Oil bulls can take heart. Maybe.

Spot West Texas Intermediate crude ($37.07/barrel) is likely on the verge of a 10/20 (daily moving average) crossover. The crude has more or less been going sideways/slightly up the past couple of weeks, and momentum could be shifting up, at least near-term. Maybe.

Last Thursday, energy bucked the general trend in stocks, with the WTI up 0.65 percent, and XLE, the SPDR Energy ETF, up 0.45 percent, even as the S&P 500 declined 0.94 percent.

Should an energy rally ensue, this would be coming in the wake of a painful, multi-month drop.

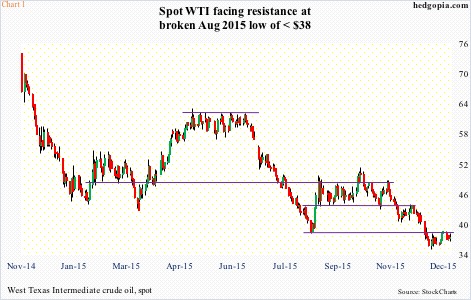

Since the June 2014 peak through the recent sub-$35/barrel low, spot WTI lost 68 percent. More recently, after it tried for a month and a half but failed to take out resistance at $61, it suffered a two-month, 38-percent drop into late August. Two weeks ago, that low was undercut (Chart 1). Crude!

The good thing – if it can be called that – is that the WTI of late has been consolidating.

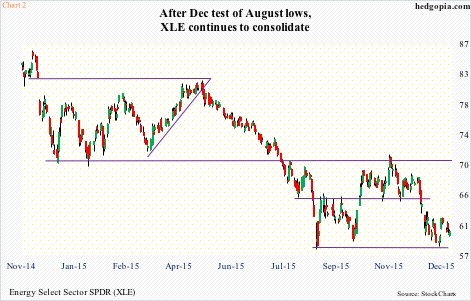

Ditto with XLE. Post-late August low, it rallied 23 percent in the next nine weeks, before coming under renewed pressure. Two weeks ago, the August low was tested, and held (Chart 2). Similar to the WTI, a 10/20 crossover is likely in the making, but could take several more sessions to develop.

Crude sentiment in general continues to be tentative.

Despite decent odds of a bounce, spot WTI/XLE could go either way near-term. Precisely the reason behind use of the word ‘maybe’ in the opening paragraphs.

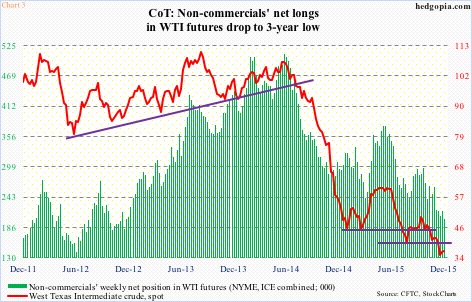

Non-commercials are yet to stop/pause cutting back net longs in West Texas Intermediate futures. As of December 22nd, they held 202,106 contracts – a three-year low (Chart 3). In the past, these traders have deftly ridden oil’s ups and downs.

We don’t yet have the latest tally. Publication of holdings as of last Tuesday have been delayed until later today because of New Year’s holiday. It is possible non-commercials are beginning to respond to recent signs of stability and have begun to add. Or not. We will find out.

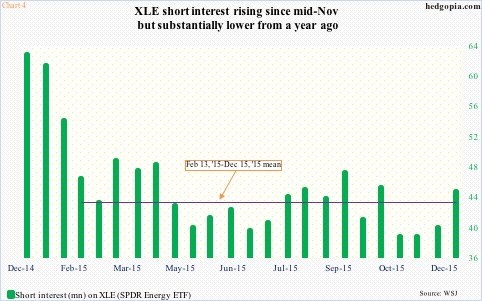

Along the same lines, XLE shorts thus far are more or less indifferent. Short interest has gone up from 38.8 million shares in the middle of November to 44.7 million a month later. But versus a year ago, it is down substantially. In the past 10 months, it has not veered too far away from its mean, including the mid-December tally (Chart 4).

That shorts are not very active at this point in time could be viewed both ways – that they don’t anticipate another leg down in oil/ETF or that there is less of a squeeze fuel available for oil bulls.

In the end, XLE this week may just meander along at best or come under pressure to once again retest the lows at worst. This perhaps creates an opportunity for nimble longs.

To recall, back on December 23rd, hypothetically a buy-write was initiated.

XLE was bought for $59.54, and December 31st 60.50 calls were simultaneously sold for $0.57. Since the calls ended out of the money, the cost effectively dropped to $58.97.

Hypothetically, longs can now either (1) sell XLE ($60.32) for a profit of $1.35, or (2) deploy a covered call.

In the latter option, Jan 8th 59.50 calls fetch $1.49.

If the ETF rallies, the short call gets called away, for an effective profit of $2.02. Should it drop and end up out of the money, the cost drops further to $57.48, which incidentally is near the lows of August and December.

Fully aware of the phrase ‘bulls make money, bears make money, pigs get slaughtered’, option (2) is probably worth a try. The idea is to have it called away at best and go long near support at worst.

Since spot WTI broke $38 three weeks ago, the support-turned-resistance has been like a ceiling, particularly the past six sessions. If the afore-mentioned 10/20 crossover indeed fuels a rally this week in energy, the covered call gets called away.

Thanks for reading!