Back on October 12th when SPY, the SPDR S&P 500 ETF, was trading at $201.52, October 16th weekly 202.50 calls were hypothetically sold for $0.84. Once assigned, this resulted in effective short at $203.34. Three weekly short puts later, and the associated $1.89 in cumulative premium, the effective short price was further pushed up to $205.23.

After having risen as high as $211.66 in early November, the ETF rose 0.5 percent yesterday to $202.90.

Continue to stay short or cover?

The answer probably depends on one’s timeframe.

Medium term, more downside probably lies ahead. Weekly overbought conditions have a long way to go before they get unwound.

The bearish outlook was further vindicated by last week’s action, in which SPY dropped 3.7 percent. The action last Friday in particular was ominous, with the ETF losing both its 50- and 200-day moving averages as well as support at both $204 and $202.

As a result, daily conditions are now grossly oversold. To top it off, the ETF was a stone’s throw away from a make-or-break support at $199.

Come Monday, buyers, taking advantage of early weakness, did show up in defense of that support. SPY ($202.90) dropped to $199.95 intra-day before reversing.

The breakout retest could not be more vivid on the S&P 500 (arrow in Chart 1). Odds favor the retest holds – at least in the near term.

The breakout retest could not be more vivid on the S&P 500 (arrow in Chart 1). Odds favor the retest holds – at least in the near term.

Seasonality is favorable.

FOMC decision is tomorrow. At best, Janet Yellen, Fed chair, will convey a ‘one and done’ message, which markets should cherish. At worst, she will reiterate her data-dependency pledge. Odds are decent that she will not say anything that will roil stocks.

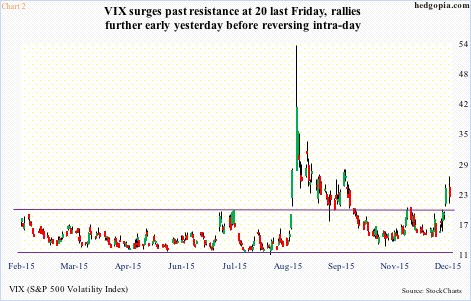

And then there is spot VIX. Last week, it shot up 65 percent, to 24.39, surging past not only its 50- and 200-day moving averages but also resistance at 20 (Chart 2). Monday, it rallied another 10 percent, to 26.81, before reversing.

Last week, it shot up 65 percent, to 24.39, surging past not only its 50- and 200-day moving averages but also resistance at 20 (Chart 2). Monday, it rallied another 10 percent, to 26.81, before reversing.

More often than not, when the spot is overbought, spikes and then reverses, that would be a time to sell volatility. We could be on the verge of one. The caveat of course being the FOMC meeting/message tomorrow. Barring a drastically hawkish message, odds favor VIX comes under downward pressure near-term.

In this scenario, it is probably not prudent to continue to stay short SPY.

Thanks for reading!