Markets were on pins and needles as to if Powell would be open to the possibility of a rate hike. He hardly sounded hawkish Wednesday. A dovish message hardly helps cool down the positive wealth effect coming from equities and home prices. It could rather be helping inflation remain sticky.

A day prior to the conclusion of the two-day FOMC meeting, the employment cost index for the March quarter was released, and it came in hotter than expected. Private-industry total compensation increased 4.1 percent from a year ago. The series peaked in 2Q22 at 5.5 percent, which was a 38-year high, and has been north of four percent for 11 quarters now (Chart 1).

This comes on the heels of hotter-than-expected readings in recent months in both the consumer price index and personal consumption expenditures. Price increases are not dropping at the rate many had hoped.

Of late, several FOMC members have sounded alarmed by prospects of sticky inflation, with some even stating only one rate cut – at best – was needed this year; the March-meeting dot plot showed FOMC members expected three 25-basis-point cuts. The fed funds rate, after having been raised from a range of zero to 25 basis points in March 2022 to between 525 basis points and 550 basis points through last July, was once again left unchanged this week.

With most economic data coming in stronger than expected of late, markets were nervous if Chair Jerome Powell would open the door to the possibility of a hike, if the need be. He did not, stating in the post-meeting presser that “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.”

When pressed what it would take for them to hike, he said, “I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to two percent over time. That is not what we think we’re seeing.”

On Wednesday, markets were confused, and this was reflected in how equities traded. Stocks took off at 2:30, rallied hard for half an hour until they rolled over at 3:00. The S&P 500 reversed from up 1.2 percent at the session high to down 0.3 percent at close, with a massive shooting star (Chart 2); on Monday, sellers showed up at 50-day moving average.

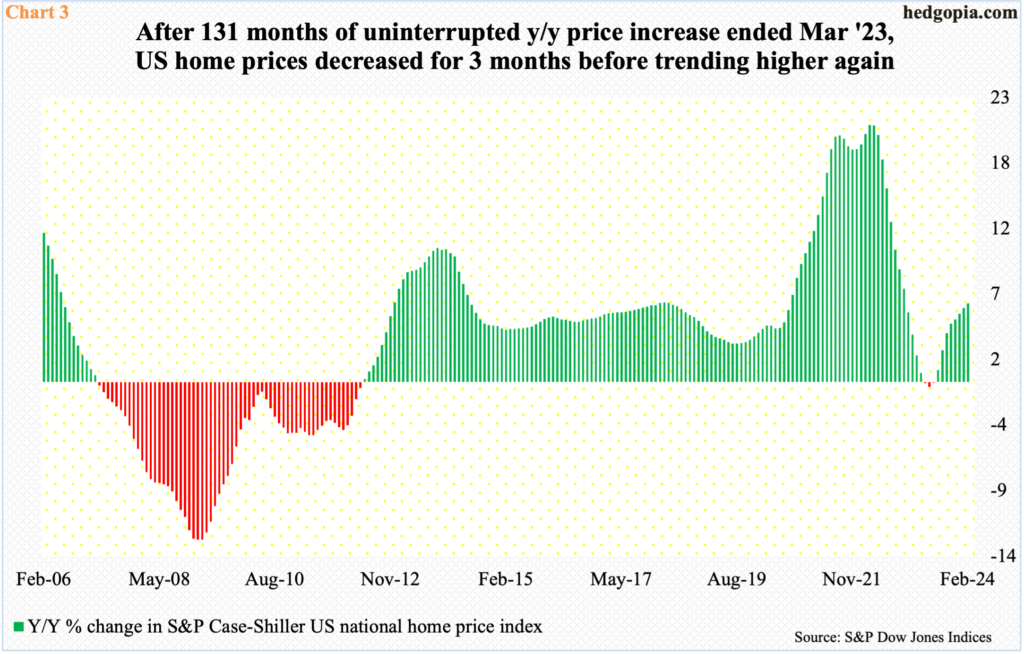

Deep down, Powell’s body language suggests there is a clear bias toward easing. But they need data to cooperate. Apart from the economy refusing to show signs of deceleration, stocks have rallied huge since last October’s low, adding trillions in market cap, and that helps consumer mood/spending. Ditto with housing. Home prices are rising once again.

In February, using the S&P Case-Shiller home price index, US home prices firmed up 6.4 percent year-over-year. This was the steepest price appreciation in 15 months. In March 2022, prices were rising at a record 20.8 percent, before going the other way. For three months from April through June last year, prices dropped, albeit marginally (Chart 3). Since last July, the growth rate has been in acceleration.

The Federal Reserve has time on its side and likely takes time on rate cuts. One can argue the monetary policy is not restrictive enough to particularly impact equities and home prices, which influence inflation through the wealth effect. A dovish message at a time like this does not help.

Thanks for reading!