On a Fed decision day, both large- and small-caps find themselves at crucial technical juncture. They have both taken a real hit the past five sessions. In the wake of last Friday’s inflation report, markets now expect a 75-basis-point hike later this afternoon, ending the year between 350 basis points and 375 basis points, from the current 75 basis points to 100 basis points. They are demanding a much more hawkish Fed, and, unless the central bank signals a 100-basis-point move, this may already be in the price.

It is the Fed decision day. The FOMC concludes its two-day meeting later this afternoon. A 75-basis-point hike is priced in, to a range of 150 basis points to 175 basis points.

Leading up to this, the Fed raised twice – by 25 basis points in March and 50 basis points in May. At the March meeting, Chair Jerome Powell knocked down markets’ expectations for a 75-basis-point raise but said a couple of 50 was possible. Futures traders quickly adjusted to this guidance. Post-last Friday’s inflation report, they again rejiggered their rates outlook.

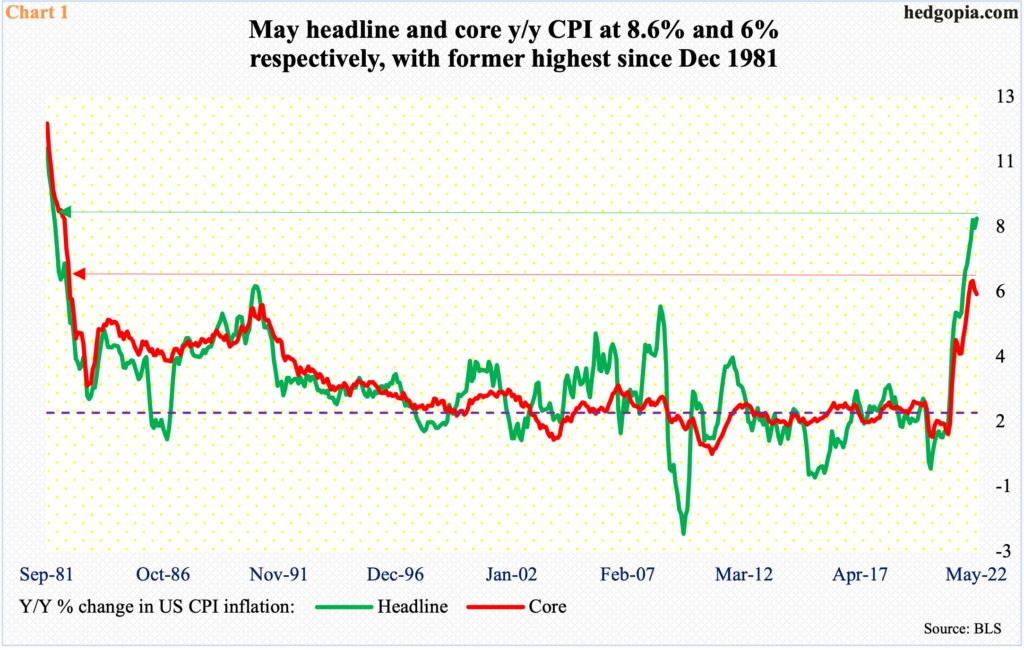

In the 12 months to May, headline consumer price index jumped 8.6 percent, which represents the steepest pace since December 1981 (Chart 1). Core CPI similarly jumped six percent, a bit slower than March’s 6.5 percent, which was the highest rise since August 1982.

Inflation continues to percolate, and markets are demanding a tighter Fed policy. In the futures market, traders expect another 75 in July, a 50 each in September and November, and at least a 25 in December, ending the year between 350 basis points and 375 basis points. Pre-CPI print, they expected benchmark rates to end 2022 between 275 basis points and 300 basis points.

Equities are responding to this tightening. They took a real beating the past five sessions.

The S&P 500 closed at 4161 on the 7th. On Tuesday, the large cap index ticked 3706, closing at 3735. From the January 4th high of 4819 through yesterday’s low, it tumbled 23.1 percent. In the first two sessions this week, the index is down 4.2 percent.

Clearly, markets expect a hawkish Fed language. Unless Powell signals that a 100-basis-point move is in consideration, right at this minute it is very possible markets will heave a sigh of relief that the meeting is over. In other words, a ‘sell the rumor, buy the news’ phenomenon is possible.

If things evolve this way, the S&P 500 ended Tuesday right on trend-line support from late last year (Chart 2).

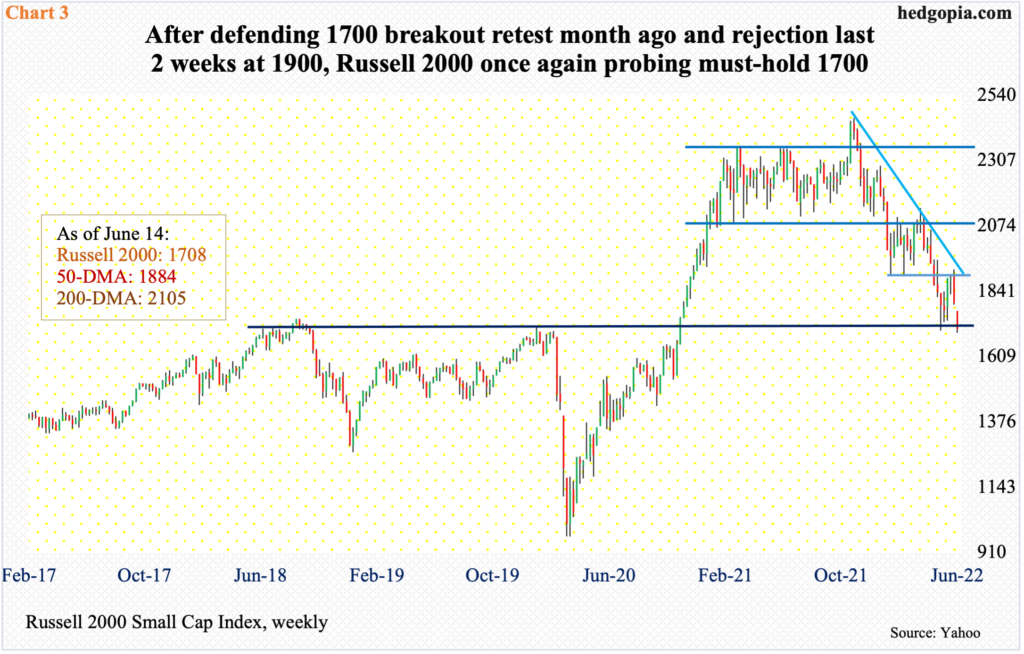

The Russell 2000 similarly finds itself at a crucial spot.

A month ago – on May 12, to be specific – the small cap index ticked 1701. This was a successful defense of a breakout from November 2000. This preceded a 30.8-percent drop between last November’s record high and that low.

Before that, the Russell 2000 was rangebound between 2080s and 1900 for three months before breaching the support in late April. Even before that in mid-January, a major range breakdown occurred, losing 2080s; for 10 months, it went back and forth between 2080s and 2350s.

A couple of weeks ago, 1900 was tested for the first time since suffering the late-April breach – unsuccessfully. Last week, small-cap bulls recaptured the level intra-week, tagging 1920 on Tuesday, but failed to hang on to it. Yesterday, 1700 was tested again, with the session tagging 1692 intraday and closing at 1708. This is obviously a must-hold for small-cap bulls. The conclusion of the FOMC meeting later today may just come to their aid.

Thanks for reading!