Three major US banks drew mixed reaction post-earnings last Friday as the 4Q21 season got underway in earnest. Ahead of this, the S&P 500 is acting a bit weak, but no major support has been breached. If anything, bulls at this point should be more worried about the decelerating earnings growth momentum for both this year and next.

The fourth-quarter earnings season got underway in earnest last week. Financials customarily got the ball rolling and drew mixed reaction.

JP Morgan (JPM), Wells Fargo (WFC) and Citigroup (C) reported on Friday. JPM’s shares reacted by gapping down 6.2 percent to land right at its 200-day moving average and C’s dropped 1.3 percent, even as WFC’s rallied 3.7 percent to a new high.

For the week, XLF (Financial Select Sector SPDR Fund) reversed lower 0.8 percent to 40.83 after posting a new all-time high of 41.70 on Thursday (Chart 1).

The season is young, so it is too soon to read too much into last week’s post-earnings reaction. Ahead of this, major equity indices were on the defensive, albeit slightly.

On the 4th (this month), the S&P 500 (4663) posted a fresh intraday high of 4819 before weakening. By the 10th, the large cap index ticked 4582 – for a quick drop of 4.9 percent. At the same time, in three of the five sessions last week, the buy-the-dip mentality was evident (Chart 2). This was likely driven by earnings optimism.

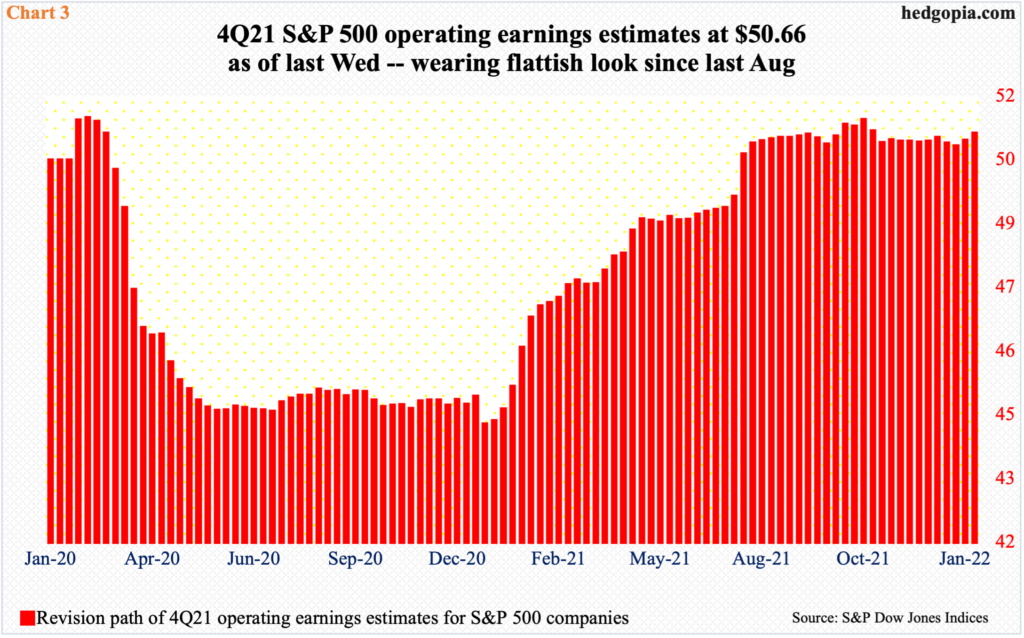

As of last Wednesday, which was before Friday’s results from the three major banks mentioned above, S&P 500 companies were expected to earn $50.66 in operations in 4Q21, up $0.15 from a week ago but essentially sideways since last August.

As a matter of fact, 4Q21 estimates crested at $51 in February 2020. Then Covid-19 hit, and the sell-side brought out their knives. By December that year, estimates reached $44.27. The red histograms in Chart 3 then progressively rose until flat-lining last August.

