before facing resistance at the upper bound of a rising channel from late October-early November (arrow in Chart 2). Earlier at the end of January, it found support at the lower bound.

Since hitting that resistance on the 10th, the Russell 2000 has come under pressure. In the first half hour on Tuesday, it was down as much as 3.6 percent, briefly dropping out of the channel. But there was another layer of horizontal support at 2160s, which, combined with the channel, attracted enough bids to end the session down only 0.9 percent. The index (2231.31) is back into the channel, and bulls in the right circumstances will be eyeing the upper bound.

The story was a little different on the Nasdaq 100, which approached Tuesday’s session already down 4.7 percent from last Tuesday’s intraday all-time high of 13879.77. Tuesday began with an additional drop of 3.5 percent within the first half hour, losing both the 50-day and the trend line from last March. Then, bids started to appear; when it was all said and done, tech bulls rallied the index (13194.71) enough to finish the session down only 0.2 percent. The 50-day (13101.14) was saved, but not quite the trend line.

As far as the Nasdaq 100 is concerned, this is a major difference from end-January when this trend line was vigorously defended (Chart 3). The divergence is subtle but can begin to matter in due course.

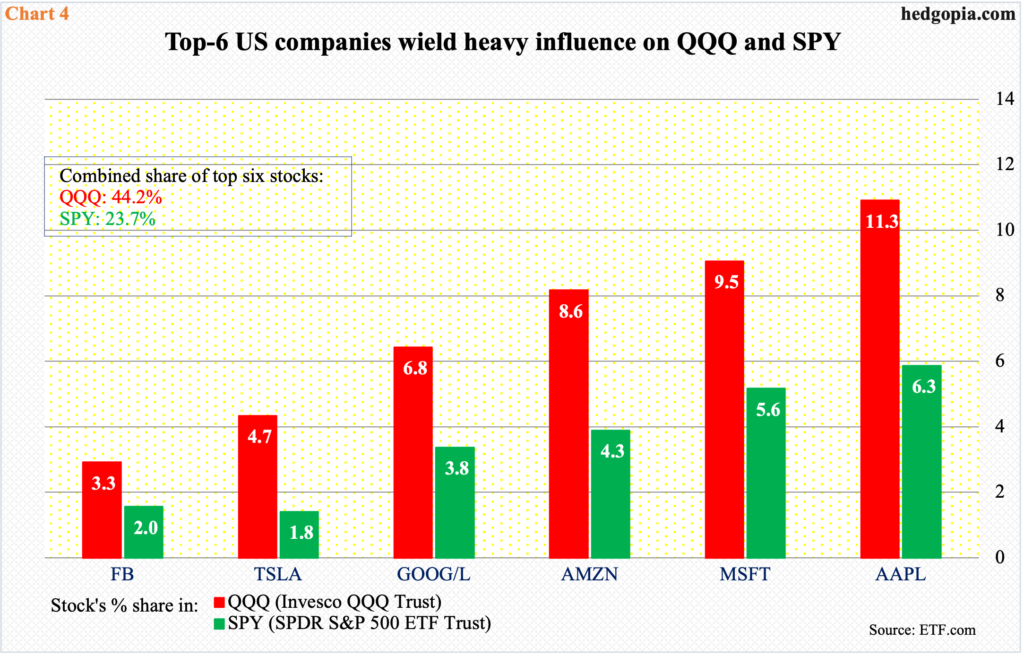

As Chart 4 shows, the Nasdaq 100, as well as the S&P 500, is home to the six largest US companies – Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOG), Tesla (TSLA) and Facebook (FB). Combined, the five account for 44.2 percent of QQQ (Invesco QQQ Trust) and 23.7 percent of SPY (SPDR S&P 500 ETF Trust). Only two of the six – MSFT and GOOG – are above the 50-day, although they are all above the 200-day.

The other thing is, the more a support is tested, the more vulnerable it tends to get. Because it is a rising trend line, as time passes, it gets tested at a higher level, raising the odds of a breach at some point.

As things stand, there is plenty of room for these indexes to weaken on the weekly, but the daily is beginning to get oversold. On the S&P 500 and the Russell 2000 in particular, important support was defended. If a rally ensues, it is likely bulls will embrace it in a half-hearted manner because, unlike early this month, they were unable to put together an aggressive defense of the aforementioned support. A little chink in bulls’ armor.

Thanks for reading!