The S&P 500 had not even dropped 10 percent from its record high from last month that there were calls for a 75-basis-point cut in an emergency Fed meeting. Three decades of the so-called Fed put have distorted the markets and spoiled the market participants. It is the Fed’s job not to acquiesce to these demands.

Markets have gone from rallying on bad data on rate-cut hopes to rallying on good data. Last Thursday, seasonally adjusted weekly jobless claims for unemployment insurance fell 17,000 in the latest week to 233,000, which was less than the consensus estimate of 240,000, and stocks rallied big.

The newfound love for positive macro data follows a growth scare post-July jobs report. On the 2nd (Friday), it was reported that the economy created 114,000 non-farm jobs and that the unemployment rate rose to 4.3 percent. On both fronts, it was worse than what the economists were expecting. The S&P 500 gave back 1.8 percent in that session, followed by a decline of three percent on the following Monday.

Last Thursday, however, on the back of the claims data, the large cap index rallied 2.3 percent, with momentum continuing Friday. For the week, it reversed higher from down 4.2 percent at Monday’s low to essentially unchanged.

Of the 550 points lost between the July 16th high and the August 5th low, 225 points have been retraced. A .618 Fibonacci retracement of this loss lies at 5459. It so happens that this level not only approximates the 50-day moving average (5446) but also lines up with two-month lateral resistance and the underside of a broken trendline from last October’s low (Chart 1). As things stand, shorts might be interested in reentering their position at this level.

There is no question the economy is decelerating. In the first seven months this year, an average 203,000 non-farm jobs were added each month. This compares with last year when an average 251,000 jobs were created; in 2022, the monthly average was 377,000.

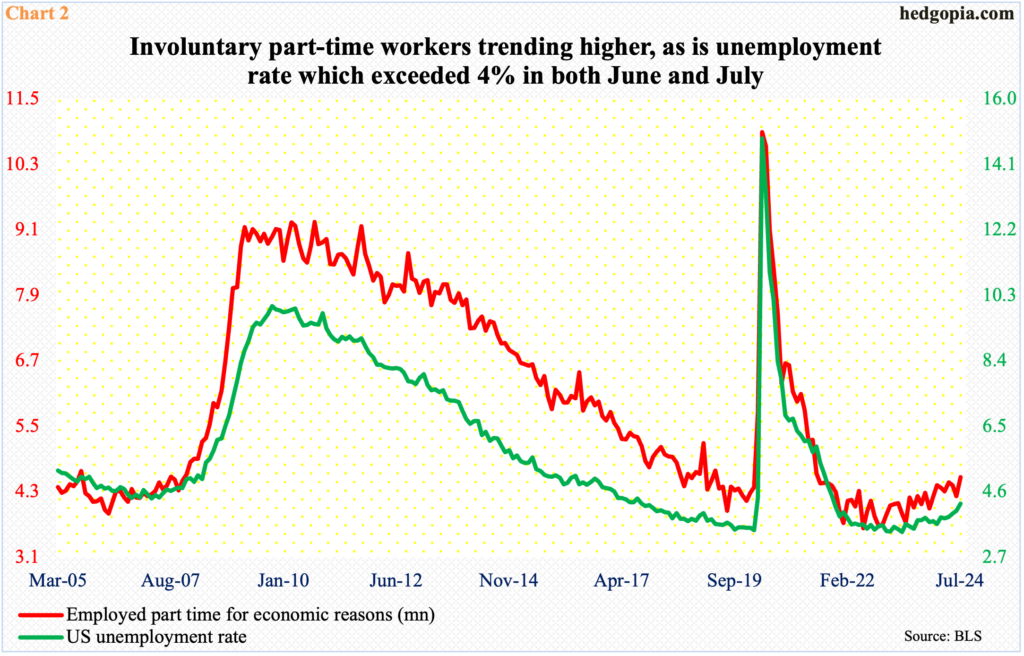

It only makes sense that involuntary part-time workers are on the way up (Chart 2). In July, their count was 4.57 million, up 346,000 month-over-month. Although the series bottomed at 3.63 million in June 2022, it was at 3.74 million in May 2023 and at 3.99 million as recently as last November. The gradual deterioration jibes with an unemployment rate that has gone from 3.66 percent in January to 4.25 percent in July, having earlier bottomed at a 54-year low of 3.43 percent in April 2023.

