Stocks have rallied massively into 1Q earnings season. Estimates have been revised lower in a big way. The bar is low. But not valuation multiples. It is a decision time for longs to either hold or fold.

US companies are getting ready to report 1Q. The sell-side has done them a big favor. Estimates have been substantially revised lower over the last three months.

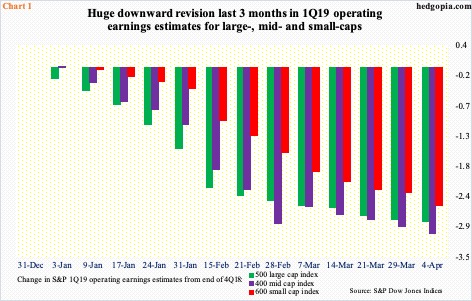

Chart 1 looks at the change in operating earnings estimates for S&P 500/400/600 companies from the end of fourth quarter last year – that is, as 1Q began. This essentially shows the extent of the downward revision in estimates during 1Q. The bar for these companies to meet/beat consensus estimates is quite low.

At the end of December, 1Q estimates for large-caps were $39.66, which by Thursday last week got cut to $36.82. During the same period, estimates for mid-caps went from $26.95 to $23.89 and for small-caps from $12.16 to $9.61.

In fact, 1Q19 estimates peaked much earlier last year – large-caps at $41.12 in August, mid-caps at $27.74 in October and small-caps at $13.39 in June.

Stocks in general have rallied massively into this.

From late-December lows, the S&P 500 is up 23 percent, the 400 24 percent and the 600 22 percent. That said, it is only the 500 that is within striking distance of its all-time high – 1.8 percent from last September’s record high (Chart 2). The 400 and 600 are still 5.5 percent and 13.8 percent from their respective August highs.

From the perspective of investor/trader sentiment, large-caps leading their mid and small cousins does not buoy much confidence. Small-caps in particular are lagging, which means risk appetite is suppressed. Bulls are taking shelter in large-caps.

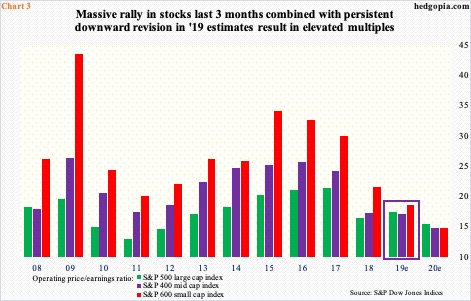

The massive rally since late-December lows has combined with the downward revision in earnings estimates to result in stretched multiples. This is probably one reason why longs are seeking protection in large-caps to begin with. But even here, on ’19 estimates, the forward P/E is 17.5x – not cheap by any stretch of the imagination. On that same basis, the 400 is selling at 17.2x and the 600 at 18.6x (box in Chart 3).

Using ’20 estimates, multiples obviously drop. But at this moment, they are just that – estimates – and a rosy one at that. For 2020, the sell-side expects $186.40 for the 500, $130.86 for the 400 and $65.39 for the 600! This compares with 2019 estimates of $165.33, $113.05 and $52 respectively. Last year, they earned $151.60, $95.98 and $39.05 in that order.

Here is why it is difficult to trust ’19 estimates – let alone ’20. Up until November last year, 2018 was expected to produce $158.26; when it was all said and done, $151.60 was earned. Similarly, ’19 last August was expected to bring in $177.13, versus $165.33 now. At this point, the sell-side expects ’19 earnings momentum to pick back up in the second half. Looking at the ongoing downward revision momentum, it is best not to fully trust this optimism.

Hence the likelihood in the next few weeks of a tug-of-war between suppressed 1Q19 estimates and probably-still-elevated ’19 estimates. Companies may meet/beat 1Q19 estimates, but then, even if ’19 estimates come through, longs are not looking at cheap multiples. In this environment, it can be tempting to lock in profit.

Thanks for reading!