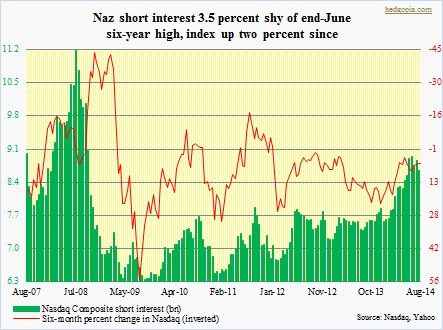

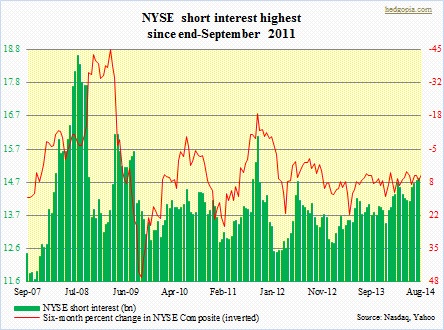

NYSE Composite short interest in the middle of August was essentially unchanged month-over-month at 14.8bn, while the Nasdaq Composite saw a 2.4-percent decrease at 8.6bn. The adjacent chart and the one below show how short interest has been building up on both indices since the beginning of the year. This is in contrast to last year when there were substantially fewer party poopers. In 2013, the Nasdaq shot up 38 percent, and the NYSE 23 percent; short interest rose five percent and four percent, in that order. This year is different. Year-to-date, these indices are up nine percent and six percent, respectively; short interest is up 14 percent (18 percent if end-June high is considered) and 10 percent, respectively. If not for the short selling, equities would probably be even higher this year. On the other hand, the presence of short interest has also helped cushion the blow of any pullback in equities. Early August, equities stabilized after a two-week drop and turned sharply higher. As stated earlier, in the most recent period Nasdaq short interest dropped 2.4 percent, suggesting some short-covering. The question is, are the bulls in a position to orchestrate more squeezing?

NYSE Composite short interest in the middle of August was essentially unchanged month-over-month at 14.8bn, while the Nasdaq Composite saw a 2.4-percent decrease at 8.6bn. The adjacent chart and the one below show how short interest has been building up on both indices since the beginning of the year. This is in contrast to last year when there were substantially fewer party poopers. In 2013, the Nasdaq shot up 38 percent, and the NYSE 23 percent; short interest rose five percent and four percent, in that order. This year is different. Year-to-date, these indices are up nine percent and six percent, respectively; short interest is up 14 percent (18 percent if end-June high is considered) and 10 percent, respectively. If not for the short selling, equities would probably be even higher this year. On the other hand, the presence of short interest has also helped cushion the blow of any pullback in equities. Early August, equities stabilized after a two-week drop and turned sharply higher. As stated earlier, in the most recent period Nasdaq short interest dropped 2.4 percent, suggesting some short-covering. The question is, are the bulls in a position to orchestrate more squeezing?

They sure hope so. But what are the odds?

The topic of discussion yesterday on this blog is relevant here. The CBO’s downwardly revised forecast of 1.5 percent growth in real GDP in FY14 leaves room open for disappointment in consensus S&P 500 earnings this year. That probably does not give much reason for the bulls to put new money to work. Nor will the bears come under pressure to cover. Of course, there have been breakouts. But breakouts also need confirmation, which is hard to pull off in a low-volume environment. Sure, if the economy fails to live up to expectations, that might raise the odds that the Fed stays accommodative longer than currently priced in. Nevertheless, valuations are no longer as reasonable as they were in 2011. At 18-plus, the P/E multiple on the S&P 500 may not be nosebleed but is high enough that new investors would think twice before getting aggressive. And we are beginning to see that. Nowhere is this psychology more evident than in how small-caps are behaving. The IWM is one of those ETFs this blogger uses to measure speculative sentiment in investor psyche. Currently, it is grossly lacking. The ETF has rallied all month, but is still four percent off its early-July highs. The S&P 500 in contrast is near all-time highs. Ten-year German bunds yielding below one percent and 10-year Treasury yield at 2.3 percent are sending a similar message: no risk of a serious short squeeze anytime soon.

The topic of discussion yesterday on this blog is relevant here. The CBO’s downwardly revised forecast of 1.5 percent growth in real GDP in FY14 leaves room open for disappointment in consensus S&P 500 earnings this year. That probably does not give much reason for the bulls to put new money to work. Nor will the bears come under pressure to cover. Of course, there have been breakouts. But breakouts also need confirmation, which is hard to pull off in a low-volume environment. Sure, if the economy fails to live up to expectations, that might raise the odds that the Fed stays accommodative longer than currently priced in. Nevertheless, valuations are no longer as reasonable as they were in 2011. At 18-plus, the P/E multiple on the S&P 500 may not be nosebleed but is high enough that new investors would think twice before getting aggressive. And we are beginning to see that. Nowhere is this psychology more evident than in how small-caps are behaving. The IWM is one of those ETFs this blogger uses to measure speculative sentiment in investor psyche. Currently, it is grossly lacking. The ETF has rallied all month, but is still four percent off its early-July highs. The S&P 500 in contrast is near all-time highs. Ten-year German bunds yielding below one percent and 10-year Treasury yield at 2.3 percent are sending a similar message: no risk of a serious short squeeze anytime soon.