After four negative weeks, equity bulls should be happy with how things have panned out week-to-date but it is far from all-clear. The Nasdaq 100 reclaimed the 50-day, while the S&P 500 closed Tuesday right on it. Both broke through a three-week wedge, even as the Russell 2000 is sitting just under the upper bound of a short-term channel. If bears are looking for a spot to step up, this is it.

Last week, after a 13-session, 14.2-percent intraday selloff in the Nasdaq 100 index, tech bulls regrouped just under the 50-day moving average. By then, they had already breached an ascending channel from the March lows (Chart 1).

After the index (11322.95) peaked on the 2nd this month at 12439.48, it was caught in a wedge, which it poked its head out of last Friday. This week, it began Monday with a gap-up past the 50-day (11246.50), with buyers rushing to defend the average intraday.

Bulls should be happy with this performance, yet more needs to be done. Volume is nothing to write home about. Last Friday’s was lower than Thursday’s and Monday’s was lower than last Friday’s. Immediately ahead, resistance lies at 11500s.

On the daily, several indicators have reached the median, including the RSI. Bears likely will try to show up here.

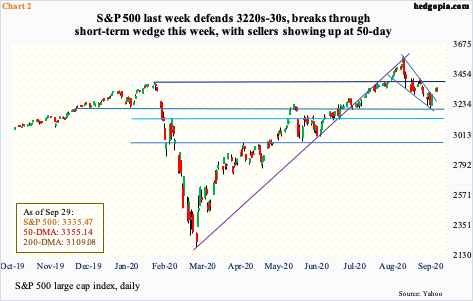

This is also true with the S&P 500 large cap index, which lost the 50-day eight sessions ago. Before bears could build this into something serious, bids showed up at 3220s-30s throughout last week. This support goes back to last December (Chart 2).

As is the case with the Nasdaq 100, Monday’s gap-up saw the S&P 500 break through a wedge from early this month. But bulls were not as lucky when it came to the 50-day (3355.14). Monday, the index (3335.47) essentially closed on the average, while Tuesday’s rally attempt was rejected there.

If bears put foot down at the 50-day, it does not take long before 3220s-30s gets tested again. In this scenario, it will be awfully hard for tech bulls to continue to defend the average on the Nasdaq 100.

In the meantime, the Russell 2000 small cap index (1504.73) is 1.9 percent away from its 50-day. For it to test the average, it first needs to push through a short-term falling channel (Chart 3). If small-cap bears manage to regroup here, horizontal support at 1450s-60s may once again act like a magnet. This support, which approximates the 200-day at 1456.64, was defended last week.

Earlier, shortly after failing at 1600-plus, which goes back to January 2018, early August, followed by the loss of a rising channel from March, the Russell 2000 began going back and forth within the falling channel, ending Tuesday right underneath the upper bound.

With both small- and large-caps having approached potentially crucial juncture, a tug-of-war is only natural. Right here and now, bears likely have the advantage. If bulls manage to fight it off, they would have made more inroads into eventual short squeeze (more on this here).

Thanks for reading!