The Russell 2000 has a parabolic look to it. Post-presidential election and vaccine news, investors are piling into the index. On Tuesday, the index had opened up a 31.1-percent gap with its 200-day – the most ever. Amidst this, Wednesday produced subtle signs of fatigue.

The Russell 2000 is going vertical. On October 30, a couple of sessions before the November 30 presidential election, small-cap bulls defended horizontal support at 1530s. This Wednesday, the small cap index (1902.15) hit a new intraday all-time high of 1935.27 – up nearly 27 percent in less than a month and a half.

Investors have piled into small-caps post-election and particularly after positive vaccine news from Pfizer (November 9) and Moderna (November 16), hoping the US economy begins to get back to normal next year. By nature, these companies have more domestic exposure than larger-cap companies which also have international exposure.

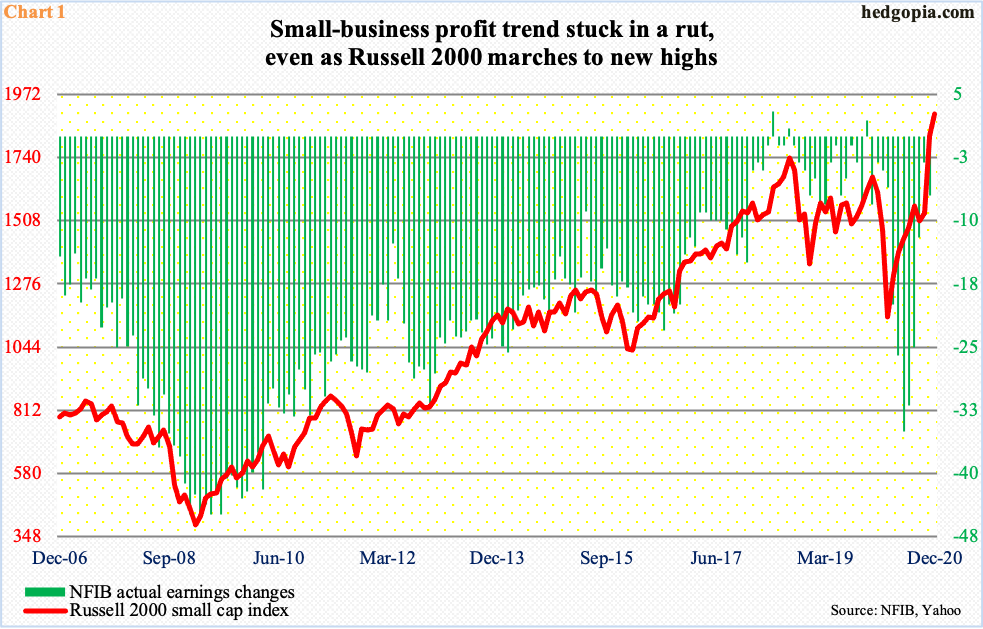

Investors who have opened up long positions in small-cap stocks are obviously not swayed by the current profit trend, which remains subdued. The NFIB ‘actual earnings changes’ sub-index deteriorated by four points month-over-month in November to minus seven. Things have of course improved a lot from June’s minus 35, but the green bars in Chart 1 have not quite gone hand in hand with the red line.

Investors are rather focused on next year’s prospects.

