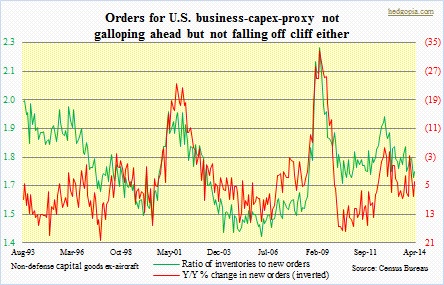

Unlike a consistent Steady-Eddie CSCO of the past, the company’s quarterly results of late have been a hit-and-miss. In the U.S., business capex is lackluster but steady. In November last year, CSCO spooked investors with a downbeat outlook. In February this year, its post-results commentary was not as disappointing, but there was not much to write home about either. Management said emerging markets remain challenged, with China once again weak, while the switching business, about 30 percent of overall business, posted sales of $3.27bn, below the consensus estimate of $3.31bn. So come FY3Q (April), shorts were sharpening their teeth with expectations of continuation of this pattern. By mid-April, short interest had risen to 75.5mn and stayed in that range for another month. Post April-quarter results, shorts probably got squeezed out a little; as of end-May, short interest stood at 65.8mn.

Unlike a consistent Steady-Eddie CSCO of the past, the company’s quarterly results of late have been a hit-and-miss. In the U.S., business capex is lackluster but steady. In November last year, CSCO spooked investors with a downbeat outlook. In February this year, its post-results commentary was not as disappointing, but there was not much to write home about either. Management said emerging markets remain challenged, with China once again weak, while the switching business, about 30 percent of overall business, posted sales of $3.27bn, below the consensus estimate of $3.31bn. So come FY3Q (April), shorts were sharpening their teeth with expectations of continuation of this pattern. By mid-April, short interest had risen to 75.5mn and stayed in that range for another month. Post April-quarter results, shorts probably got squeezed out a little; as of end-May, short interest stood at 65.8mn.

In the April quarter, sales fell 5.5 percent to $11.55bn year-over-year. EPS was flat at $0.51. Results nevertheless were better than consensus estimates of $11.36bn/$0.48. Gross margin (non-GAAP) came in at 62.7 percent, down from 63 percent y/y, but better than the consensus 61.3 percent. CSCO’s revenues had declined sequentially in the prior two quarters and is likely to drop again in FY4Q (the company guided to a one- to three-percent decline y/y). Nevertheless, the rate of decline is slowing. Because of the pressure on the top line in recent quarters, y/y comps are likely to get easier in the out quarters. In the quarter, deferred revenues fell one percent quarter-over-quarter and up four percent y/y to $13.15bn.

CSCO repurchased 90mn shares of its common in the quarter, for $22.24 a share on average ($2bn in total). It also paid out $974mn in dividends. Cash flow from operations was $3.2bn. Since the current share repurchase plan was instituted, the company has bought back $86.9bn in stock. Management also pledged to pay out 50 percent of annual free cash flow in dividends and buybacks. The stock yields 3.1 percent. Cash flow is predictable at $11bn-$12bn annually – has grown from $10.1bn in FY11 to $11.5bn in FY12 to $12.9bn in FY13. Accordingly, the balance sheet has plenty of cash cushion – $53.4bn ($33.1bn net). These are all things that value investors get naturally gravitated toward. Better still if the company manages to hold annual revenues flattish in the $46bn-$48bn range (sales are expected to come in at $47bn this fiscal year, vs. $48.6bn in FY13, even as the consensus expects $49bn in FY15) and operating expenses in the $16bn-$17bn range (opex was $18.9bn in FY11, $18.1bn in FY12 and $18.2bn in FY13).

The four-percent-plus growth expected on the top line and five-percent-plus on the bottom for FY15 has priced in a lot of good things to come. Expectations have been gradually moving higher. Three months ago, EPS estimates for the current FY were $1.99 and $2.10 for FY15; now, they are $2.04 and $2.15, respectively. Historically, CSCO sales have tracked very well to global GDP, so how CSCO fares depends a lot on how the global economy fares in 2H this year and 1H next year. The IMF just last week cut its forecast for U.S. economic growth this year to two percent from previous 2.8 percent. In April, it lowered its global growth forecast for this year from 3.7 percent to 3.6 percent. Back then, it still expected 2.8 percent growth for the U.S. economy, so in all probability its view of global growth potential is lower now than versus back then. As well, two weeks ago, the World Bank cut its forecast for global GDP to 2.8 percent this year. Sell-side estimates for CSCO obviously do not buy into IMF/World Bank view as numbers in recent weeks/months have rather been inching up. But given the 20-percent-plus move in the stock since December last year, disappointment of any sort probably forces investors/traders to lock in profit.

