The two-day FOMC meeting ends today. Unlike calls from some major brokers not to raise, the policy-setting body in all probability will hike by 25 basis points to a range of 475 basis points to 500 basis points. More importantly, it is unlikely to yield to market demands for a pause, followed by several cuts by year-end.

Merely two weeks ago, Federal Reserve Chair Jerome Powell told Congress that the central bank may be forced to hike rates more than expected because of elevated and sticky inflation. In the futures market, the benchmark rates at the time were expected to rise as high as 550 basis points to 575 basis points by September, ending the year between 525 basis points and 550 basis points. Soon after, Silicon Valley Bank and Signature Bank collapsed, forcing the Treasury, the FDIC (Federal Deposit Insurance Corporation) and the Fed into action; several confidence-boosting measures were introduced. For now, the situation looks contained.

The two-year treasury yield, which is the most sensitive to the central bank’s monetary policy, tumbled from 5.05 percent on the 8th (this month) to a low of 3.81 percent on the 17th, closing Tuesday at 4.17 percent. Futures traders, who have been vacillating quite a lot of late, now expect the Fed to hike one more time after a 25-basis-point raise today, reach a terminal rate of 500 basis points to 525 basis points and then begin to lower by June and end 2023 at 425 basis points to 450 basis points (Chart 1). Toward the end of last week, amidst heightened bank turmoil, they expected 2023 to end between 350 and 375 basis points. That is how volatile rate expectations have been the past couple of weeks.

Post-SVB, there has been a chorus of voices calling for a pause in this week’s meeting, including Goldman Sachs and JP Morgan. Even the futures market is not in agreement with this, although these traders do expect three 25-basis-point cuts this year once the terminal rate is hit in May. Odds heavily favor the market is mispricing where the fed funds rate ends up by the end of the year.

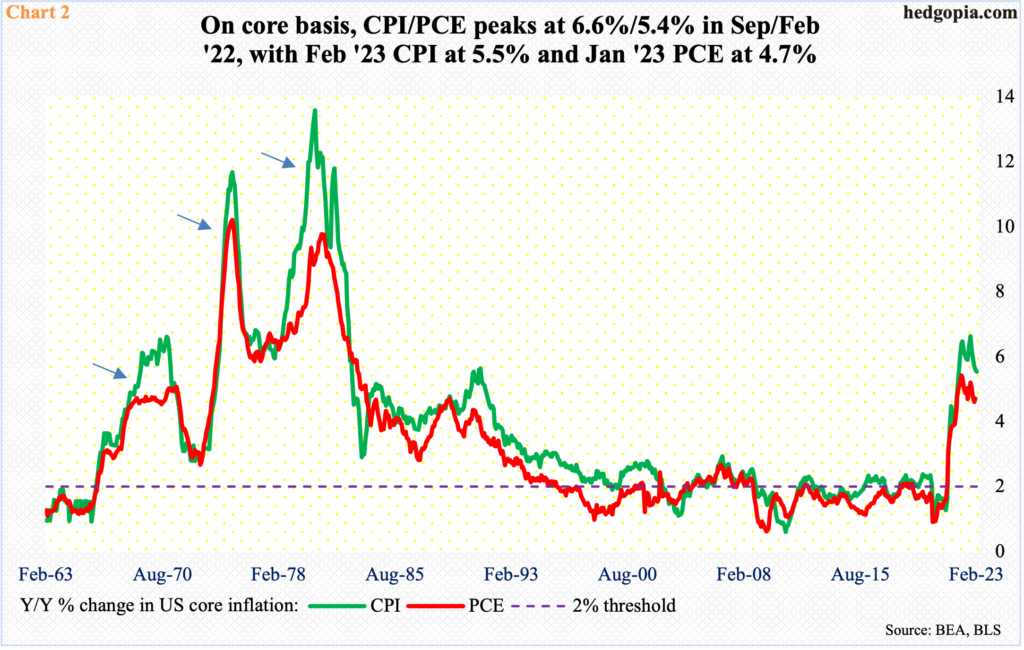

Of its dual mandate of maximum employment and price stability, the Fed is currently focused on the latter. Inflation, which remains too high for its comfort, has been trending lower, but, if past is prelude, could easily resurge at the slightest opportunity. This was evident in the ’70s (arrows in Chart 2).

In the 12 months to February, core CPI (consumer price index) jumped 5.5 percent in February, having peaked at 6.6 percent last September. Similarly, core PCE (personal consumption expenditures) in the 12 months to January increased 4.7 percent, peaking at 5.4 percent last February. The Fed has a two percent objective on core PCE.

Thus, the Fed likely will try to use the benchmark rates to contain inflation as needed and use other tools to contain possible contagion post-SVB. Already, its balance sheet expanded $297 billion in the week to last Wednesday to $8.64 trillion (Chart 1). A language to this effect – either in the post-meeting statement or during Powell’s press conference, has the potential to surprise the markets. He is not going to commit to a pause – not yet anyway.

Thanks for reading!