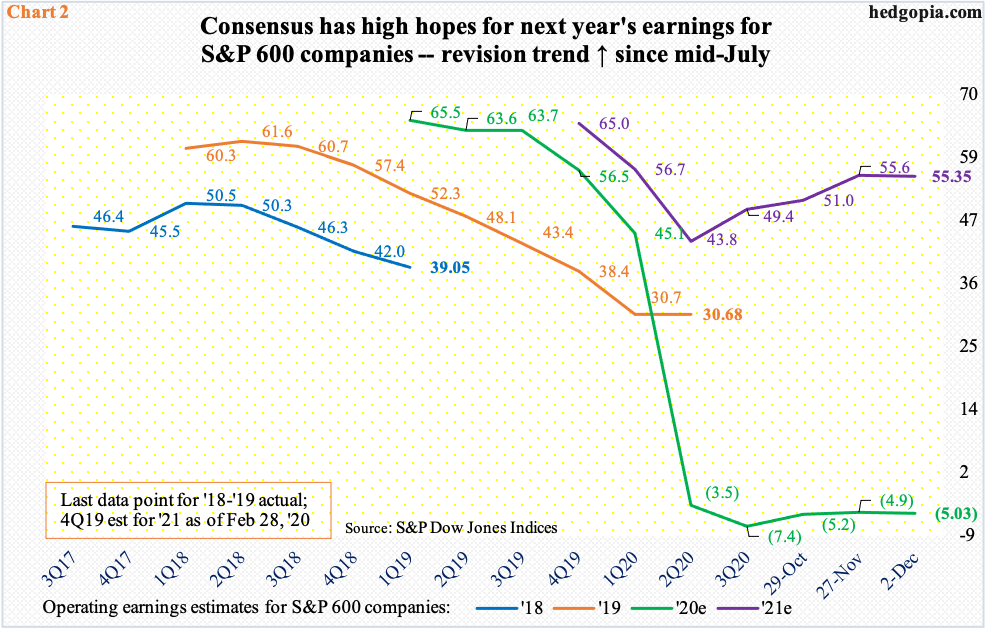

As of Wednesday last week, the sell-side had S&P 600 companies earning $55.35, down slightly from $55.60 as of November 27. Granted these analysts expected $64.96 in February this year, but the revision trend has been up since mid-July when 2021 estimates bottomed at $42.99 (Chart 2).

If next year’s numbers come through, this would represent quite a reversal from this year’s expected loss of $5.03. Even here, with one quarter of earnings to go, the revision trend has improved, with an expected loss of $8.35 in late September.

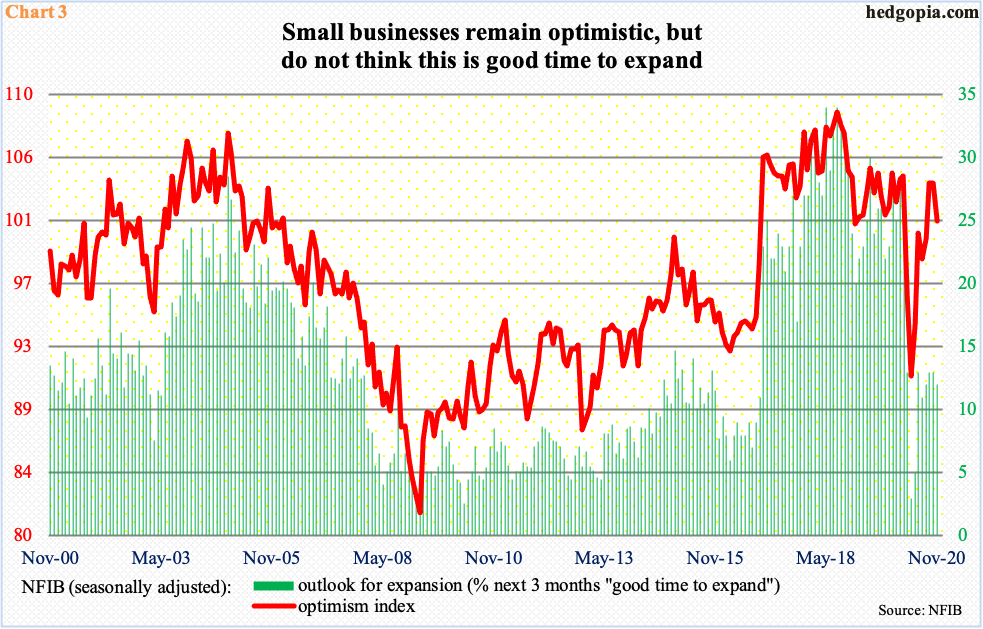

This is all encouraging, except small businesses are yet to definitively project an air of confidence when it comes to expansion plans.

In November, the NFIB optimism index fell 2.6 points m/m to 101.4. This was the fourth straight 100-plus reading and fifth in six. Earlier in April, the index fell to 90.9. Even earlier, optimism remained north of 100 for 39 weeks before going sub-100 in March. In other words, small-business optimism is holding up, but they are not ready to open up their wallets to expand just yet.

In November, the ‘outlook for expansion’ sub-index, which measures if these businesses view the next three months as a good time to expand, fell a point m/m to 12. In April, it fell to three, but at the same time it was 28 in January. There is a clear divergence between small-business optimism and their expansion plans.

Small-cap stocks are essentially betting that the currently lagging expansion plans will catch up to the current optimism.

As previously mentioned, the Russell 2000 is going gangbusters. Along the way, it took out major resistance just north of 1600 and 1740s, with the former resistance going back to January 2018 and the latter its prior high from August that year.

On Tuesday, the index was 31.1 percent away from its 200-day moving average, surpassing the prior record of 30.4 percent from March 2000 (more on this here).

Amidst all this, bulls were unable to hang on to Wednesday’s gains, with the index reversing to end the session down 0.8 percent. It is too soon to make too much out of this, but it is a sign of fatigue. Nearest support lies at 1850s, which, if broken, opens the door to breakout retest at 1740s.

Thanks for reading!