The US bond market is in the thick of interesting dynamics. The Fed plans to reduce its bloated balance sheet – meaning less demand for treasury notes and bonds – even as foreigners are buying more and the US budget deficit is declining.

With two sessions to go, the 10-year treasury yield has rallied big this month – from 1.68 percent on the 1st to last Friday’s 2.50 percent. Rates again touched 2.50 on Tuesday before slightly weakening.

Conditions are way overbought. As recently as December 3, these notes were wielding 1.34 percent. Then, as soon as January began, rates broke out of an inverse-hear-and-shoulders formation (Chart 1). If the bullish pattern completes, the 10-year is headed toward 2.9 percent in due course.

Right here and now, the daily seems to want to go lower. Immediate support lies at 2.06 percent. Tuesday, the 10-year closed at 2.4 percent.

The sudden spike in the 10-year is not for a lack of buyers for these securities. Rather, markets are pricing in a very aggressive Fed.

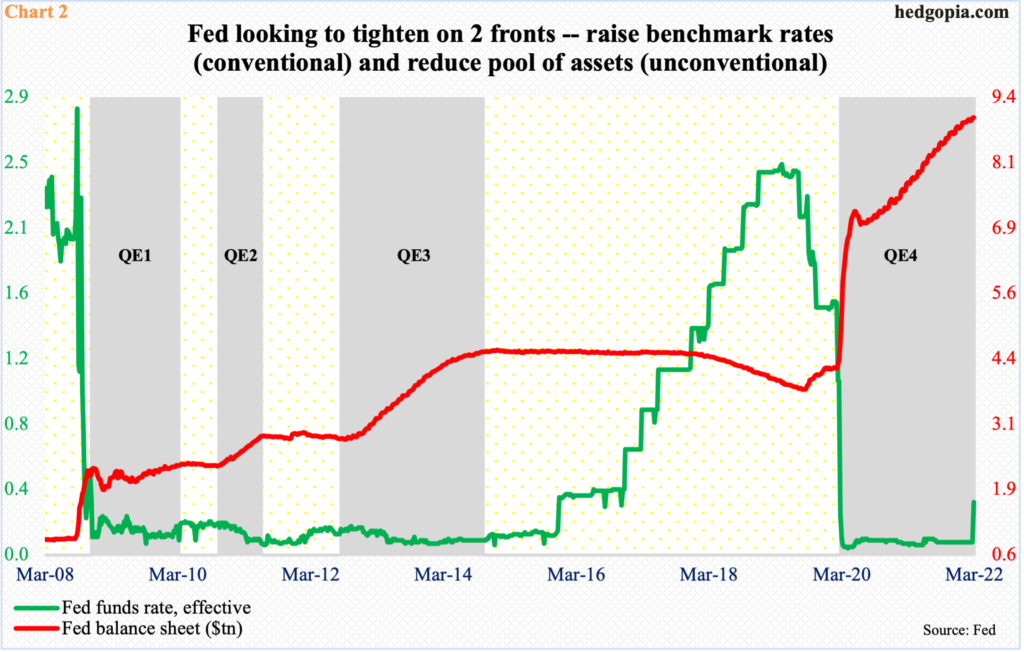

At the FOMC meeting last week, the fed funds rate was raised by 25 basis points (Chart 2); the Fed also said it would announce a plan to shrink its balance sheet in the next meeting, which is scheduled for May 3-4. The dot plot signaled six more hikes this year – essentially one each in the remaining six scheduled meetings – but no 50-basis-point hike was signaled. This changed last Monday when Chair Jerome Powell, declaring “inflation is much too high” said that the central bank, if necessary, would be open to raising rates by a half-point at multiple FOMC meetings.

The balance sheet in the meantime continues to grow. In the week to last Wednesday, it rose $8.2 billion week-over-week to $8.96 trillion, though the pace of increase has softened.

