Among several culprits behind the recent sell-off in global stocks, two probably stand out: the yuan and crude oil.

Chinese stocks began this week where they left off on Friday, dropping more than five percent on Monday. Last week, the Shanghai composite index fell 10 percent, following the yuan lower.

On Monday, the two diverged. The yuan was guided higher yesterday, yet stocks continued lower.

Of late, the volatility in the yuan has sucked the life out of stocks. So far this year, the currency has depreciated 1.5 percent, after losing 4.7 percent in 2015. Stability in the currency will go a long way in soothing investor nerves.

That said, overnight lending rates spiked in Hong Kong yesterday. Offshore buying by the People’s Bank of China last week drained the supply of offshore yuan, putting upward pressure on rates.

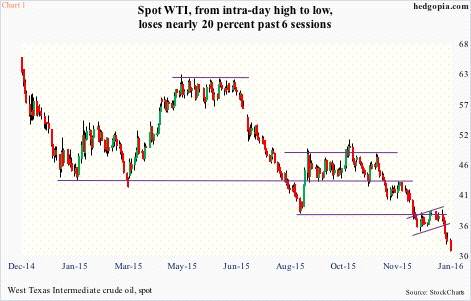

Last week, the spot West Texas Intermediate made an intra-day low of $32.10/barrel, matching the low of December 2003. Yesterday, it undercut that low, dropping to $30.88, before closing at $31.13. Between the intra-day high and low, it has now dropped nearly 20 percent in the past six sessions (Chart 1).

Unlike the Chinese currency, which the authorities are trying hard to stabilize, no such luck with the crude. Not yet anyway. Early strength was sold yesterday. Ditto with U.S. stocks, which was unable to hang on to early strength.

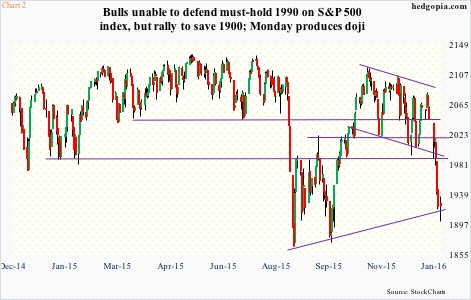

Between the intra-day high and low in the past eight sessions, the S&P 500 has tumbled 8.7 percent (Chart 2). The market has shifted from ‘buy the dips’ into ‘sell the rallies’. The overall tone of the market has changed.

When things stabilize, it is hard to imagine a rally as vigorous as was witnessed in the wake of the sell-off in August/September last year. The first test would be 1990, which the index needs to get back over in order for the bulls to be given the benefit of the doubt. On SPY ($192.11), this corresponds to $198-199 (Chart 3).

Amidst this rather hazy outlook, spot VIX is beginning to diverge from the S&P 500.

At yesterday’s intra-day low, the S&P 500 was just 1.8 percent from testing the August low of 1867, yet VIX needed to double to match the intra-day high back then. Yesterday, VIX barely traded in the green even though the S&P 500 at one point was down 1.1 percent.

Along the same lines, on December 14th, spot VIX shot up to 26.81 before reversing. The S&P 500 yesterday undercut the intra-day low in that session by 4.6 percent, yet VIX uncharacteristically has only gone sideways (Chart 4).

For now, the so-called fear index is itching to go lower.

If so, a reprieve is around the corner for stocks – if nothing else, an oversold bounce.

Once again, there has been a lot of technical damage wrought on major U.S. indices, and the bulls have their work cut out for themselves.

That said, if there is imminent stability near-term, then deploying options can at least (1) build position at a lower price or (2) generate income.

Hypothetically, January 15th 191 puts fetch $1.68. If put, it is a long at $189.32, slightly under yesterday’s low. Else, with four sessions to go, it is a nice premium to keep.

Thanks for reading!