Bulls are not ready to give up just yet. At the end of last week, bears had a decent opening, as subtle technical weakness developed on major US equity indices. Before this could morph into something serious, bulls put their foot down as soon as this week began. Concurrently, bears are not allowing breakout either.

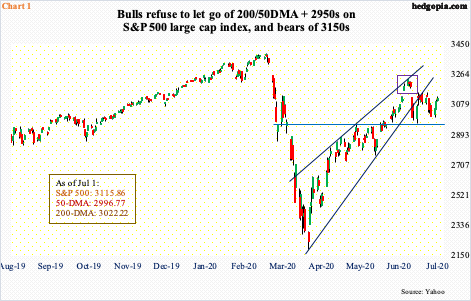

The S&P 500 large cap index (3115.86) last Friday breached the 200-day moving average albeit by less than 12 points. There was a similar breach 11 sessions ago – on June 11th – which was followed by more selling until bulls stepped up to defend 2950s-60s (Chart 1).

So, when the 200-day was undercut last Friday, it was widely expected that 2950s-60s would once again get tested. Month- and quarter-end markups came in the way of bears. Monday’s early weakness was bought, with the session low tagging 2999.74, just above the 50-day.

The action this week preceded an island reversal plus breach of a rising wedge three weeks ago. This was an opening for bears, but bulls in the next couple of sessions defended 2950s-60s. Once again on Tuesday last week, bears had an opening after bulls were rejected at 3150s. And once again, bulls stepped up where they needed to, this time in defense of the 50- and 200-day. But, until 3150s give way, the index remains rangebound.

The Nasdaq 100 (10279.25) acts stronger. On February 19th, the index tagged 9736.57 intraday before the rug was pulled out from under it. The collapse that followed bottomed at 6771.91 on March 23rd. Three months and a week later, it posted a new intraday high Wednesday.

Bears had some opening on Tuesday last week after a shooting star showed up in a session in which the index rose to a new high. The subsequent weakness stopped this Monday when bulls bought near the February high (Chart 2). This was also a successful test of a rising trend line from the March low.

Channel support from the March low was also defended on the Russell 2000 small cap index. This took place Monday as well as later last week (Chart 3). This followed rejection at 1450s, which has proven to be an important price point going back three years.

After the Russell 2000 bottomed in March, late May was when 1450s was tested for the first time. After a brief hesitation, the index pushed through to eventually tag 1537.62 on June 8th, but the breakout was short-lived. The selloff that followed stopped at a confluence of the aforementioned channel support and horizontal support at 1330s. Since then, bulls have gone after 1450s several times, including Wednesday – all unsuccessfully.

So, except for the tech-heavy Nasdaq 100 which is in its own world, both large- and small-caps are essentially rangebound – the Russell 2000 between 1330s and 1450s and the S&P 500 between 2950s and 3150s. Last week, bulls risked loss of support, but managed to save it on time. Now, it is bears’ turn to defend resistance, which they did on the Russell 2000 Wednesday.

Thanks for reading!