At least until August, foreigners were crystal clear which US assets to part with and which to hold on to. They have been selling equities and buying long bonds.

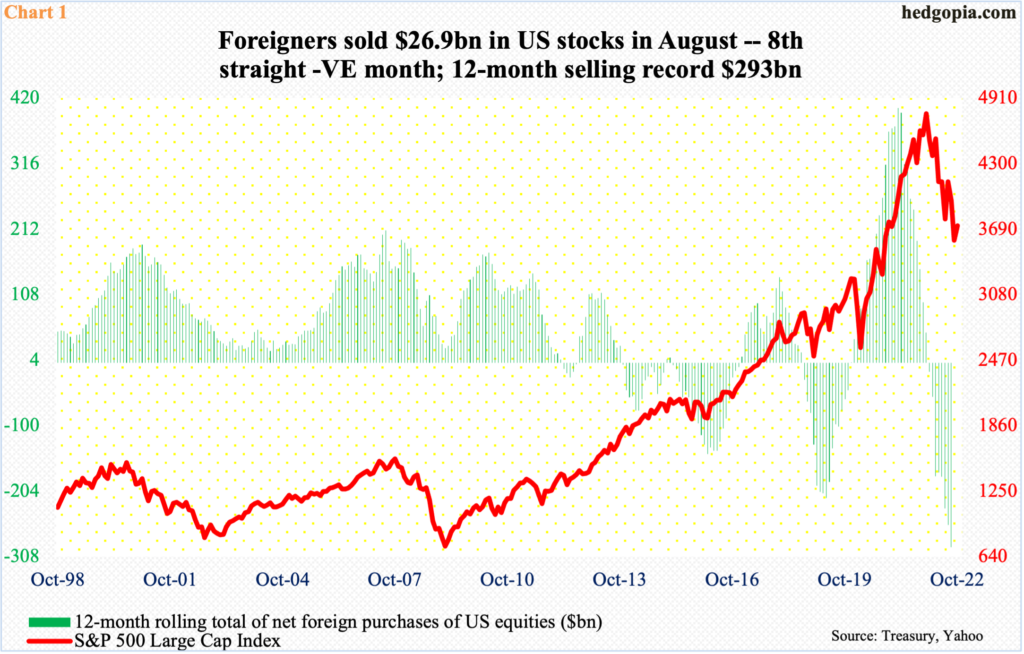

Foreigners sold another $26.9 billion in US stocks in August. This was the eighth month in a row they have disposed of US stocks on a net basis.

On a 12-month basis, they sold $293 billion worth in August – a fresh record (Chart 1). This is quite a U-turn on their part as they were net long $404.7 billion worth in March last year – also a record. In fact, they remained net long until December, before flipping to ‘sell’ in January and maintaining that posture for the eight months to August.

Incidentally, the S&P 500 peaked in January at 4819 and ticked 3492 last Thursday.

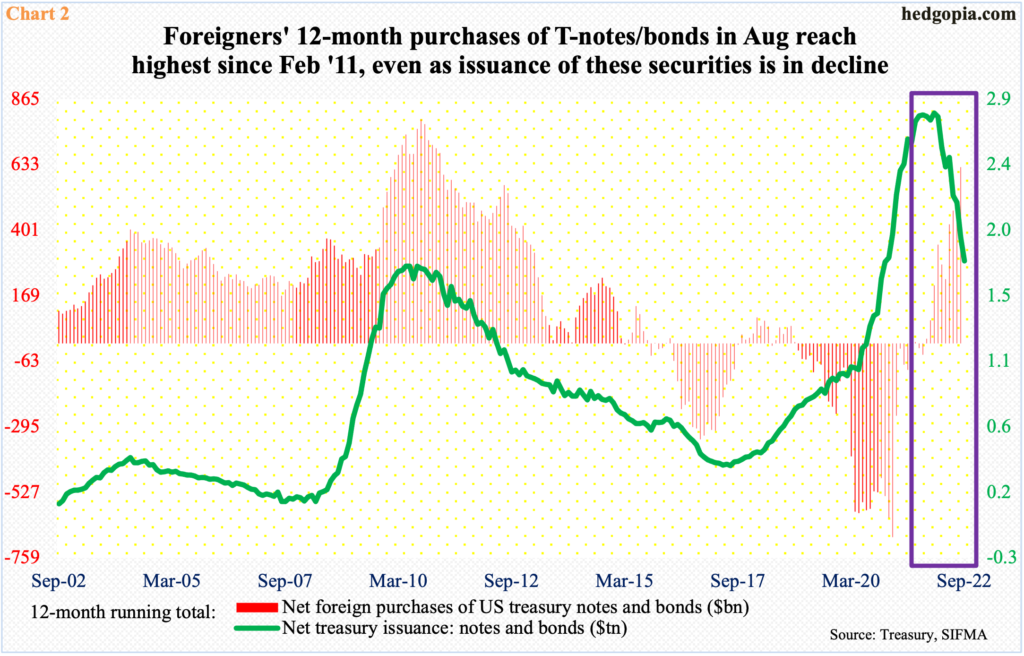

Concurrently, foreigners have been aggressively buying up treasury securities. As of last October, on a 12-month basis, they were selling $39.1 billion in treasury notes and bonds. Then they went the other way. In August, they bought $624.7 billion worth, which was the highest 12-month total since February 2011 (Chart 2).

