Following futures positions of non-commercials are as of December 24, 2018.

The below is from the CFTC site.

“The last COT report was published on December 21, 2018. Reports going forward from that date will be published in chronological order beginning with the report previously scheduled for release on Friday, December 28, 2018 (based on data from Monday, December 24, 2018). The CFTC expects to publish this report on Friday, February 1, 2019. After this, the CFTC expects to publish one report on Tuesday and another on Friday of each week until the reports are current as per the normal schedule.”

The CFTC was not able to publish reports on time due to the partial shutdown of the federal government, which has now reopened. But it will be several weeks before these reports become current. Since December 24, five more reports have been due. Until they become current, we will only present the charts below, but not commentaries.

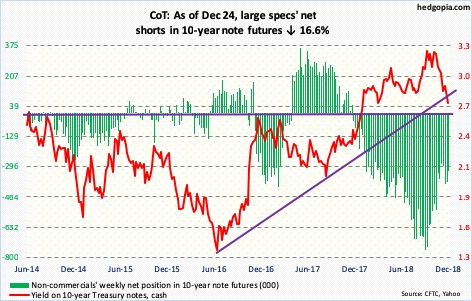

10-year note: Currently net short 317.6k, down 63.1k.

30-year bond: Currently net short 25.7k, down 26.6k.

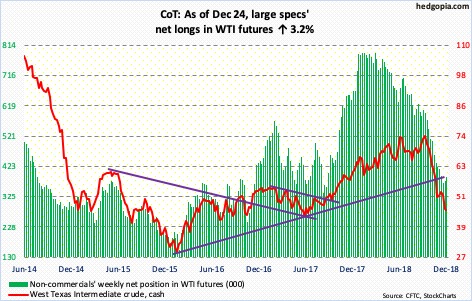

Crude oil: Currently net long 389.2k, up 12.1k.

E-mini S&P 500: Currently net long 170.2k, down 40k.

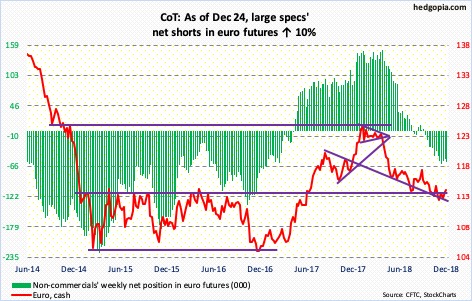

Euro: Currently net short 58.5k, up 5.3k.

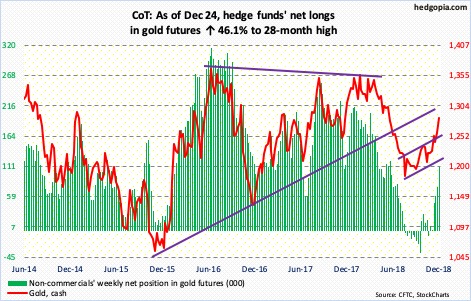

Gold: Currently net long 111k, up 35k.

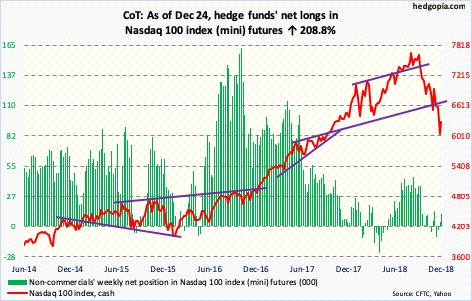

Nasdaq 100 index (mini): Currently net long 10.8k, up 7.3k.

Russell 2000 mini-index: Currently net short 3.2k, down 17.7k.

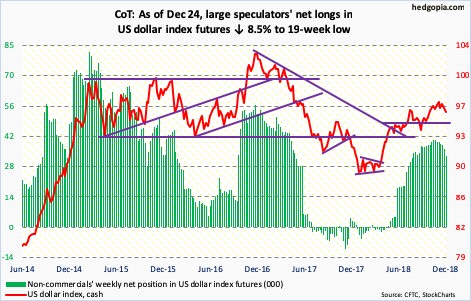

US Dollar Index: Currently net long 33k, down 3.1k.

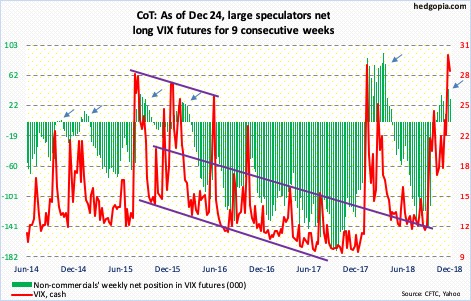

VIX: Currently net long 30.2k, up 14.1k.

Thanks for reading!