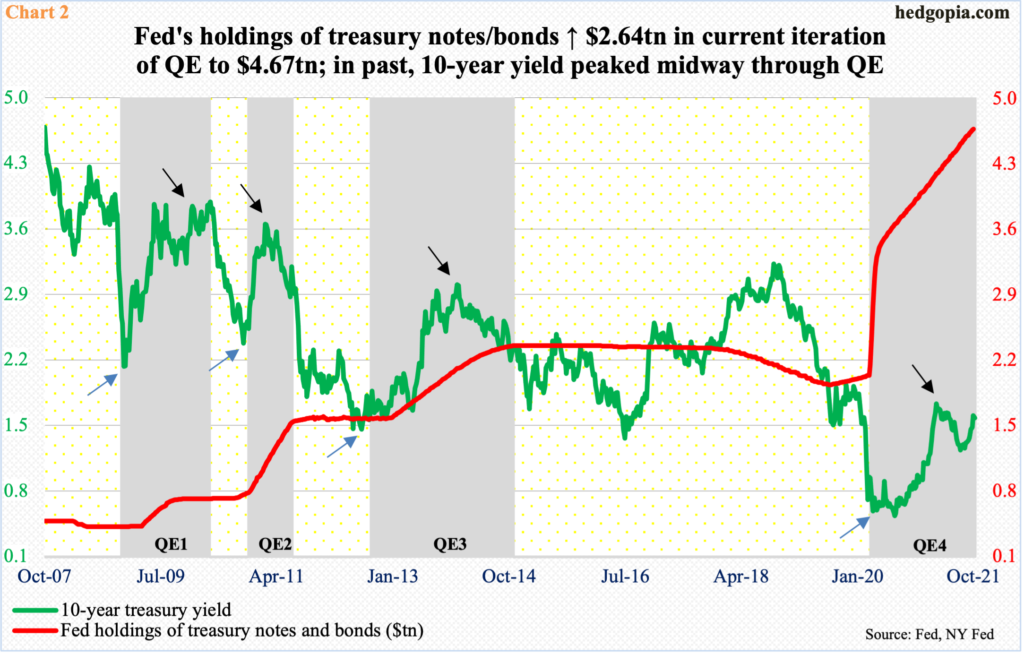

The Fed is under intense pressure to not only taper but to do so with aggression. Going by the prior three iterations of QE, the 10-year tends to peak mid-way through the program. In March, rates touched 1.77 percent.

Last Friday, the 10-year treasury yield ticked 1.62 percent before ending the week at 1.61 percent. As recently as August 4, rates touched 1.13 percent before rallying. Subsequently, rates broke out of crucial mid-1.40s on September 24. The breakout was successfully retested on the 4th this month. Odds favor another test lies ahead.

The daily is grossly overbought. On both Monday and Tuesday this week, last Friday’s high was just about tested. Besides the aforementioned breakout, mid-1.40s is where a three-year trend-line support lies as well (Chart 1).

It will be an important test and will represent an opportunity for bond bears (on price) to put their foot down and defend the breakout. A failure exposes the 10-year yield to the 200- and 50-day (1.41 percent and 1.36 percent respectively).

The latest FOMC meeting took place on September 21-22, during which Chair Jerome Powell set the stage for a tapering announcement in November. There were also hints that the fed funds rate, which is currently zero bound, may rise sooner than expected.

Currently, the Federal Reserve buys up to $120 billion a month in treasury notes and bonds ($80 billion) and mortgage-backed securities ($40 billion). The balance sheet has shot up from $4.24 trillion in early March last year to $8.46 trillion as of last Wednesday. Of this, holdings of treasury notes and bonds went from $2.03 trillion to $4.67 trillion.

Rates have moved up anticipating the impending tapering.

Importantly, during the last three iterations of quantitative easing, which lasted from December 2008 to October 2014, the 10-year yield dropped in the weeks leading up to that and bottomed around the time the Fed began purchasing these securities (blue arrows in Chart 2). Subsequently, rates also tended to peak toward the middle of QE (black arrows). If past is prelude, the March 2021 high of 1.77 percent could prove to be important.

The Fed is coming under pressure to taper – promptly, and with aggression, at that.

On Tuesday, James Bullard, St. Louis Fed president, advocated the Fed to aggressively unwind its bond-buying program. He thinks it is a 50-50 chance that the current inflation pressures are transitory. The central bank’s official take on inflation is that it is transitory.

Also on Tuesday, Raphael Bostic, Atlanta Fed president, said “evidence is mounting that price pressures have broadened beyond the handful of items most directly connected to supply chain issues or the reopening of the services sector.” He will stop using the word transitory to describe inflation.

