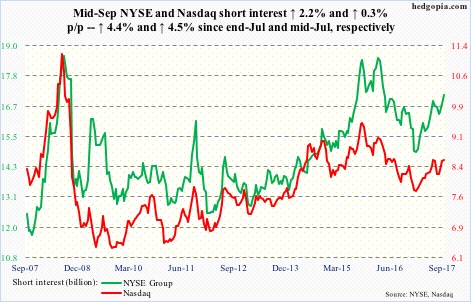

Here is a brief review of period-over-period change in short interest in the September 1-15 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

Nasdaq

Since reaching an all-time high of 6477.77 in a spinning top session on September 18, the composite (6380.16) has come under pressure. Support lies at 6300-plus, which was just about defended Monday.

Momentum – at least near term – shifts the bears’ way should this support give way. In this scenario, the bulls’ hope is that the bears get tempted to lock in gains soon. Short interest remains elevated.

NYSE Group

Monday saw a new intraday high of 12165.25 on the composite (12127.92); the bulls defended the 10-day, but the session also produced a long-legged doji. The daily chart is extended, and looks to be wanting to go lower.

Near-term support lies at 12000.

As is the case with the Nasdaq, short interest remains high on the NYSE.

…

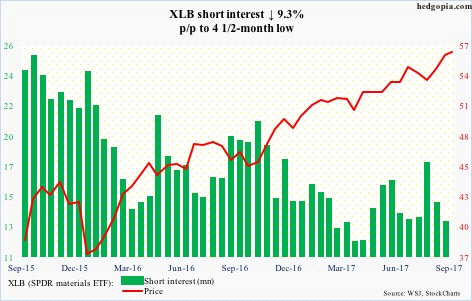

XLB (56.40) rose to a new intraday high of 56.99 on September 20, but not before producing a potentially reversal candle.

Near-term support lies at 55-plus. Around there lies a rising trend line from January/February last year. The bears would have scored victory if it broke.

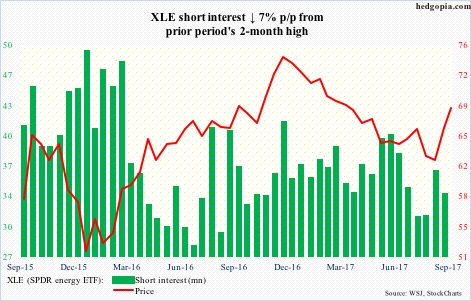

After peaking in December last year, XLE (68.14) traded within a falling channel, until it broke out three weeks ago. Since then, it has gone straight up, with the daily chart severely overbought.

That said, momentum lies with the bulls, who recaptured the 200-day Monday, riding along the upper Bollinger band. All good until momentum reverses.

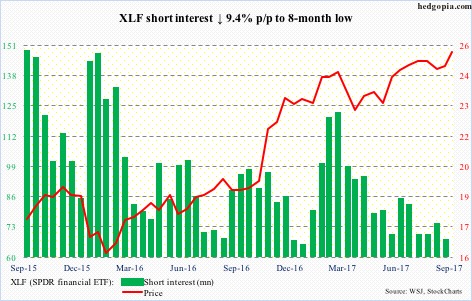

After defending the 200-day early this month, the bulls managed to rally XLF (25.39) to a new all-time high of 25.52 on September 21.

Resistance at 25-plus goes back to May 2007, and has been unsuccessfully attacked several times. Time will tell if this time is different.

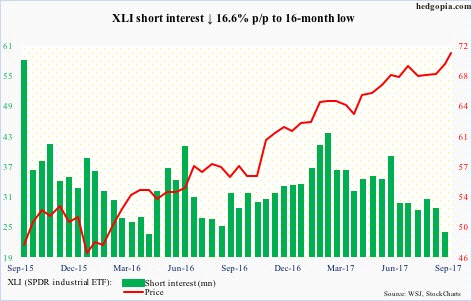

XLI (70.75) produced a daily hanging man Monday. In a doji session Tuesday, it rose to a new all-time high of 70.88. The potentially reversal candles show up after a five-plus-percent rally over 13 sessions.