Medium- to long-term, one of the major knocks on CSCO is the potential of software-defined networking (SDN) to redraw the market-share map in networking. SDN and network function virtualization (NFV) enable the value of the network to migrate away from the switch/router to software. Using NFV, for example, carriers can buy off-the-shelf switching equipment and run functions such as firewalls as software on top of the boxes. Several startups are vying for relevance. CSCO understands the threat to its bread and butter. At last year’s Cisco Live, it introduced its Application Centric Infrastructure (ACI) vision, followed by the introduction of the Nexus 9000 family in November last year. In the April quarter, it grew its customer base (Nexus 9000 and ACI solution) to 175, versus 20-plus q/q; the pipeline is approaching 1k customers. Here are the issues. First, even if things turn out the way CSCO foresees it, it will take several quarters to convert these customers to revenues in a meaningful way. Second, major cloud providers and enterprises also have the flexibility to evaluate alternative offerings such as VMW. Last but not the least, SDN may end up adversely impacting what ultimately matters the most – gross margins. Given its dominant position in switching and routing, it is CSCO’s game to lose.

At the same time, white-box switching is garnering momentum. Operators of cloud computing such as AMZN have been increasingly using white-box gear to run switching software. CSCO bears also cite software-defined WAN as having the potential to replace the $3bn enterprise edge routing market, where the company dominates. The new architecture provides for programmability and prioritization of traffic, among others.

And finally, open architectures have the potential to introduce competition to near-monopoly verticals. We are already seeing it unfold in several markets. The server processor market is one, in which ARM-based offerings are all but set to snatch market share away from INTC’s own dominant position. Elsewhere, commodity storage and software is taking over from traditional storage arrays. Similarly in networking, enterprise’s interest in OpenStack has meaningfully increased over the last year or so.

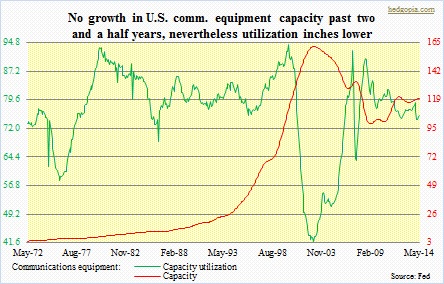

These are all issues that have the potential to develop into genuine problems for CSCO, or not. When it is all said and done, it may all amount to nothing. The company has gotten scale (both in business and market cap), has strong balance sheet, and existing relationships with enterprises and service providers. If let us say its ACI solution does not get traction, it is not outside the realm of possibility that it tries to acquire its way into being relevant. At the same time, this is probably the first time that CSCO’s market dominance is looking vulnerable. Rivals obviously are jockeying for position. In an environment in which the overall market is not growing much, market-share growth helps. The past two and a half years, U.S. communications-equipment capacity has not grown much, but so much was added leading up to 2003 that utilization remains low.

These are all issues that have the potential to develop into genuine problems for CSCO, or not. When it is all said and done, it may all amount to nothing. The company has gotten scale (both in business and market cap), has strong balance sheet, and existing relationships with enterprises and service providers. If let us say its ACI solution does not get traction, it is not outside the realm of possibility that it tries to acquire its way into being relevant. At the same time, this is probably the first time that CSCO’s market dominance is looking vulnerable. Rivals obviously are jockeying for position. In an environment in which the overall market is not growing much, market-share growth helps. The past two and a half years, U.S. communications-equipment capacity has not grown much, but so much was added leading up to 2003 that utilization remains low.

With this as a backdrop, CSCO as a stock the past six months has priced in a fair amount of optimism. It has also benefited from recent investor preference for large-caps. Technically, it is beginning to look tired and can come under pressure in the medium-term. It must be pointed out that the stock seems to be in the middle of a bullish cup-and-handle formation, though it is hard to imagine it taking out resistance just below $26 any time soon. The company does not report its July quarter until early August. At least in the near-term, shares look vulnerable. It probably makes sense to sell July 25 (2014) $24 calls for $0.85 and use that money to purchase three puts each for $0.28 of the same expiration and strike.