- True to ‘when it rains, it pours,’ Goldman turns bearish on oil

- Sustained low price will reverberate through oil earnings, jobs, capex

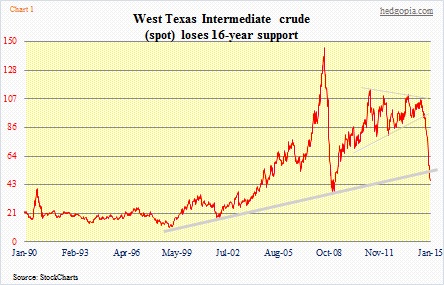

- Technicals have probably already spoken; WTI unable to save 16-year support

Remember Arjun Murti? He was a Goldman Sachs oil analyst who back in 2008 made that famous (or, infamous?) call. Writing in a May 5th report that year, he said crude oil may rise to between $150 and $200 a barrel over the next six to 24 months. His argument was that growth in supply failed to keep pace with increased demand from developing nations. The day the report came out, the West Texas Intermediate crude closed three-percent-plus higher to $120/barrel. People heeded his call. Back in 2005, he had correctly forecasted a ‘super spike’ in which prices would reach as high as $105/barrel. Within two months of his 2008 call, WTI made an intra-day all-time high of $147.27, then proceeded to drop 75 percent within the next seven months.

Now Goldman is going the other way. In a bearish report yesterday, Jeffrey Currie argued that oil prices needed to stay lower much longer in order to curb production and end a global supply glut. WTI three-, six- and 12-month price forecasts have been cut to $41, $39 and $65 (from $70, $75 and $80) a barrel. Brent’s three-, six- and 12-month price forecasts went to $42, $43 and $70 respectively, (from $80, $85 and $90).

The interesting aspect of the call is the one-year forecast, which for both WTI and Brent is higher than they are currently trading. And it is in line with what the futures market is predicting. Oil is in contango (price on a futures contract is higher than the expected future spot price). In the short-term, though, Goldman is really bearish. Oil traders are going along with Goldman’s argument. WTI slumped another 4.4 percent yesterday (46.07). It is Goldman we are talking about, not any Tom, Dick and Harry. They have heft. They move the market.

And with the move lower yesterday, WTI has lost an important support.

The thick grey line in Chart 1, which in the past stopped declines three times, has buckled under selling pressure. This could be significant. More often than not, these support zones end up becoming a self-fulfilling prophecy. Heard an analyst on Bloomberg Radio yesterday saying the last 20 points in oil are sentiment-related. Probably true. Technicals do play a role. And with the break of this support, now we will probably begin to hear more $30s/$40s calls.

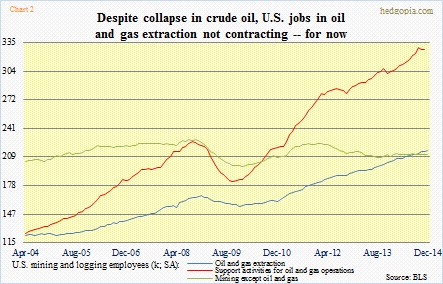

This has come at a time when crude oil as well as gasoline inventories are rising. Because crude has dropped so much refineries are churning out huge volumes of gasoline. Great for consumers, but not so from the perspective of employment/earnings/capital expenditures. 4Q14 earnings for S&P 500 energy companies are now expected to drop 19 percent (courtesy of FactSet). ‘Oil and gas extraction’ employment is holding up, but it is just a matter of time before the blue and red lines hook down (Chart 2). Ditto with capex. Which is Goldman’s point. A sustained lower price will keep capex away which will eventually help re-balance the market.

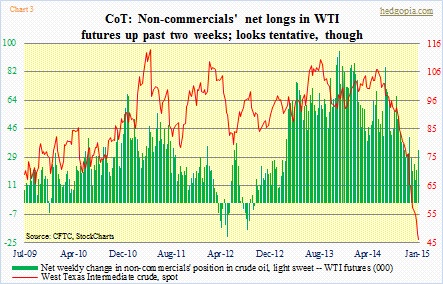

Will Goldman be able to repeat the 2008 feat of getting the short-term direction right? Time will tell. Momentum is definitely to the downside. A tell could come from the futures market. The past two weeks, non-commercials have raised net longs in WTI futures a little (from 14k contracts to 33k). But this was as of last Tuesday. We will learn this Friday how they reacted to the Goldman call/subsequent price drop.