Odds favor most data will continue to soften in the months and quarters ahead. This is a headwind for the equity bulls, now that they are focused on the data as they are. This also means they will put pressure on the Federal Reserve to aggressively cut rates. We already saw this unfold last week.

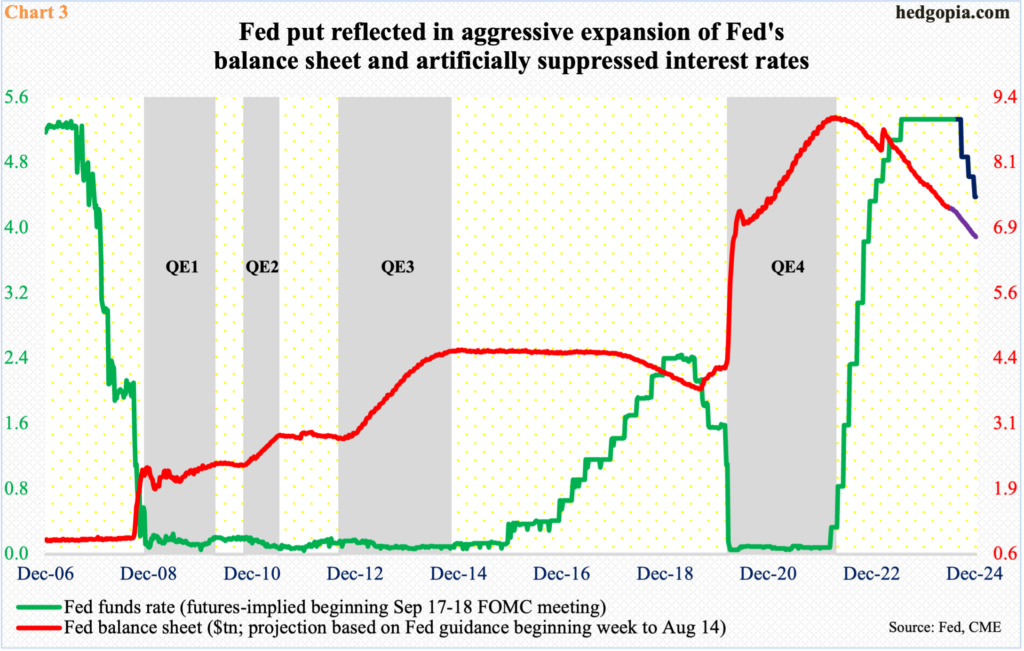

At one time early last week, some even called for a 75-basis-point cut in an emergency Federal Reserve meeting! The central bank has left the fed funds rate unchanged at a range of 525 basis points to 550 basis points since July last year. It earlier began to tighten in March 2022 when the benchmark rates were languishing between zero and 25 basis points.

During the July meeting, the Fed strongly hinted that they were ready to cut by 25 basis points in September. After the July jobs report, futures traders immediately priced in a 50-basis-point cut in the upcoming meeting (September 17-18). Never mind the fact that late last year-early this year, they were expecting up to seven 25-basis-point cuts this year. They now expect 100 basis points of cuts.

Investors have been spoiled by the so-called Fed put, which essentially ensures the central bank steps in with expansionary monetary policy to put a stop to excessive declines in stocks. Alan Greenspan (1987-2006) dealt with the 1987 crash by committing the Fed’s “readiness to serve as a source of liquidity to support the economic and financial system”. Excessive liquidity creation is probably what caused the dot-com bubble and the housing bubble. His successors – Ben Bernanke (2006-2014) and Janet Yellen (2014-2018) – were no exceptions. This is evident in the parabolic rise in the Fed’s balance sheet and in the suppressed fed funds rate (Chart 3).

Hopefully, Jerome Powell, the current chairman, is not going to commit the same mistake. Yes, a decline in the stock market can set in motion the wealth effect, thereby adversely impacting consumer sentiment and spending, and by default, jobs and the economy. At the same time, it is also during economic contraction that the uncompetitive go by the wayside and the strong survive, thus laying the foundation for the next up cycle.

Unfortunately, the Fed put robs the economy of the natural cycle from taking its course, leading to speculation, high valuations and distortions. That said, markets will use every opportunity they get to demand excess liquidity. It is the Fed’s job not to acquiesce to these demands.

Thanks for reading!