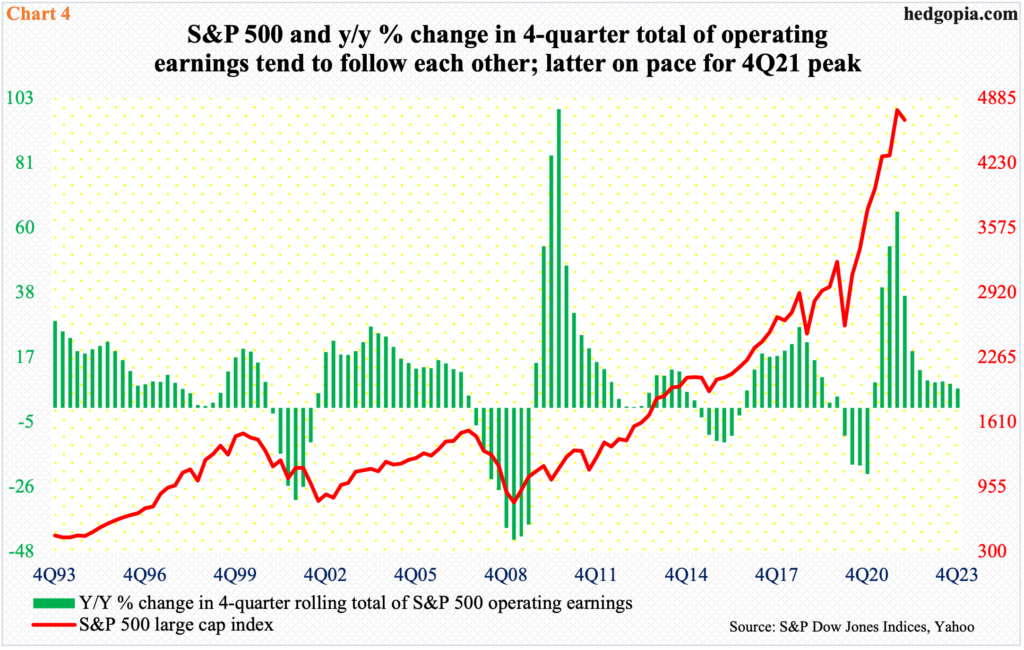

Incidentally, the year-over-year growth rate in four-quarter total of operating earnings is on course for a peak in 4Q21. If estimates for the last quarter come in as expected, then earnings would have grown 65.2 percent at the end of 2021. This is then set to decelerate to nine percent growth at the end of this year and 6.3 percent at the end of next.

If history is guide, a growth peak in the four-quarter total of earnings has tended to mark a peak in the S&P 500 (Chart 4).

