Bond bears likely view the imminent tapering of T-notes/bonds as a tailwind to their outlook but not foreigners’ recent increased purchases of these securities.

Bond bears are probably not happy how things seem to be unfolding in the supply-demand dynamics for US treasury notes and bonds. Foreigners could be throwing a monkey wrench in their bearish outlook for long bonds.

The 10-year treasury yield has trended higher since March last year after tumbling to as low as 0.40 percent, and particularly since early August this year when rates bottomed at 1.13 percent. Subsequently, the 10-year broke out of mid-1.40s in the last week of September (Chart 1).

On Wednesday, rates tagged 1.64 percent – just under the daily lower Bollinger band – before ending the session at 1.64 percent, which was a five-month high. In March this year, the 10-year hit 1.77 percent before coming under pressure to bottom in July-August.

Around the time the 10-year recaptured mid-1.40s, the FOMC met – on September 21-22, to be precise; the breakout occurred on the 24th.

During that meeting, Chair Jerome Powell set the stage for a tapering announcement in November. The FOMC is scheduled to meet on 2-3 next month.

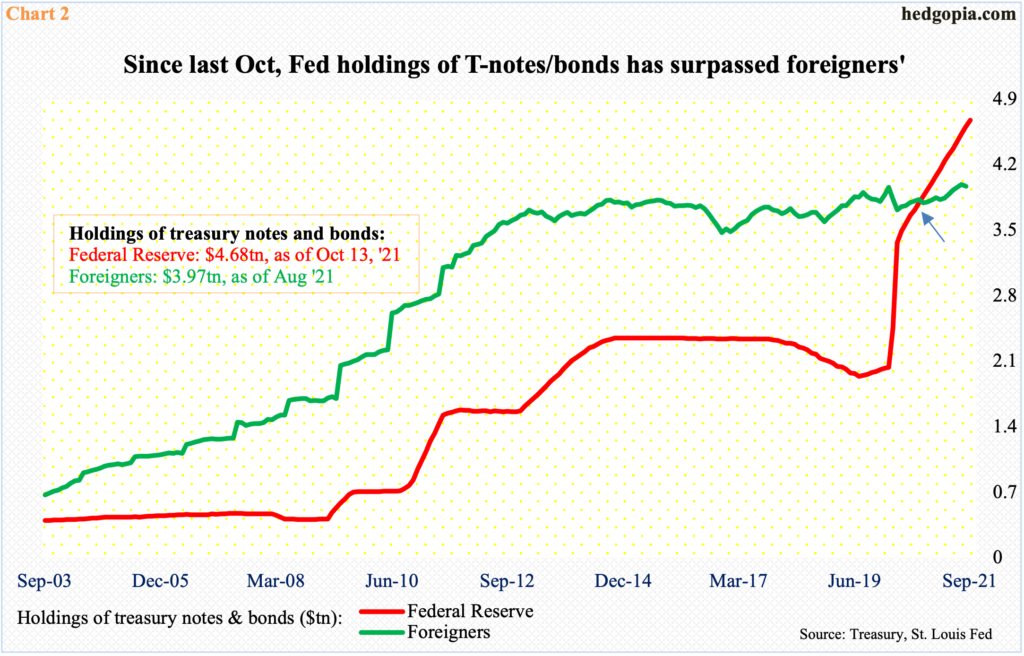

The Federal Reserve is sitting on loads of treasury securities. It currently buys up to $80 billion a month in treasury notes and bonds (and another $40 billion in mortgage-backed securities). In early March last year, the central bank held $2.03 trillion in treasury notes and bonds, which has now ballooned to $4.68 trillion, surpassing that of foreigners (Chart 2).

As the Fed starts tapering, what has otherwise been a reliable demand for these securities is set to peter out. At least in theory, this should translate to higher yields. Markets tend to be anticipatory, and it is possible bond vigilantes have been doing that for several months now.