Foreigners’ love for these securities has persistently risen even as the Treasury has been issuing fewer and fewer of these. The 12-month total of issuance of T-notes/bonds peaked this January at a record $2.76 trillion; last month, this was down to $1.74 trillion.

The aggression shown by foreigners in purchasing these securities comes at a time when the Federal Reserve is reducing its balance sheet.

As of Wednesday last week, the Fed held $4.82 trillion in treasury notes/bonds, down from $4.95 trillion in April; early March 2020, this was $2.03 trillion.

Given the elevated inflation, the Fed has committed itself to mopping up liquidity by both raising the fed funds rate and reducing its balance sheet, which more than doubled from $4.24 trillion early March 2020 to $8.97 trillion this April, with the latest reading at $8.76 trillion.

The 10-year yield is caught in this Fed-versus-foreigners push-and-pull – one selling the securities and the other buying – among others.

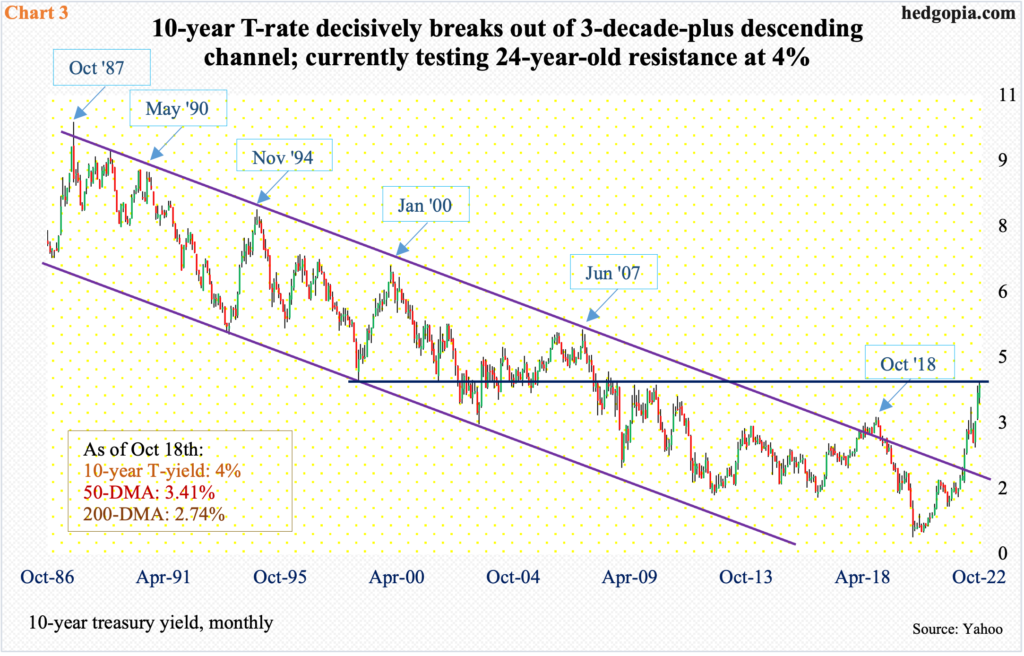

As the central bank has aggressively raised the benchmark rates to the current 300 basis points to 325 basis points – implied to reach north of 475 basis points in the futures market by next February – the 10-year quickly rallied from 2.52 percent early August to the current four percent. Rates hit 4.08 percent on the 13th (this month).

In March this year, the 10-year also broke out of a three-decade-plus descending channel (Chart 3), which is an important development long term. Right here and now, it has also reached an important juncture, with resistance at 4.1 percent going back to October 1998.

Rates do not have to pull back right away. The upward momentum is still strong, given the upward interest-rate trajectory on the short end of the curve. But at some point, as short rates continue to tighten, the long end should begin to worry about next year’s outlook. A recession looks inevitable, in which case rates will have to then go the other way, meaning treasury securities, which have been obliterated presently, will begin to appreciate. Foreigners are on the right side of this trade, as they were in US equities.

Thanks for reading!