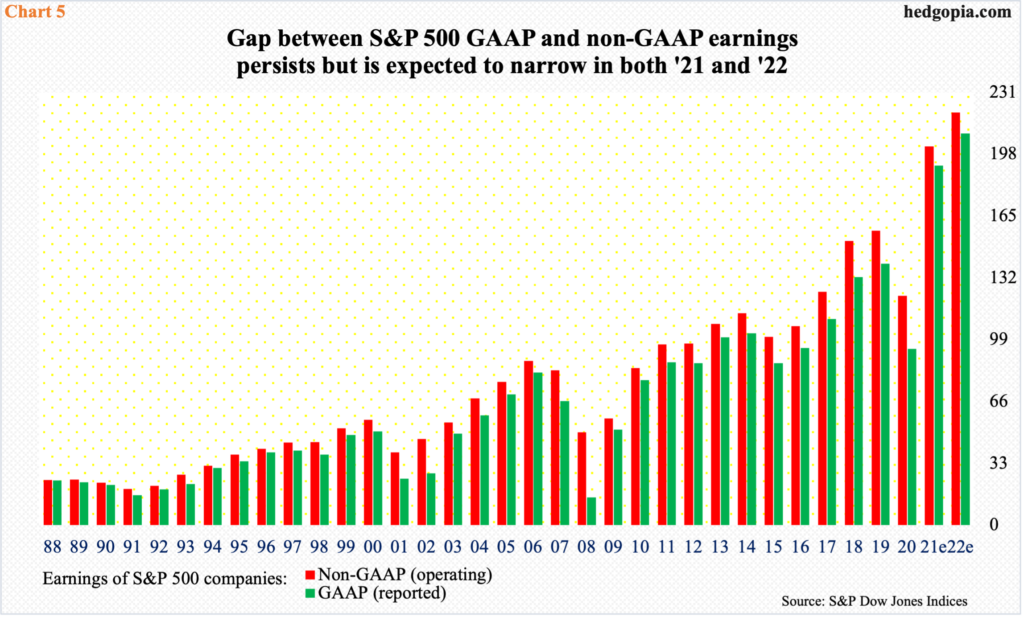

On a related note, the difference between reported and operating estimates is narrowing. With 4Q currently being reported, S&P 500 companies are expected to post $202.14 in operating (non-GAAP) and $191.83 in reported (GAAP) earnings in all of 2021. The $10.31 gap thereof is expected to slightly rise to $11.32 – $220.32 and $209 respectively – this year but remains narrower compared to recent years. In 2020, the gap was $28.24 (Chart 5).

In general, the narrower the gap, the healthier the earnings. This is obviously good from the quality point of view but is also a sign that companies are struggling to massage operating earnings, which is what multiples are based off of.

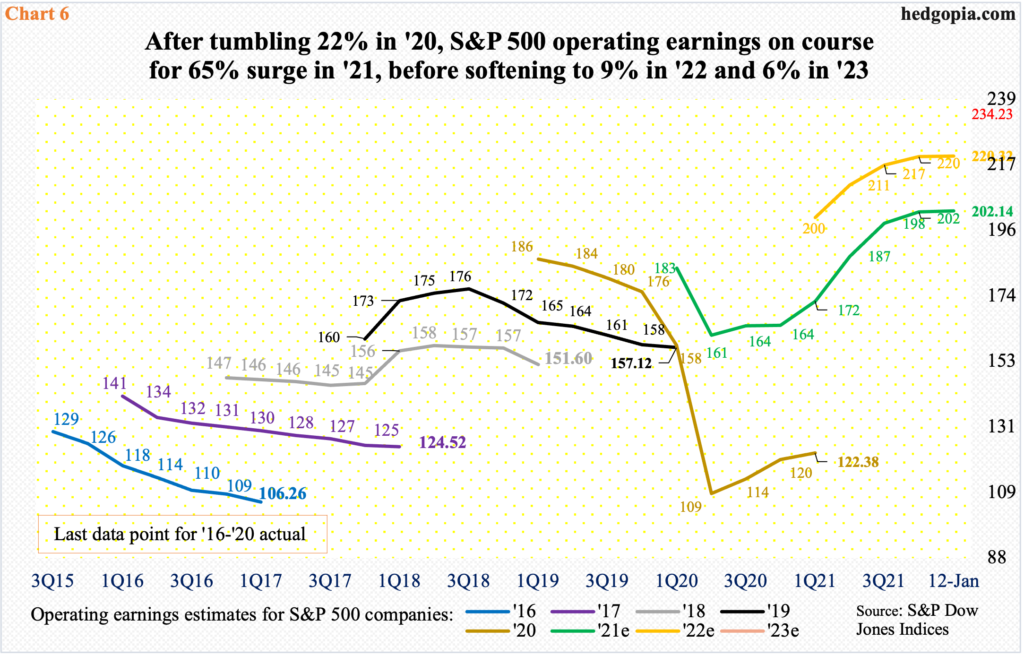

Earnings growth is in rapid deceleration.

In 2020, as the pandemic took hold, estimates began a nosedive in March, ultimately bottoming at $108.86 in July, down from a high of $186.26 in April 2019. When it was all said and done, 2020 ended down 22.1 percent to $122.37. Based on three quarters of actual results and one quarter of estimates, 2021 earnings are on pace to surge 65.2 percent, to $202.14. Growth is expected to continue this year and next but with decelerating momentum. This year, the sell-side has earnings growing nine percent to $220.32 and then another 6.3 percent next year to $234.23 (Chart 6).

Estimates for next year are new, so no trend can be discerned. But the revision trend for both 2021 and 2022 is decidedly flat to slightly down. This is not something equity bulls at this stage of the earnings cycle can use to push up multiples. This is a headwind and they will have to deal with it in the months and quarters to come.

Thanks for reading!