U.S. financials are acting lethargic but they have so far managed to cling on to potentially crucial support.

Post-presidential election last November, a fire was lit under U.S. financials.

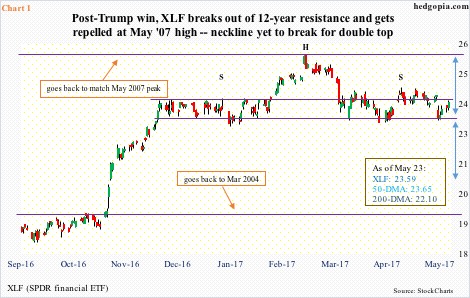

Intraday between November 9 and March 2, XLF, the SPDR financial ETF, rallied 24.8 percent! To boot, it broke out of 12-plus-year resistance at just under 20 (Chart 1), followed by a test of the prior high of May 2007 – 25.31 back then versus 25.21 this March. It was not a successful test.

A double top in the making?

March 2 also produced a bearish engulfing candle. The reversal took place less than two weeks before the FOMC met on 14-15 that month, when the Fed funds rate was pushed up by another 25 basis points to a range of 75 to 100 basis points.

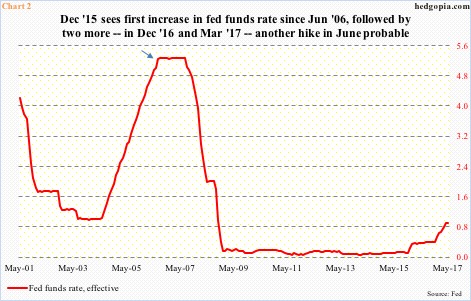

This was the third 25-basis-point increase since December 2015 – which was the first hike since June 2006 (arrow in Chart 2). The Fed also raised last December.

Leading up to the Fed’s first hike in 10 years, XLF tried to break out of resistance at 20 in both November and December, but was rejected. Then there were attempts in August-October last year – all unsuccessful. The breakout only came after President Trump’s victory last year.

Fast forward to now, and XLF is giving out signs of fatigue. From the March 2nd peak through the intraday low last Wednesday, it shed 8.9 percent. When the Fed hiked in March, it suggested it would like to move at least two more times this year. June is a lock, with the odds in the futures market of a 25-basis-point increase at 83 percent.

Yet, XLF cannot get going.

That said, it is not falling apart either.

Bulls have defended support at 22.80 for over five months now, including last week. Above lies resistance at 23.70, which the ETF broke out of early February but only for six weeks. This was when the May 2007 peak was tested in March.

All this back-and-forth has helped forge a head-and-shoulders formation (Chart 1). Should it complete, technicians would be eyeing just north of 20 on XLF, which would just about retest the November 2016 breakout. A break of the neckline probably also constitutes completion of the afore-mentioned double top formation.

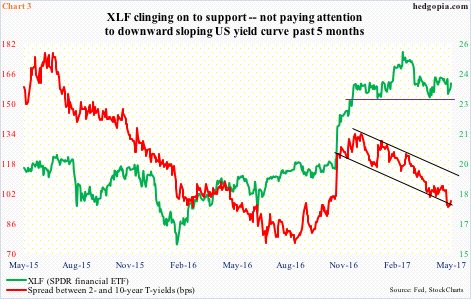

From the bulls’ perspective, the good thing is that XLF has hung to support even as the Treasury yield curve has tightened. From just about the time the ETF began to go sideways early December last year, the spread between 10- and two-year yields peaked, going from 134 basis points to 98 basis points now (Chart 3).

Banks borrow short and lend long, hence benefit by a steeper yield curve. One primary reason financials rallied vigorously post-election was expectation that Trump’s promised tax cuts, fewer regulations and enhanced infrastructure spending would kick U.S. growth into high gear.

Though the fact remains that the long end is yet to seriously buy into this thesis.

On December 15 last year, 10-year yields retreated from hitting 2.62 percent. This level was unsuccessfully tested again on March 13 (Chart 4). Both these dates were around the time the FOMC met and raised. This resistance goes back to February 2009. (2.6% is Jeff Gundlach’s line in the sand to decide if the multi-decade bull market in bonds has ended.)

As 2.62 percent was holding firm, so did support at 2.32 percent. No longer. Yields have broken support, but are trying to stabilize near gap support. The daily chart in particular is oversold, and has room to rally in the right circumstances.

Also on the daily chart, XLF, too, has room to rally. Should 10-year yields rally, will XLF follow? Failure on the latter’s part will be a big tell.

Thanks for reading!