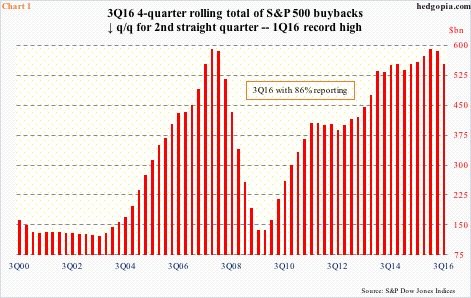

The pace of stock buybacks by S&P 500 companies continued to decelerate in 3Q16.

With 86 percent reporting, as per Howard Silverblatt of S&P Dow Jones Indices, buybacks are down eight percent quarter-over-quarter and down 22 percent year-over-year.

These are preliminary numbers, but with only 14 percent remaining to report, final numbers will probably not deviate much.

Buybacks were $127.5 billion in 2Q16 and $150.6 billion in 3Q15, so that puts 3Q16 at $117.3 billion – give and take. This is the lowest total since $116.2 billion in 2Q14. Buybacks peaked at $161.4 billion in 1Q16 – second only to $172 billion in 3Q07.

Chart 1 uses a 12-month rolling total. On this basis, too, buybacks peaked in 1Q16 – at an all-time high of $589.4 billion, with 3Q16 at $552.1 billion.

Why are they dropping?

Simplistically, for four straight quarters through 2Q16 – and in five out of six – buybacks and dividends combined surpassed 100 percent of operating earnings. Dividends were $98.3 billion in 2Q16 for a combined total of $225.8 billion, versus $222.8 billion in operating earnings.

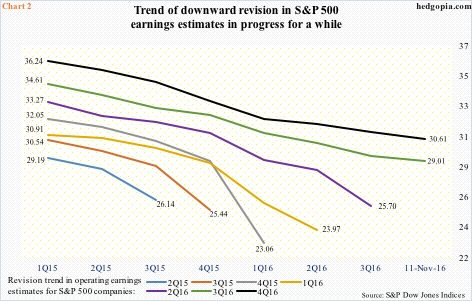

If these companies kept up this pace of buybacks believing earnings would get better, that is yet to happen.

Chart 2 plots operating earnings estimates for 2Q15-4Q16 going back to 1Q15. For 2Q16, for instance, estimates were as high as $33.27 in 1Q15, and, when it was all said and done, merely $25.70 was earned.

Along the same lines, at the start of the year, 2016 was expected to earn $125.56 (in fact, estimates were as high as $137.46 in February last year). Throughout the year, estimates have been persistently revised downward – now at $109.29. In the middle of January this year, 2017 was expected to bring in $141.11, which has now been cut down to $130.88.

With excitement over Mr. Trump’s victory in U.S. presidential election and prospects of growth-oriented policy, the sell-side will probably begin to revise 2017 estimates higher. Whether or not this will come to pass is anyone’s guess.

For now, given a choice, between cutting buybacks or dividends, corporations logically would cut the former first. Indeed, as Howard points out, the S&P 500 last week indicated that the dividend rate reached $400 billion for the first time ever.

Buybacks have provided a bulwark of support for the current bull market – as evident in the gradual increase in the red bars in Chart 1. If they start trending down, some other buying source (s) need to take their place.

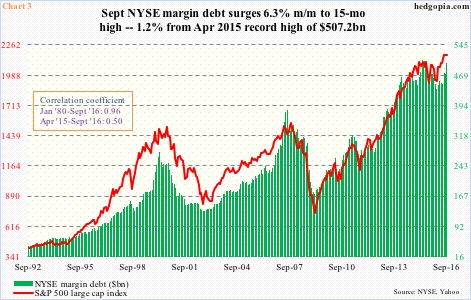

Margin debt is a potential source. It does tend to correlate strongly with the S&P 500 large cap index. In April last year, margin debt peaked at $507.2 billion. A month later, the S&P 500 peaked. Then in February this year, the index bottomed, as did margin debt at $435.8 billion. The July breakout in the S&P 500 was not matched by a new high in margin debt, but September saw a 6.3-percent increase to $501.1 billion – 1.2 percent from the April 2015 peak (Chart 3).

In fact, in 3Q16, margin debt increased by a whopping $53.8 billion – more than five times the $10.2-billion decline in buybacks.

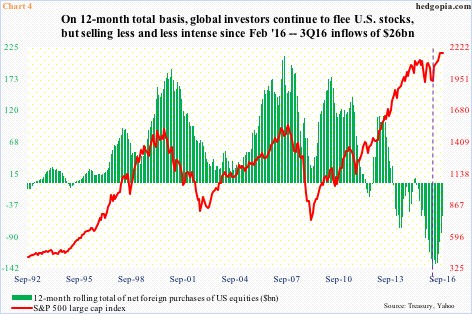

As strong as buybacks have been in the current bull market, they helped fill the void left by a lack of foreign buying, among others.

Foreign purchases of U.S. equities also tend to have a strong correlation with the S&P 500 index. The correlation began to break down in the early months of 2013, as the green bars in Chart 4 began to get smaller even as the S&P 500 pushed higher.

On a 12-month rolling total basis, foreigners sold a record $138.9 billion worth of U.S. equities in February this year. They have continued to sell since, but with less intensity. From this perspective, the two have been moving together since that month. In 3Q16, they purchased a total of $26 billion worth – peanuts in a larger scheme of things, but positive nonetheless. Along with a rise in margin debt, these flows helped.

The question is, would that continue to be the case going forward? This is important, particularly so considering that equity flows into U.S.-based funds continue to be negative – $32 billion was redeemed in 3Q16 (courtesy of Lipper).

The takeaway here is that the decelerating pace of buybacks is bound to matter – degree notwithstanding.

Thanks for reading!