Near-term support lies just south of 69, with the 50-day (68.38) right underneath.

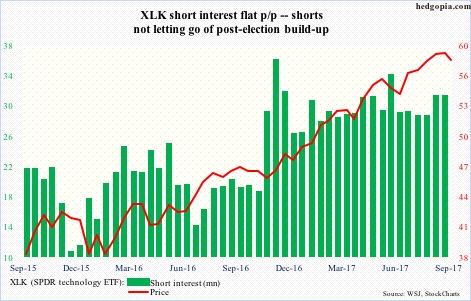

After leading for months, tech is beginning to lag. XLK (58.04) rallied to a new all-time high of 59.17 on September 19, and then turned lower.

There is decent support at 56.50. Should it be tested, the ETF would have lost the 50-day.

Short interest doggedly remains elevated.

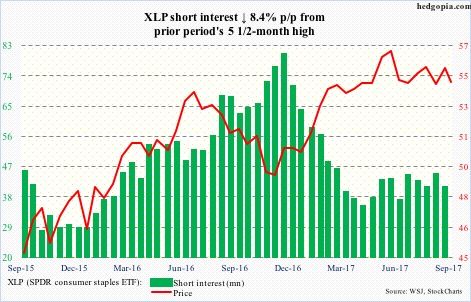

XLP (SPDR consumer stables ETF)

After dropping 2.7 percent intraday in four sessions, XLP (54.44) found support at the 200-day last Friday. Although, since peaking at 56.57 on June 5, it has been making lower highs. Momentum will turn bearish if the bulls lose 53.60.

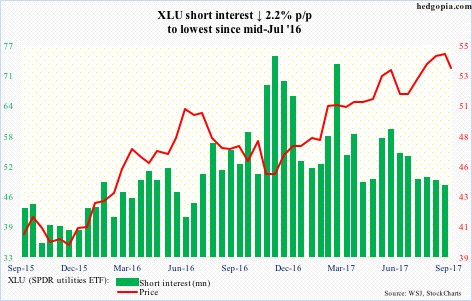

The break out of 53.80 mid-August barely lasted. Monday, XLU (53.62) closed right underneath that support-turned-resistance, which also approximates the 50-day. This was followed by a rejection Tuesday. The bulls need to retake this to recapture momentum.

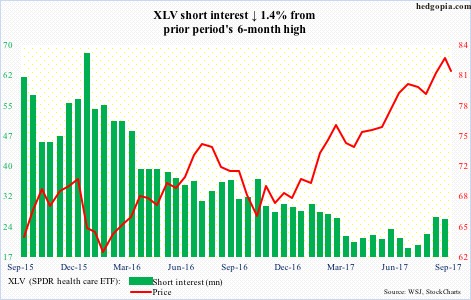

On September 7, XLV (81.21) broke out of nearly three-month resistance just south of 81, before rallying to an all-time high of 83.10 on September 13. A breakout retest took place last Friday, successfully thus far.

In the meantime, shorter-term moving averages are rolling over. Another retest likely lies ahead.

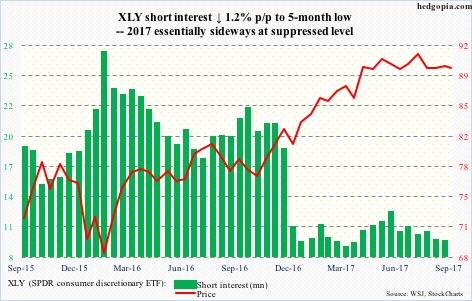

XLY (SPDR consumer discretionary ETF)

Six-month support at 87.50-88 was successfully tested twice in August, but XLY (89.36) bulls have not been able to build on it. The July 27 all-time high of 92.22 stands, with lower highs since.

A loss of this support would complete a double-top formation, with technicians eyeing $84 as the new target.

Thanks for reading!