Markets are acting very fidgety. Emerging ones are no exception.

On Monday, off Friday’s intra-day high, VIX, the S&P 500 Volatility Index, dropped 16-percent plus. Yesterday, at one point it was up 17-percent plus. TLT, the iShares 20+ Year Treasury ETF, lost 1.2 percent on Monday, followed by a 1.6-percent rally yesterday. The S&P 500 Index rallied 1.3 percent on Monday, only to lose one percent yesterday. You get the point.

It is difficult to make heads or tails of this action – or maybe not. Increasingly it feels like market participants do not yet wish to jump off the bandwagon, yet are aware that risks are rising – from geopolitical to U.S. earnings deceleration to the global economy. Hence the jittery action.

The latest curve ball came from China, as it allowed its currency to depreciate, cutting the daily reference rate for the yuan by nearly two percent to 6.2298. It is no coincidence the Chinese central bank’s action comes on the heels of an 8.3-percent drop in exports in July. Other Asian currencies such as the South Korean won, Japanese yen, Taiwan dollar and Singapore dollar have been weakening for a while.

The People’s Bank of China did state that the devaluation is one-off and will not be repeated. Time will tell. In fact, in early Wednesday trading, it did allow the yuan to fall for second day. What the Chinese action has done in the meantime is force markets to reassess global growth – whether it is accelerating or decelerating. July PMI was 47.6 in Korea, 47.1 in Taiwan, 47.8 in China (Caixin/Markit) and 50 (China official PMI). These are all economies heavily reliant on exports, and recent statistics on exports are anything but encouraging.

Then there is the issue of carry trade, of which China is a beneficiary. A lower renminbi raises the risk that hot money leaves that nation. It is not an easy task devising a perfect balance between stimulating exports and arresting capital flows. This also applies to emerging economies that have attracted U.S. quantitative easing (QE) money and that now face risks of an unwinding of that trade – particularly if the Fed does indeed go ahead and raise rates this year.

In some ways, as far as emerging markets are concerned, this may very well be an example of ‘heads I win, tails you lose’ phenomenon. If global growth does not materialize as hoped for, they will have their share of pain. If growth does indeed come in as expected – particularly in the U.S. – then they face risks of capital flight as U.S. rates begin to lift off from the prevailing zero-bound.

Are markets beginning to worry about this possibility?

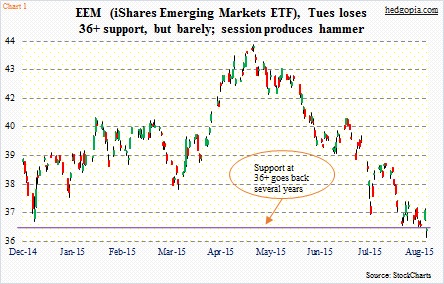

It is too soon to conclude, but yesterday was witness to some jitters. The iShares Emerging Markets ETF, dropped 2.2 percent, and was down as much as 3.1 percent at one point. Since noon, however, bids started showing up, producing a hammer when it was all said and done (Chart 1). The downside is that longs were not able to save support at 36+, though it is not lost by much.

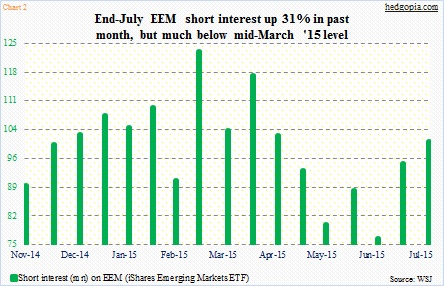

The hypothetical August 3rd buy-write trade was predicated on the premise that the ETF ($36.10) does not violate that support. With that said, it is not a convincing breakdown – not yet anyway. Technicals are way oversold both near- and medium-term. Short interest has risen 31 percent in the month through end-July (Chart 2); shorts nailed it as the ETF dropped six-plus percent during the period. At the same time, this can also act as fuel for rally should the bulls are able to regroup and press the ETF higher.

So rather than close out the trade outright for a loss of $0.80, one potential way to deal with the situation is to, let us say, write August 14th 36.50 covered calls fetching $0.17. If called away, the long position is liquidated for a loss of $0.23. If not, the cost effectively drops to $36.73 from $36.90. But here is the thing. There is no downside cushion using this strategy, given that the ETF has broken below support. There is way too much uncertainty, even though some options-related indicators are waving a green flag for stocks in general. Better to stay out of EEM for now, and take the loss.

Thanks for reading!