Up 1.5 percent in the first three sessions this week, the S&P 500 probably has more gains in store in the sessions ahead. A crucial dual resistance is two percent away.

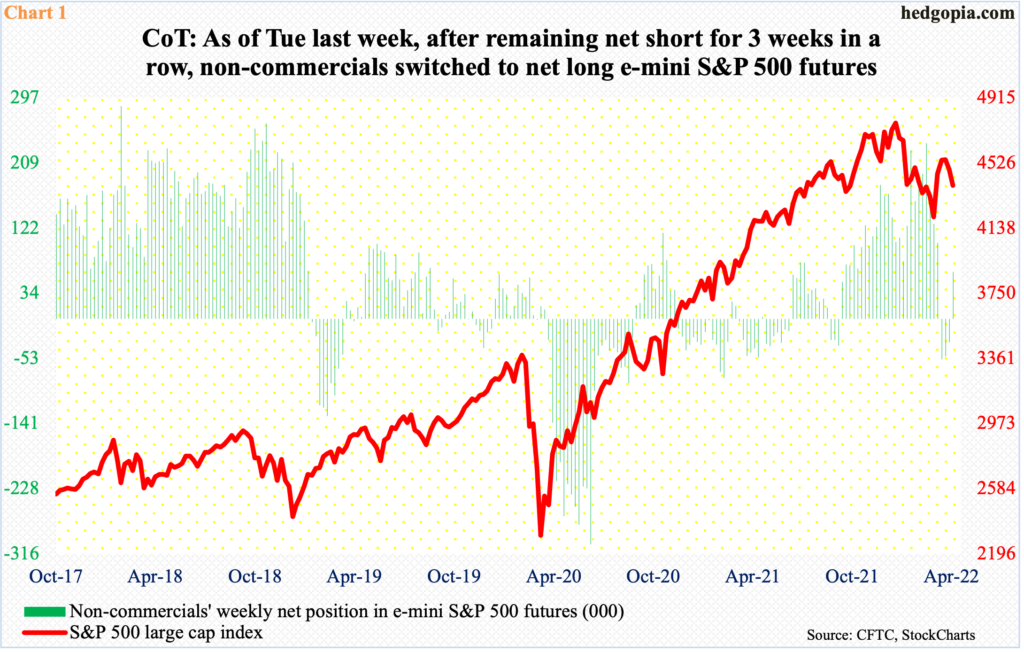

Last week, for the first time in four weeks, non-commercials went net long S&P 500 e-mini futures. In the week to April 5, they were net short 31,659 contracts. In the following week, this changed to 62,964 net longs, for a net change of 94,623 contracts (Chart 1).

This week’s numbers – as of Tuesday – will be out tomorrow and will be revealing.

As things stand, with two sessions to go this week, their trade is in the money and has potential to make more profit.

The S&P 500 (4459) is up 1.5 percent week-to-date. On Wednesday, it shed 2.76 points but was up 26.08 points in the opening minutes, which the bulls were unable to hang on to. They probably will have more opportunities in the sessions ahead.

The daily is in the process of unwinding its oversold condition. Wednesday’s intraday high of 4488 was posted just under the 200-day at 4497. Odds favor this average gets taken out soon, which will open the door to a test of dual resistance.

Between January 4 (4819) and February 24 (4115), the large cap index dropped 14.6 percent intraday. A 61.8-percent Fibonacci retracement of this decline lies at 4550 (Chart 2). Right around there also lies a falling trend line from the January high. This level can attract sellers, but until then the coast in all probability is clear.

Thanks for reading!