Several tech heavyweights, including AAPL and MSFT, report next week. With massive weights in indices such as the Nasdaq 100, their reports will matter. Earnings estimates have held up better than for the S&P 500 index itself. That said, they have also rallied massively the past three months, raising the odds of a buy-the-rumor, sell-the-news.

Tech stocks have just about gone parabolic since late October. From October 26th to Wednesday’s intraday high of 17665, the Nasdaq 100 surged 25.7 percent. The November 2021 high of 16765 was surpassed on December 19th, with the index rallying another 900 points since (Chart 1).

With two sessions to go, the tech-heavy index is up 1.1 percent this week. If the week ends up in the green, this will be the 12th up week in 13. Conditions are overbought, with the daily RSI ending Wednesday at 75.2 and the weekly at 71.5.

This week – Wednesday in particular – some subtle signs of fatigue showed up; the session ended way off its high, closing at 17499 with a shooting star. The daily is itching to go lower. Nearest short-term support lies at 17000.

The Nasdaq 100 rallied hard into fourth-quarter earnings. It is early in the reporting season. This week, Netflix (NFLX) hit it out of the park and was rewarded, with the stock jumping 10.7 percent on Wednesday, although the gap-up session ended with a shooting star. In the after hours, Tesla (TSLA) disappointed, and, as of writing this, it was down 7.9 percent.

Next week is heavy. Apple (AAPL), Amazon (AMZN) and Facebook owner Meta (META) report their December quarter on Thursday, while Microsoft (MSFT) and Google owner Alphabet (GOOG) do so on Tuesday.

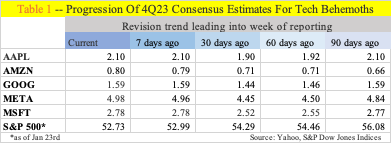

Interestingly, estimates are holding up just fine. Over the past 90 days, consensus estimates for AAPL, GOOG and MSFT have essentially gone sideways, even as those for AMZN and META have trended slightly higher. This is in sharp contrast to the sell-side’s overall 4Q23 estimates for S&P 500 companies, where, as of Tuesday, the blended estimates stood at $52.73 versus $56.08 90 days ago (Table 1).

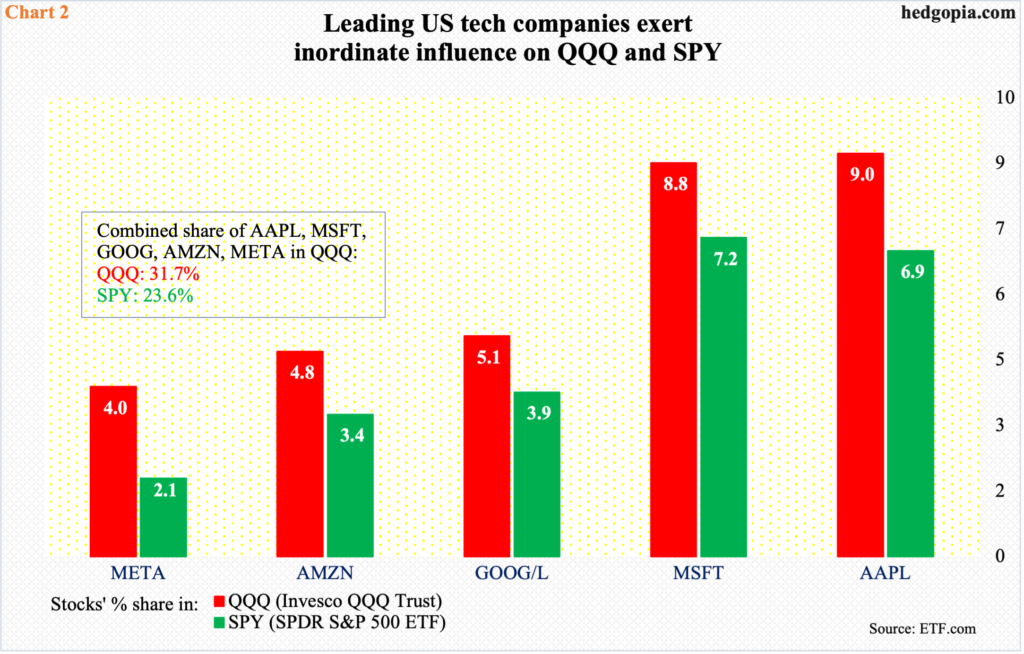

Their results next week have a potential to move the markets – if nothing else just for the sake of their sheer weight. Market cap-wise, both AAPL and MSFT are in the $3-trillion category, give or take; GOOG is $1.9 trillion, AMZN $1.6 trillion and META $1 trillion.