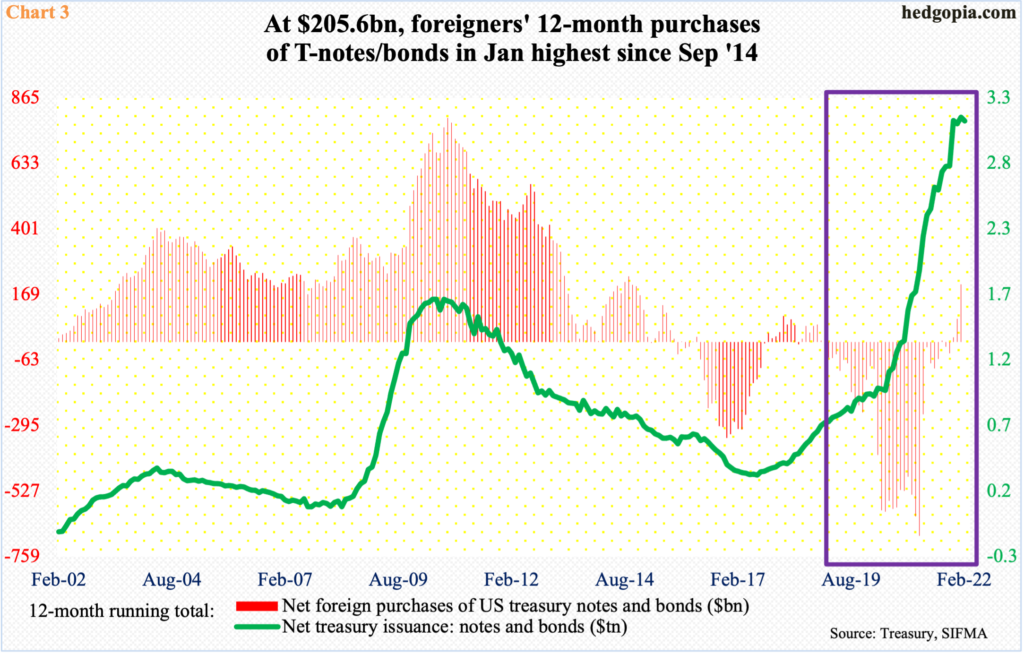

As the Fed gets ready to move away from this market, creating less demand for these securities, foreigners are buying more. In the 12 months to January, they bought $205.6 billion in treasury notes and bonds – the highest total since September 2014 (Chart 3).

In February last year, foreigners were selling heavily, with the 12-month total at minus $685.1 billion, which was a record. Now, they are buying, potentially filling the void left by the Fed.

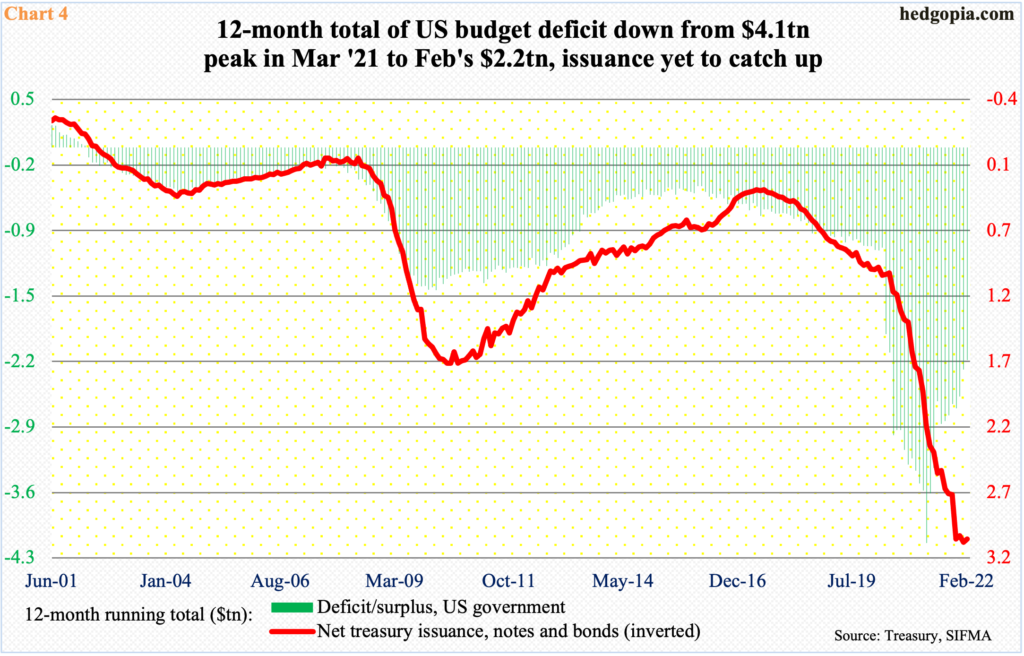

In the meantime, the federal budget deficit, which is still very high, has begun to improve. In the 12 months to last March, it peaked at $4.1 trillion. By last month, this was cut to $2.2 trillion. Two years ago, the deficit was $1.1 trillion.

Issuance of treasury notes and bonds has followed the deficit higher; the 12-month total reached $3.1 trillion in January, with February slightly down month-over-month. In essence, the red line in Chart 4 is yet to seriously catch up with the green histograms. The two tend to move together.

Caught in these dynamics, the 10-year yield has scored some important breakouts. If they are real, rates could still head higher. Immediately ahead, a giveback is due.

Thanks for reading!