- Expectations of higher US interest rates and stronger economy acting as tailwind behind resurgent $

- Sentiment too bullish, reflected in non-commercials’ near-record net longs in US $ futures

- Safe bet probably is to wait to take the other side of the consensus

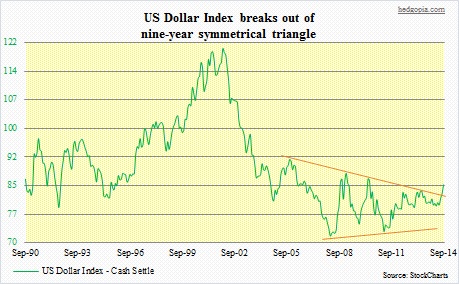

The dollar has a spring in its step. Technical backdrop looks great. After it peaked early 2002, the US Dollar Index (a measure of the dollar’s value against a basket of major foreign currencies) took six long years to trough, and since had been meandering along in a tight range. Until early this month, when it managed to push past resistance that had been in place for nearly nine years. This is too long a time not to respect the validity of this move. With the qualifier that there is this thing called false breakout in technical analysis, repercussions are huge, provided it is a genuine breakout. Cheaper imports, of course, are one of the pros. Ditto with commodities, as they are priced in dollars. Since June this year, the West Texas Intermediate Crude has dropped by $14 to $93/barrel and the Brent crude by $19 to $97. It is hard to argue that a stronger dollar alone is the culprit here. Weak global demand is another side of the coin. Nevertheless, a strong greenback does help US shoppers’ pocketbooks. There are cons as well. Exports become less competitive, particularly when others such as the EU and Japan are hell-bent on debasing their own currency. Companies in the S&P 500 index generate nearly half their sales abroad. When they bring those profits back home, they will be worth less. Reason why some argue a strong dollar is not good for the US stock market. In fact, the dollar could very well be already playing a role in the US real-estate market. Since May this year until the intra-day high today, the index was up 7.7 percent – humongous move in the currency world. July was up 2.4 percent, August 1.6 percent, and September another three percent. Then this! August saw a huge decline in cash sales of US existing homes; they were 23 percent, down from 29 percent in July. We will find out more if a surging dollar is a factor in this when September data is released, but it is a possibility.

The dollar has a spring in its step. Technical backdrop looks great. After it peaked early 2002, the US Dollar Index (a measure of the dollar’s value against a basket of major foreign currencies) took six long years to trough, and since had been meandering along in a tight range. Until early this month, when it managed to push past resistance that had been in place for nearly nine years. This is too long a time not to respect the validity of this move. With the qualifier that there is this thing called false breakout in technical analysis, repercussions are huge, provided it is a genuine breakout. Cheaper imports, of course, are one of the pros. Ditto with commodities, as they are priced in dollars. Since June this year, the West Texas Intermediate Crude has dropped by $14 to $93/barrel and the Brent crude by $19 to $97. It is hard to argue that a stronger dollar alone is the culprit here. Weak global demand is another side of the coin. Nevertheless, a strong greenback does help US shoppers’ pocketbooks. There are cons as well. Exports become less competitive, particularly when others such as the EU and Japan are hell-bent on debasing their own currency. Companies in the S&P 500 index generate nearly half their sales abroad. When they bring those profits back home, they will be worth less. Reason why some argue a strong dollar is not good for the US stock market. In fact, the dollar could very well be already playing a role in the US real-estate market. Since May this year until the intra-day high today, the index was up 7.7 percent – humongous move in the currency world. July was up 2.4 percent, August 1.6 percent, and September another three percent. Then this! August saw a huge decline in cash sales of US existing homes; they were 23 percent, down from 29 percent in July. We will find out more if a surging dollar is a factor in this when September data is released, but it is a possibility.

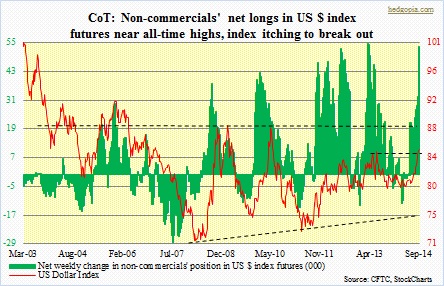

More important perhaps in this respect is try to figure out what might be causing the dollar to strengthen. At times of heightened geopolitical risk, the dollar gets treated as a safe haven. The euro-zone economy is stuck in a rut, putting pressure on the euro. The US economy is relatively better. All this is already reflected in the dollar. For continuation of the rally, US macro data clearly needs to strengthen, which is the consensus call as well. Now if this expectation is what is causing the currency to rally – higher interest rates, wider spreads, etc. – then we need a timeout. Yes, there are some signs US business capital spending is set to rise, but there have been so many false starts this cycle that it is a little too early to convincingly bet on that. Sentiment-wise, everybody and his dog is now bullish on the dollar. Nowhere is this more evident than in the futures market. As the adjacent chart shows, non-commercial futures traders last week raised their net longs by 64 percent, to 53k contracts, just a shade below the record in March last year. That high in net longs marked the peak in the index last year. This year, there is a lot of energy already spent in pushing the index to the 85 resistance, which raises the odds of a false breakout. Technicals are strong but way extended. The index is likely to take a breather here. If it has energy left, it will regroup and attack that resistance again. If not, it will fizzle.

More important perhaps in this respect is try to figure out what might be causing the dollar to strengthen. At times of heightened geopolitical risk, the dollar gets treated as a safe haven. The euro-zone economy is stuck in a rut, putting pressure on the euro. The US economy is relatively better. All this is already reflected in the dollar. For continuation of the rally, US macro data clearly needs to strengthen, which is the consensus call as well. Now if this expectation is what is causing the currency to rally – higher interest rates, wider spreads, etc. – then we need a timeout. Yes, there are some signs US business capital spending is set to rise, but there have been so many false starts this cycle that it is a little too early to convincingly bet on that. Sentiment-wise, everybody and his dog is now bullish on the dollar. Nowhere is this more evident than in the futures market. As the adjacent chart shows, non-commercial futures traders last week raised their net longs by 64 percent, to 53k contracts, just a shade below the record in March last year. That high in net longs marked the peak in the index last year. This year, there is a lot of energy already spent in pushing the index to the 85 resistance, which raises the odds of a false breakout. Technicals are strong but way extended. The index is likely to take a breather here. If it has energy left, it will regroup and attack that resistance again. If not, it will fizzle.

Loren

Watch the German Bund. With the relatively rich 10 yr UST level spread over the bund there is an incentive to export funds to park in dollar denominated government debt.

hedgopia

Agree! The Treasury-bund spread is a key driver of the €/$ exchange rate. Interestingly, there is potentially a dual benefit to non-$ investments. In addition to a favorable interest-rate spread, these investments potentially appreciate when they are converted into local currency, assuming of course the $ continues to stay strong. Carry trade! People who borrowed in € and ¥ and put the funds into treasuries have done very well since May.