Here is a brief review of period-over-period change in short interest in the February 16-28 period in nine S&P 500 sectors.

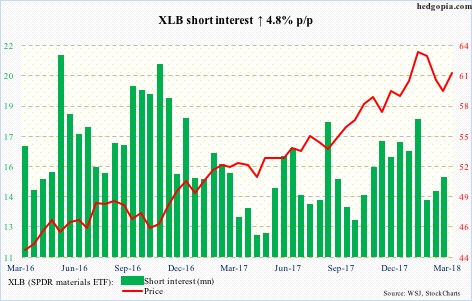

Post-February 9 low/reversal, XLB (61.32) rallied to test the 50-day moving average, but was rejected. The subsequent decline stopped at a higher low. Once again, the ETF is testing the average (61.27). For continued near-term momentum, it needs to at least take out 61.60 to also post higher highs.

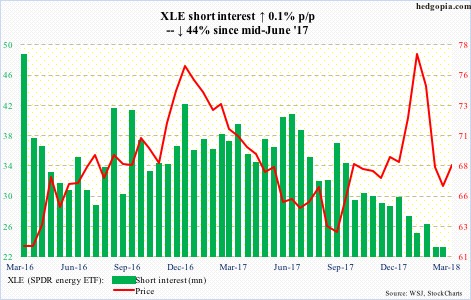

XLE (68.45) has straddled the 200-day (67.89) for a month now. Last Friday, it rallied past it; the move followed defense of near-term support at 66.60 in three of the four sessions. There is likely a crossover in the making between the 10- and 20-day. The bias is up near term, particularly so if resistance at 69 is won over. After that, 72 is the next ceiling, which also approximates the now-falling 50-day.

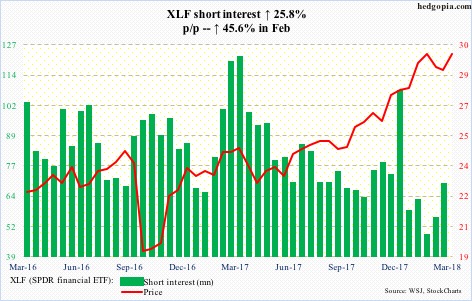

XLF (29.70) short interest went up nicely in February. It is possible shorts got squeezed in the current period, as the ETF began rallying from a low of 27.89 early this month. It can still push higher, but there is genuine resistance at 30 (high of 30.33 on January 29 this year).

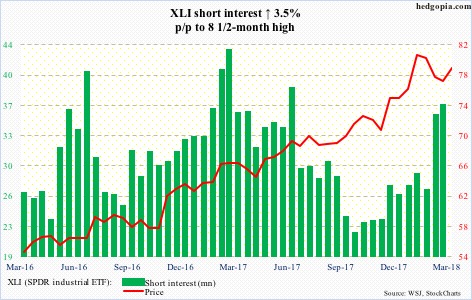

After peaking at 80.96 on January 29, XLI (78.45) fell to 71.49 on February 9. In the subsequent sessions, a pennant developed. Depending on how one draws it, the ETF has either broken out or sitting right on it. In either case, how it trades this week will be crucial, with resistance solid at 79.

Shorts got aggressive in February. From the lows early this month, XLI is already up six percent. Squeeze likely played a role.

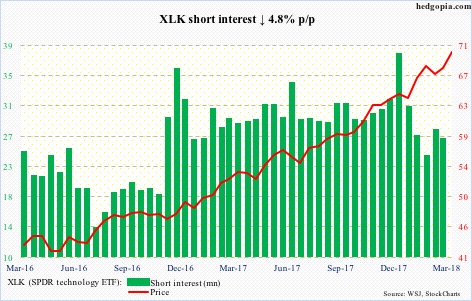

XLK (70.51) is the only S&P 500 sector ETF that has rallied to a new high after the recent correction.

Short interest began rising post-presidential election in November 2016, and has since remained elevated. These shorts probably contributed to last Friday’s 1.9-percent breakout. Retest lies at 69.30.

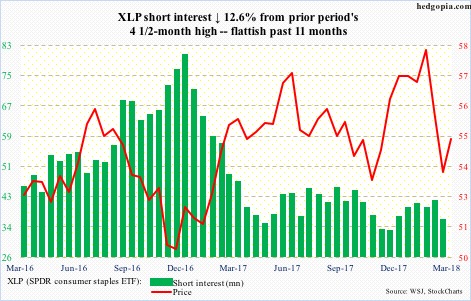

XLP (SPDR consumer stables ETF)

Since the February selloff, XLP (54.60) has closed above the 200-day (55.34) just once, that was on the 16th. From the bulls’ perspective, the good thing is that support at 52-53 has been defended. Shorter-term averages are turning up. In ideal circumstances, resistance at 55.50 gets tested near term, which is where the 200-day lies.

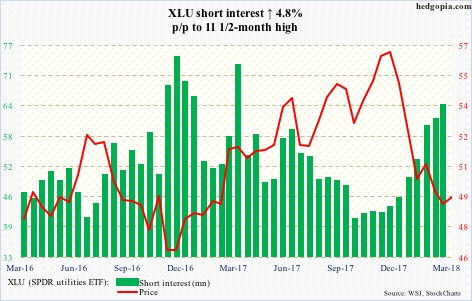

Potential fuel for squeeze is building in XLU (49.40). This likely takes place if the ETF is able to take out the 50-day (50.08). Since late February, the bulls have attacked the average several times, but all unsuccessfully. Another test looks imminent. The average is falling, so sooner or later a breakout is due.

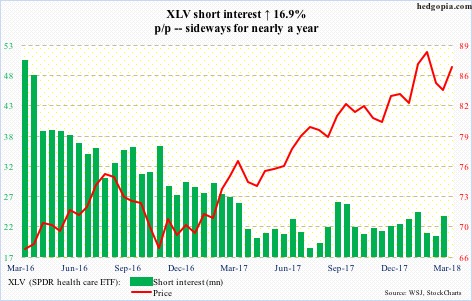

Since the low on February 9, XLV (86.51) has carved out higher lows. Last Friday, it closed just under resistance at 86.70. A breakout ensures higher highs.

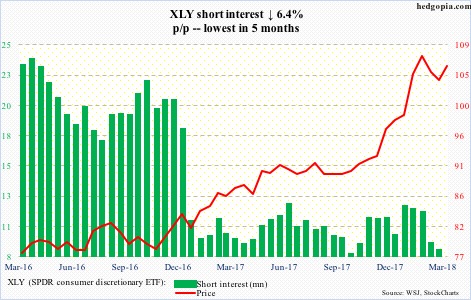

XLY (SPDR consumer discretionary ETF)

XLY (106.24) short interest has remained subdued for over a year now. Rightly so, as the ETF rallied big last year. Last Friday, it squeaked past a pennant. If this is followed by a rally past the February 27 high of 106.90, the bulls will be eyeing 107.50.

Thanks for reading!