Following futures positions of non-commercials are as of January 22, 2019.

Beginning December 21, the CFTC was not able to publish reports on time due to the partial shutdown of the federal government, which has now reopened. The CFTC expects to publish one report on Tuesday and another on Friday of each week until the reports are current as per the normal schedule. It will be three more weeks before due reports are published. Until then, we will only present the charts below, but not commentaries.

10-year note: Currently net short 125.8k, down 74.4k.

30-year bond: Currently net short 21k, down 4.4k.

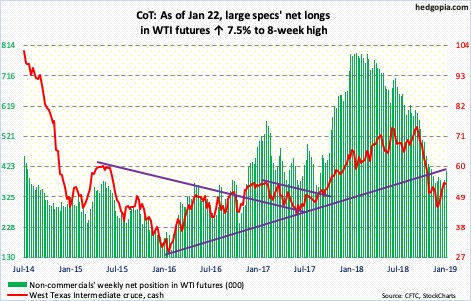

Crude oil: Currently net long 409.6k, up 28.6k.

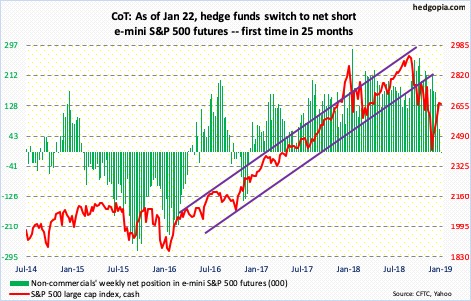

E-mini S&P 500: Currently net short 4.6k, down 68.8k.

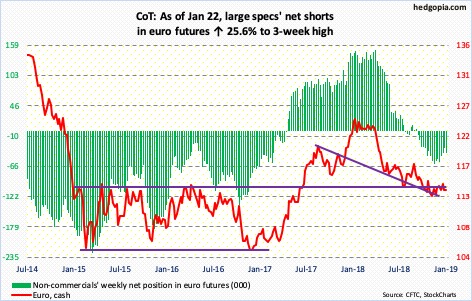

Euro: Currently net short 41k, up 8.3k.

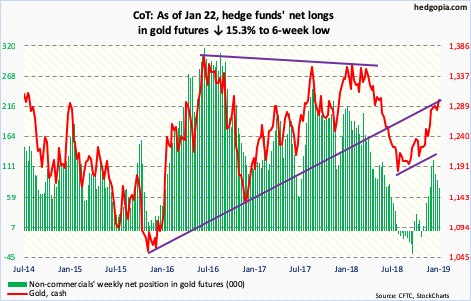

Gold: Currently net long 74.5k, down 13.4k.

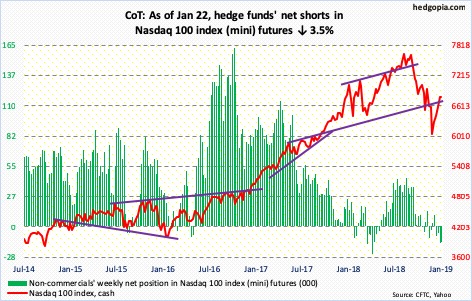

Nasdaq 100 index (mini): Currently net short 14.2k, down 510.

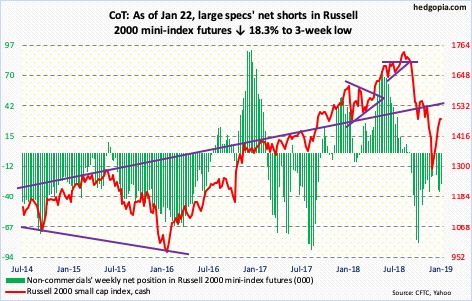

Russell 2000 mini-index: Currently net short 28.4k, down 6.4k.

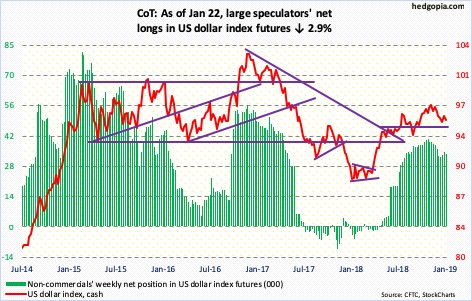

US Dollar Index: Currently net long 33.6k, down 985.

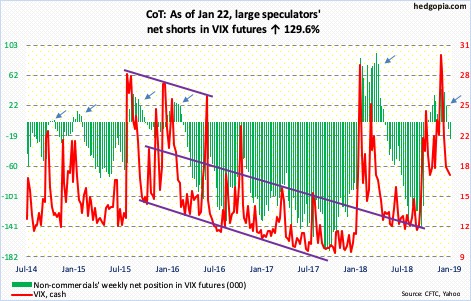

VIX: Currently net short 22.6k, up 12.7k.

Thanks for reading!