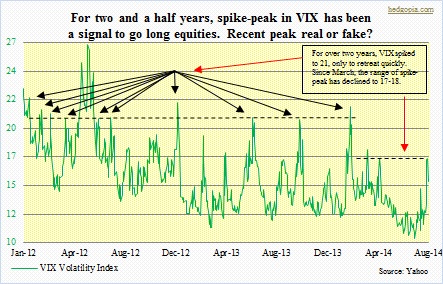

How equity traders are likely to position themselves for at least the next week or so will depend on how they answer the question above. As the accompanying chart shows, going back at least two and a half years, a VIX spike to around 21 has been a place to go long equities (The spike signal can best be seen using a candlestick chart.). The only exception was in June 2012 when it spiked to north of 26, and that was the last time the S&P 500 Index suffered a 10-percent decline. Since then, equities have had smaller corrections; the VIX has not gone over 22. Since March, the magnitude and duration of correction has shrunk even further, and the VIX has made lower highs and lower lows. Twice already – one in March and the other in April – the ‘fear gauge’ spiked to 17-18, only to quickly turn tail and run. We saw this again on Friday when the index surged to 17.57, and flashed a minor spike signal. It is now nearly two and a half points lower. If it is indeed a spike signal, then once again equities will start attracting bids. But the signal is not as clean as in the past.

How equity traders are likely to position themselves for at least the next week or so will depend on how they answer the question above. As the accompanying chart shows, going back at least two and a half years, a VIX spike to around 21 has been a place to go long equities (The spike signal can best be seen using a candlestick chart.). The only exception was in June 2012 when it spiked to north of 26, and that was the last time the S&P 500 Index suffered a 10-percent decline. Since then, equities have had smaller corrections; the VIX has not gone over 22. Since March, the magnitude and duration of correction has shrunk even further, and the VIX has made lower highs and lower lows. Twice already – one in March and the other in April – the ‘fear gauge’ spiked to 17-18, only to quickly turn tail and run. We saw this again on Friday when the index surged to 17.57, and flashed a minor spike signal. It is now nearly two and a half points lower. If it is indeed a spike signal, then once again equities will start attracting bids. But the signal is not as clean as in the past.

After last week’s rout, near-term, equities are in deep oversold territory, even as the VIX remains way overbought. So the Monday action could very well be a process of unwinding some of those conditions. Alternatively, it could be that market participants have decided the sub-four-percent decline in the S&P 500 is all they are going to get in the name of decline. One good way to find out is how major indices now act near resistance. Importantly, support got taken out on several indices in last week’s rout. Levels to watch include 1950-1955 on the S&P 500, 4425 on the Nasdaq, 16700-16800 on the Dow, 22.50-22.60 on XLF (financials), 113 on IWM (small-caps), 50 on SMH (semis).

After a tough week, a bounce is perfectly normal. Indeed, volume was anemic yesterday. Nevertheless, when it is all said and done, it is the price that matters. If sellers are not yet willing to part with their holdings, that is reason enough to create a supply-demand imbalance, and that pushes prices higher. Time will tell if those that sold last week were prescient or were unnecessarily quick on the trigger. We will get some clues as/if prices approach the afore-mentioned support-turned-resistance.