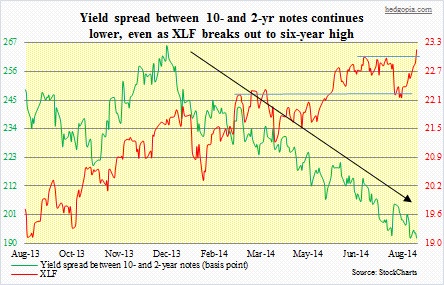

A month ago, we pointed out a divergence between 10- and two-year Treasury yield spread, which peaked as 2013 was unwinding, and financial stocks, which had ceased to track the spread and were rallying. Going back nearly 18 years, the correlation between the two is not always that tight. But since 2008, they have tracked each other real closely (not shown in the chart). Entities such as banks live and die by spreads. A slight exaggeration there, but the fact remains that they lend long and borrow short. Spreads impact net interest margins – their bread and butter. Early this year, the 10-2 spread peaked and began to really diverge from financial stocks beginning March. The latter on the other hand went sideways and broke out in June. Once again yesterday, they (represented here by the XLF) broke out of two-month sideways congestion. The ETF did come under pressure in the latter half of July, shedding four-percent-plus, found a trough early August, as did equities in general, before breaking out. In the meantime, the 10-2 spread continues to shrink. Since the beginning of the year, the 10-year yield has gone from three percent to 2.41 percent, even as the two-year has risen from 0.39 percent to 0.49 percent. The latter more or less makes sense. With relative improvement in the employment picture, the debate has shifted from if the Fed would feel comfortable hiking interest rates next year to when next year. But why are 10-year yields dropping? This is particularly perplexing given the Fed is cutting back on its Treasury purchases, which, the consensus thought, would lower prices/increase yields. Obviously, other buyers are emerging. It is a classic duel between stock investors and bond vigilantes. The former obviously believe there is no risk to the economy and none whatsoever to equity prices, the latter not so much, at least going by the buying pressure for long bonds. Personally, I believe the bond market will have the last laugh. But that is not the message coming out of financials currently. Would the 10-2 spread catch up? We will see. For now, the breakout deserves the benefit of the doubt. For whatever reason, there is enough buying interest currently. The way the ETF broke out yesterday and if technicals prevail, it has a shot at $24.

A month ago, we pointed out a divergence between 10- and two-year Treasury yield spread, which peaked as 2013 was unwinding, and financial stocks, which had ceased to track the spread and were rallying. Going back nearly 18 years, the correlation between the two is not always that tight. But since 2008, they have tracked each other real closely (not shown in the chart). Entities such as banks live and die by spreads. A slight exaggeration there, but the fact remains that they lend long and borrow short. Spreads impact net interest margins – their bread and butter. Early this year, the 10-2 spread peaked and began to really diverge from financial stocks beginning March. The latter on the other hand went sideways and broke out in June. Once again yesterday, they (represented here by the XLF) broke out of two-month sideways congestion. The ETF did come under pressure in the latter half of July, shedding four-percent-plus, found a trough early August, as did equities in general, before breaking out. In the meantime, the 10-2 spread continues to shrink. Since the beginning of the year, the 10-year yield has gone from three percent to 2.41 percent, even as the two-year has risen from 0.39 percent to 0.49 percent. The latter more or less makes sense. With relative improvement in the employment picture, the debate has shifted from if the Fed would feel comfortable hiking interest rates next year to when next year. But why are 10-year yields dropping? This is particularly perplexing given the Fed is cutting back on its Treasury purchases, which, the consensus thought, would lower prices/increase yields. Obviously, other buyers are emerging. It is a classic duel between stock investors and bond vigilantes. The former obviously believe there is no risk to the economy and none whatsoever to equity prices, the latter not so much, at least going by the buying pressure for long bonds. Personally, I believe the bond market will have the last laugh. But that is not the message coming out of financials currently. Would the 10-2 spread catch up? We will see. For now, the breakout deserves the benefit of the doubt. For whatever reason, there is enough buying interest currently. The way the ETF broke out yesterday and if technicals prevail, it has a shot at $24.