- 10-yr Treasury yield rises, diverging from loads of weaker-than-expected macro data recently

- There is no shortage of reason to argue for lower yield, even so sentiment can get extended

- Levels bond bulls will be drawn to if they believe rates are headed lower not too far away

The 10-year Treasury yield is diverging.

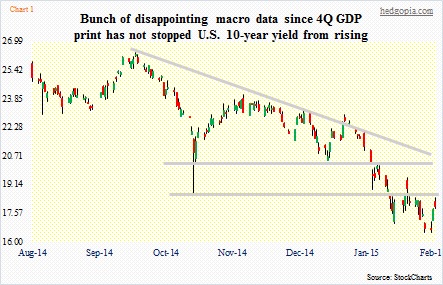

Since the weaker-than-expected 4Q14 GDP print of 2.6 percent this past Friday, there has been a spate of other weak-leaning U.S. data. Factory orders were disappointing. The ISM manufacturing index was below expectations (though non-manufacturing was slightly ahead of estimates), as was the private-sector jobs report from ADP. Regional PMIs have not been any better.

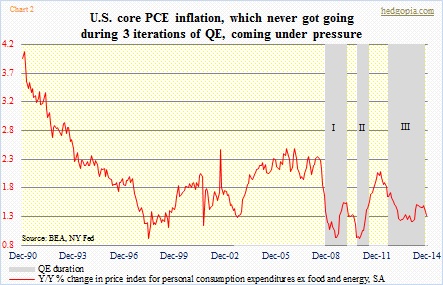

Conventionally, this should have made up for a perfect recipe for lower rates. Yet long rates are higher. As a matter of fact, the 10-year bottomed on Friday, the day the GDP report came out (Chart 1). In that report, we also learned that the GDP deflator went negative in 4Q – only the second time since 1952 of a quarter-over-quarter drop; the other was in the midst of Great Recession. Year-over-year, core PCE inflation, the Fed’s favorite, slid further in December, to 1.3 percent (Chart 2). QE was supposed to ignite inflation. So much for that.

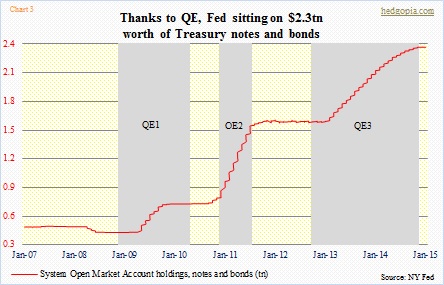

Yet rates have gone the other way. We discussed in the past as to what might be causing 10-year notes (as well as 30-year bonds, which have risen to yield the lowest ever) to continue to come under upward pressure – ranging from shrinking U.S. budget deficit matched by decreasing issuance of Treasurys to continued foreign buying to the Fed sitting on $2.3tn of notes and bonds (Chart 3).

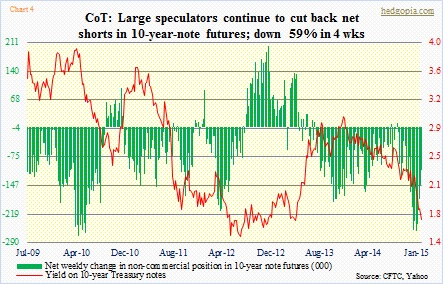

One other powerful reason was the amount of professional money betting on higher rates. As of the end of December last year, large speculators held 261k contracts in net shorts in 10-year note futures – highest since mid-May 2010 (Chart 4). Back then, rates fell subsequently as these shorts got squeezed. Ditto this time. Since December-end, the 10-year dropped 52 basis points before jumping the past couple of sessions. Net shorts have gone down 59 percent, to 108k contracts.

Squeeze can still occur. Net shorts are still sizeable. But for now, the 10-year seems determined to head higher. Is it signaling some kind of strength in macro data down the line? Possible, but not probable. Or is it just a case of a rubber band stretched too far? In all of 2014, the 10-year dropped 86 basis points. Here we are in 2015, yield was already down 50 basis points in the very first month.

So it may entirely be a case of overbought conditions in a process of getting unwound. Even under that scenario, given that technicals are way overbought, in the right circumstances rates can head higher. Levels to watch closely include two percent on the 10-year, which is already finding resistance near mid-October low. If two percent gets taken out, then we know something is cooking. On TLT, 127 is a level to watch – as well as 132 and 123. Bond bulls should step up to defend these prices if they believe rates are headed still lower.