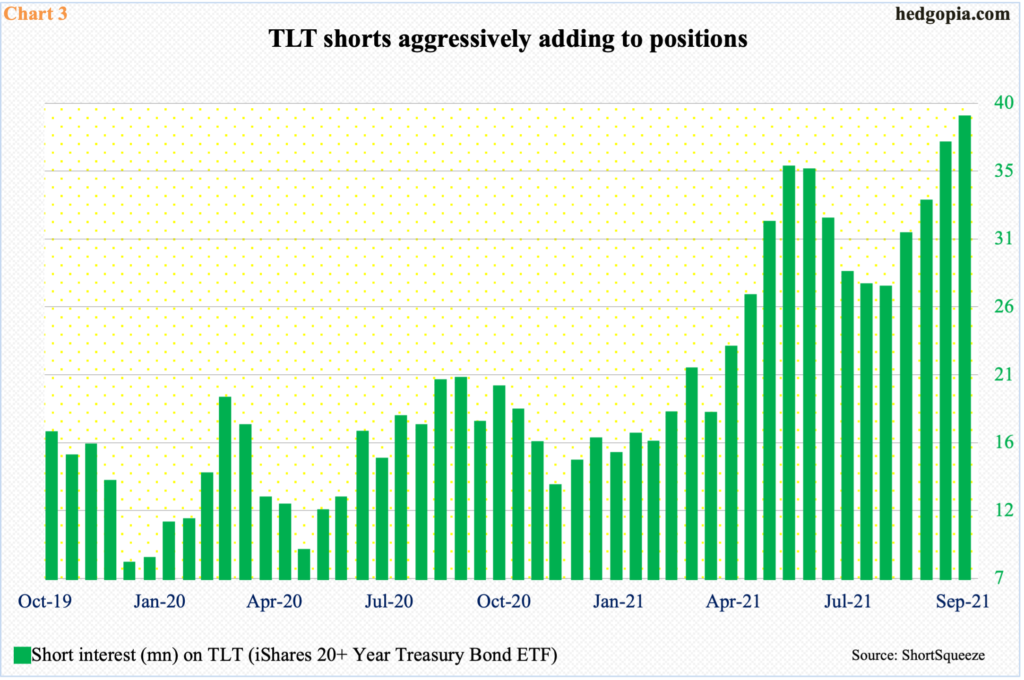

TLT (iShares 20+ Year Treasury Bond ETF) shorts have been aggressively adding to their holdings. Short interest at the end of September stood at 38.8 million, up 4.9 percent period-over-period, and up 43.8 percent in just a couple of months (Chart 3).

Shorts by and large have done well. At the end of April last year, short interest stood at merely 8.7 million, before trending higher. To recall, the 10-year bottomed at 0.4 percent on March 9 last year.

The way they are positioned, these shorts obviously expect rates to continue higher.

The imminent tapering of bond purchases by the Fed should act as a tailwind in this scenario. Although, as things stand, foreigners can act as a counterforce. They have been warming up to these securities.

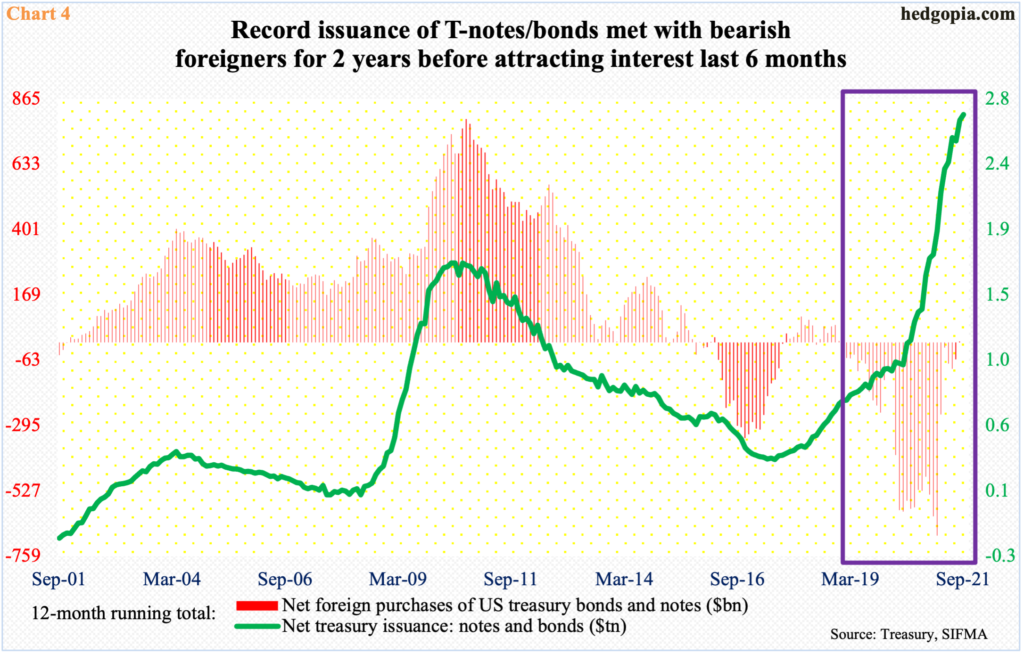

In the 12 months to February this year, foreigners sold treasury notes and bonds to the tune of $685.1 billion – a record. In general, foreigners’ buying pattern tends to move in tandem with the Treasury’s issuance of these securities. But the two have diverged since the early months of 2019 (box in Chart 4).

Since the February peak in net selling, the red bars have been shrinking, even as the green line has continued going vertical. In the 12 months to September, issuance of T-notes/bonds totaled $2.7 trillion. This should begin to contract, as the budget deficit begins to soften from Covid Stimulus-spurred uncharted territory. Concurrently, foreigners’ 12-month purchases in August went positive at $3.8 billion. This was the first positive month since December 2018.

In the months ahead, should foreigners continue their affection for these securities, this would have come at a time when fewer treasury notes and bonds would have been issued and the Fed would have been tapering. This has the potential to throw a curve in bond bears’ rates outlook. At some point, sentiment can get lop-sidedly bearish for its own good.

Thanks for reading!