In QQQ (Invesco QQQ Trust), the five command just under 32 percent weight, while in SPY (SPDR S&P 500 ETF), this is under 24 percent (Chart 2). Either way we cut it, their results will matter for these ETFs/indices.

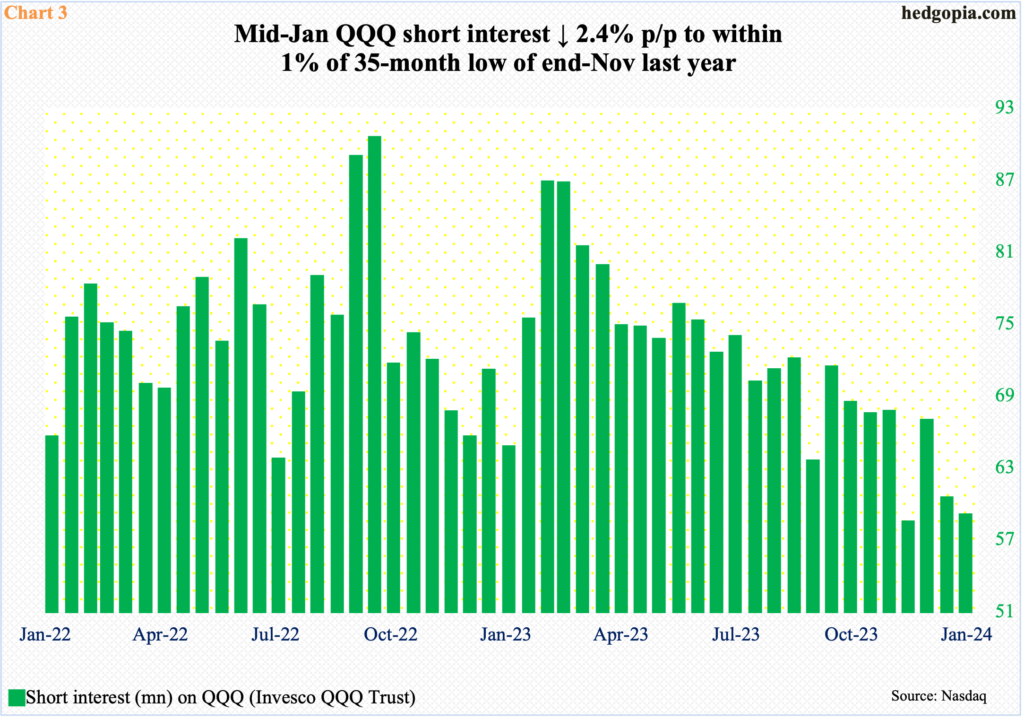

Going into this, shorts have been defensive.

Mid-January, QQQ short interest fell 2.4 percent period-over-period to 58.7 million shares (Chart 3), only one percent from the end-November ’23 low of 58.1 million, which was the lowest since mid-January 2021. That is nearly three years.

As a matter of fact, shorts have been cutting down their exposure for a while now, with short interest at 90.1 million end-September 2022. The ETF/Nasdaq 100 bottomed late October that year and has rallied 70 percent since.

The bottom line is that, because short interest remains suppressed, squeeze odds remain very low. This was a huge factor in the latter months of 2022, and even in the first half last year when short interest had jumped to 86.4 million mid-February. Not now.

This also raises the odds that, because these stocks have rallied so hard the past three months, shorts will be looking to build new/add to positions next week as the five report.

Thanks for reading!