Short interest as of the end of March was flat on an index level, but action was hot and heavy on an industry/sector level.

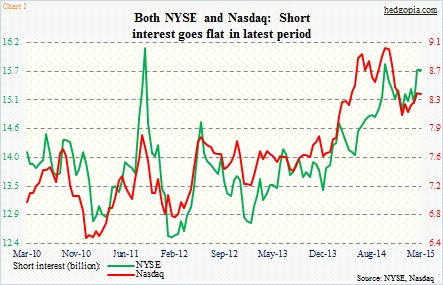

On the NYSE, short interest was 15.68 billion, down from 15.69 billion two weeks ago. On the Nasdaq, it stood at 8.4 billion, versus 8.41 billion.

In the middle of last October, when stocks bottomed, short interest had risen to 15.79 billion on the NYSE and 9.02 billion on the Nasdaq (Chart 1). NYSE shorts are essentially back to where they were five and a half months ago. On the Nasdaq, however, short interest is nearly seven percent lower, even as the index is 21 percent higher. Shorts are not getting aggressive. This kind of jives with how large specs are positioned on Nasdaq 100 futures.

Nonetheless, it is hard to imagine the Nasdaq surging another 20-plus percent in the next several months. From this perspective, these shorts probably have better odds of success versus back then, when they got squeezed.

Be that as it may, bulls do have the baton right now, and can cause pain, however short-lived.

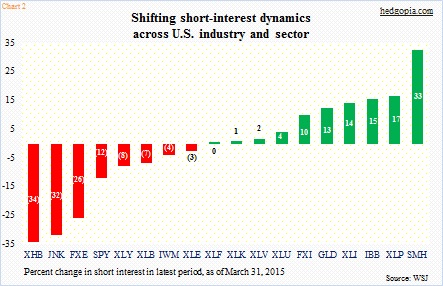

On a micro level, things are different (Chart 2).

Some notable changes include SPY (short interest down 12 percent, when index was only up 0.7 percent!), XHB (short interest down 34 percent, ETF up 3.9 percent), JNK (short interest down 32 percent, ETF up a mere 0.4 percent), SMH (short interest up 33 percent, ETF up 1.1 percent), among others.

Some of these shorts have paid dearly. Pure wrong timing!

Since March 31st, FXI has surged 15 percent (in seven sessions); short squeeze probably played a role. Also interesting is the decline in FXE short interest even as large specs continue to have sizable net shorts in euro futures. As well, XHB shorts cut back even as the ETF approached late-February highs.

SMH will be interesting this week and next. Several major U.S. chipmakers will be reporting, and the ETF just managed to poke its head out of the 52-56 range it has been in. Bulls can cause damage to these shorts if they can build on this new momentum.