To say that energy stocks are back in favor will be an exaggeration, but they have perked up of late.

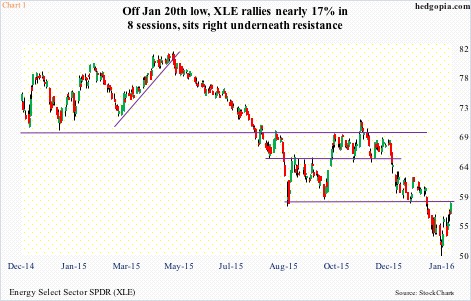

Off the January 20th intra-day low, XLE, the SPDR Energy ETF, has rallied north of 16 percent. That is in eight sessions. Not much if we consider the 30-percent drop in the past three months, but those who caught the recent lows are sitting with nice profit.

The question is, would the momentum continue or pause at best and reverse at worst?

Intermediate-term, there is reason to be optimistic. XLE’s weekly momentum indicators have turned up, with a pickup in volume the past couple of weeks. The hammer reversal in the prior week in particular was impressive.

That said, off the June 2014 high of $97.43 through the recent low, the ETF has suffered relentless selling. One after another, support gave way… means rallies will have to be able to absorb all the potential selling expected to occur at/near resistance.

Last Friday, XLE closed right underneath one such resistance (Chart 1).

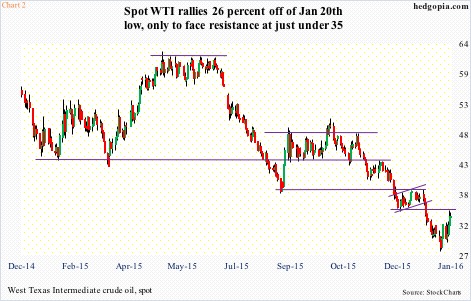

Ditto with spot West Texas Intermediate crude.

Between the January 20th intra-day low of $27.56 and the 28th high of $34.82, the WTI rallied north of 26 percent. Volume has noticeably picked up in the past several sessions. In the right circumstances, oil can rally – if nothing else, just to unwind oversold conditions.

However, similar to XLE, spot WTI, on the way down, lost several support zones, which will now resist rally attempts. The nearest resistance lies at $34.50-$35, which was tested last Thursday – unsuccessfully (Chart 2).

Oil’s recent rally can be attributed to part fatigue – fatigue of going down – and part rumors of possible Russian willingness to discuss output cutbacks.

Last Friday, talking to Bloomberg, Russian energy minister said Russia would participate in talks with both OPEC and non-OPEC nations that Venezuela has proposed for February. But there is no date and no confirmed meeting yet. Saudi Arabia in the meantime says it would continue to maintain its capital expenditures.

Through all this, crude supplies have continued to rise. In the week ended January 22nd, U.S. crude stocks rose 8.4 million barrels, to 494.9 million barrels – the highest ever (data goes back to 1982).

Near-term, if these rumors do not become reality, odds grow that at least some of the recent gains will be given back. Spot WTI produced a doji on Friday, and daily conditions are getting extended.

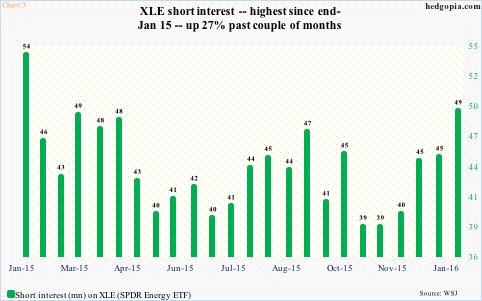

In a scenario in which the crude pulls back, XLE in all probability will follow suit. Shorts are positioned to benefit, should things unfold this way.

Short interest on XLE rose nine-plus percent in the latest period, to 49 million, and has gone up 27 percent in the past couple of months. In the past year, the only time it has been higher was at the end of January last year (Chart 3). Back then, the WTI went on to rally eight plus percent in the following period, as shorts got squeezed.

Could this happen again? Possible, especially if something substantive comes out of the afore-mentioned rumors.

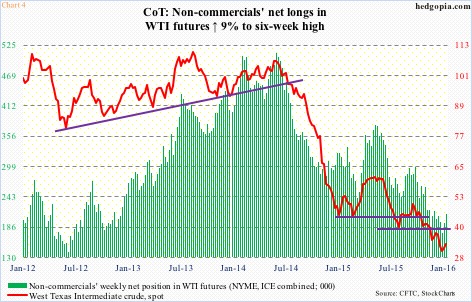

At least as of last Tuesday, non-commercials were not anticipating this. Net longs in WTI futures have gone up 20 percent in the past couple of weeks, but those holdings were the lowest since July 2012 (Chart 4). The latest increase is nothing much to speak of.

Put all this together, XLE longs have a decision to make. Should s/he continue to hold or bail out now and wait for a better signal for the next move?

To recall, on December 23rd, a buy-write was hypothetically initiated in which XLE was purchased at $59.54 with simultaneous selling of December 31st 60.50 calls for $0.57. These calls expired worthless, and the cost of the underlying effectively dropped to $58.97. This was then followed by back-to-back weekly covered calls for a cumulative $2.45. The cost further dropped to $56.52.

At one point, the trade was deeply in the red. With the recent rally in XLE ($58.21) and the premium earned through covered calls, it is now $1.69 in the green. Time to lock it in… and wait to see which way the wind blows next.

Thanks for reading!