The yellow metal cannot catch a break.

GLD, the SPDR Gold ETF, broke down last week, losing eight-month support at $110. The corresponding support on spot gold lies around $1,140. Friday, gold closed at $1,132.20 and GLD at $108.65.

The metal has been in the doldrums for a while now. Ever since gold peaked in September 2011, it has been unable to mount a meaningful rally. The past couple of years, GLD’s rally attempts have been repelled by an August 2013 declining trend line. Last October, it lost support at $114-plus, followed last week by the loss of $110 (Chart 1).

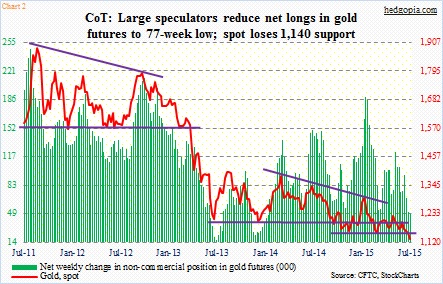

Gold bugs are losing patience. Last week, non-commercials further reduced net longs in gold futures, to a 77-week low. Toward the end of January, they held 189,000 contracts, and by last week had cut that down to 48,000 (Chart 2). During the period, GLD dropped nearly 13 percent. If the past is any guide, these traders’ holdings matter.

In March this year, GLD rallied seven percent in a couple of months, even as non-commercials increased net longs by 131 percent during the period. Last November, the ETF rallied north of 14 percent in two and a half months, coincided with a 237-percent jump in net longs. Before that in December 2013, GLD rallied nearly 17 percent in nine weeks; once again, net longs surged 503 percent during the period.

So the question is, are non-commercials done unwinding their net longs or is there more to come? Volume was very heavy on GLD last Friday. Lots of frustrated bulls probably got out once $110 gave way. In December 2013, net longs dropped all the way to 23,000 before rising.

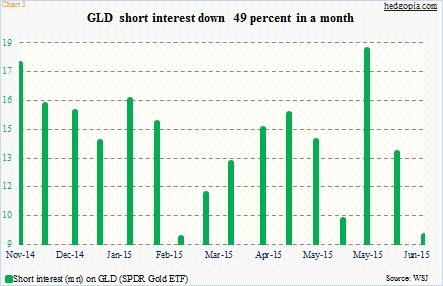

Interestingly, short interest has collapsed during the last two reporting periods, even as gold has come under pressure. Are shorts rushing to lock in profit? If that is what is driving the drop in short interest, then there may be some breathing room for gold bugs – at least near term. GLD’s short interest has gone down 49 percent in a month (Chart 3).

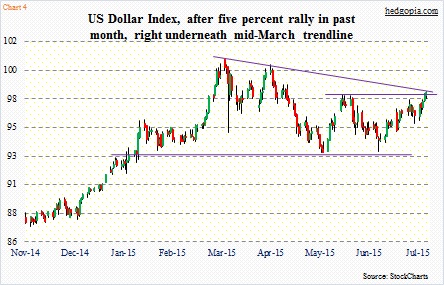

Another factor that could potentially be helping gold near-term is the greenback. The US Dollar Index has rallied five percent in the past month. The euro, which makes up 57.6 percent of the Index, dropped 5.2-percent during the period. On a daily chart, the Dollar Index is getting grossly overbought, and currently rising along the upper Bollinger Band. More importantly, it is currently right underneath the mid-March declining trend line (Chart 4).

A weak dollar can potentially bring good news to the metal, as it is not getting any from elsewhere. Greece is “fixed.” Fed Chair Janet Yellen, along with other FOMC officials, continue to talk about a possible rate hike later this year – if economic data cooperate, that is. Last week, we learned that China increased its gold reserves to 1,658 metric tons, up from 1,054 metric tons in 2009. The U.S. has the largest reserves at 8,133.5 metric tons. So there is no comparison. But China is also ambitious about raising the status of renminbi as a reserve currency, and likely will continue to build gold reserves going forward. This was not enough to break the downward momentum in gold.

As things stand now, the dollar and gold’s oversold conditions are the only hope near-term as far as gold bugs are concerned. The hypothetical July 7th trade on GLD is in a bit of a trouble. To refresh, July 17th 111 puts were sold for $0.60. At expiration, these puts were in the money. So it is an effective long at $110.40. It is a trade gone wrong, hence time to decide if to stay or bail out.

In normal circumstances, after support gets taken out the way has happened on GLD, it is prudent to exit. But in this case, once again because of the way the buck is positioned and GLD’s technicals, it is possible the ETF attracts some bidding this week. It is kind of risky, nonetheless worth a try. With that said, as China markets opened yesterday evening, gold futures, along with other precious metals, were slammed hard.

The way $110 support was lost, should GLD rally this week, that price point is a good spot for shorts to appear and/or longs to lighten up/exit. Weekly July 24th 110 calls fetch $0.37. Using a covered call strategy, the premium is either kept – reducing the effective cost to $110.03 – or if the ETF rises above $110, the option will be exercised for an overall loss of $0.03.

Thanks for reading!