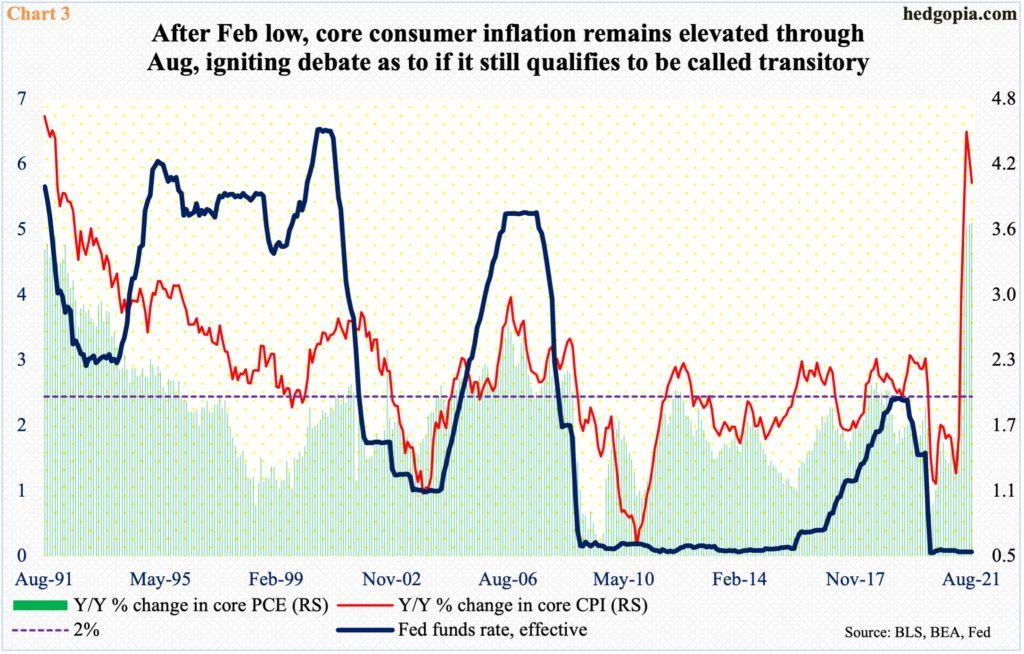

In the 12 months to February this year, core CPI and core PCE grew 1.29 percent and 1.49 percent respectively. By June, core CPI was growing at a 4.48 percent clip, which was the steepest rise since November 1991; it decelerated the next couple of months to August’s four percent. September’s report will be published later this morning.

In the meantime, core PCE – the Fed’s trusted measure of consumer inflation – has continued to trend higher, with August prices appreciating 3.62 percent; this was the fasted pace since May 1991 (Chart 3).

In other words, there is now several months of data available to those who believe inflation is persisting.

The consensus is nowhere near convinced runaway inflation is in the cards, but it, too, is beginning to dispel the transitory argument.

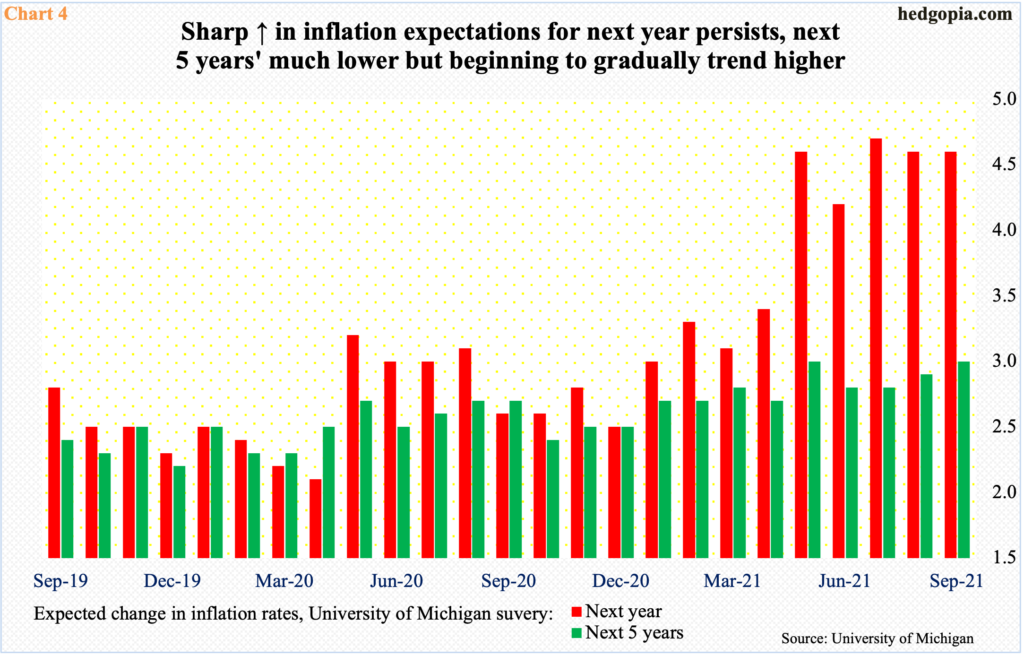

The University of Michigan’s expected change in inflation rates next year was 4.6 percent in September, versus 4.7 percent in July, which was a 13-year high. The outlook for the next five years is relatively subdued, with September at three percent, matching May’s tally (Chart 4); that said, this was the first time since September 2013 a three handle was hit.

In the meantime, the International Monetary Fund added more pressure on central bankers of countries such as the US saying “inflation risks are skewed to the upside” in these economies.

As things stand, tapering is coming, most likely next month, and odds favor the pace will be faster than imagined even a few weeks ago. Once again, if past is prelude, the 10-year either already hit its high in March or is in the process of doing so.

Thanks for reading!