Yet again, equity bulls successfully denied bears of an opportunity to build on incipient downside momentum. Action in the last two weeks had given the latter some opening, but the door was slammed shut after Wednesday’s FOMC meeting. It increasingly feels like there is a bias to cut interest rates.

Going into this week’s FOMC meeting, the S&P 500 showed some early signs of exhaustion. From last October’s low through the March 8th high of 5189, the large cap index was up 26.5 percent, rallying in 16 out of 20 weeks; the last two weeks saw minor drops, but both produced large upper shadows. This was a potential opening for the bears.

The index also closed last week right on a rising trend line from last October’s low (Chart 1). (The Russell 2000 sat on a similar trend line, while the Nasdaq 100 experienced a marginal breach. This support is now intact on both.) A decisive breach of the trend line could have swung the door open for the bears.

Sitting on important support, the S&P 500 began the week with decent gains in the first two sessions. Come Wednesday, it rallied another 0.9 percent to 5225, with a new intraday high of 5226. For several sessions, sellers showed up at 5170s, which has now been taken care of.

The catalyst for Wednesday’s jump was the conclusion of the two-day FOMC meeting that day.

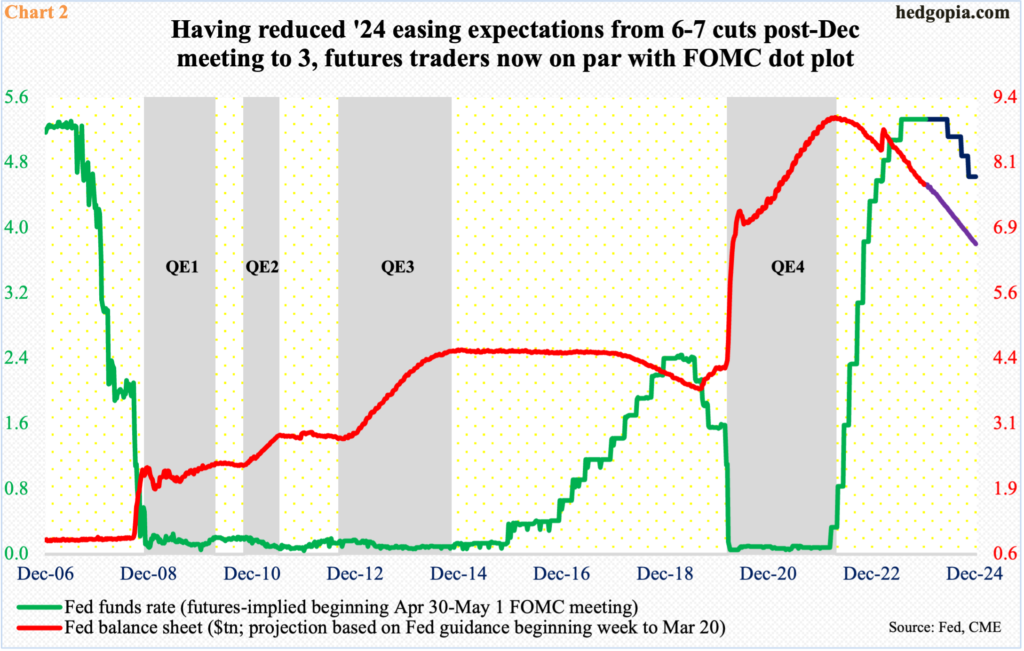

Ahead of the meeting, markets were on pins and needles as to if the FOMC dot plot would scale back rate expectations this year to two cuts from three at the December meeting. In recent weeks, economic data were coming in stronger than expected, even as February’s CPI (consumer price index) and PCE (personal consumption expenditures) – not to mention producer prices – easily exceeded expectations. In the futures market, traders, who not that long ago were expecting six to seven 25-basis-point cuts, were now expecting three.

Markets heaved a big sigh of relief Wednesday as the dot plot showed that the members are staying the course for three cuts. More interesting is the fact that the officials shifted up their inflation outlook this year to 2.6 percent from 2.4 percent, even as growth forecast of real GDP went from 1.4 percent to 2.1 percent, while the unemployment rate is expected to end the year at four percent from the previous 4.1 percent.

The Fed is more optimistic about the economy, expects higher inflation and lower unemployment rate, yet it still feels three cuts are needed. As early as the September meeting, the dot plot penciled in two cuts. In the last six months, the economy has proven to be much more resilient than thought at the time.

Translation: in an election year, this is a Fed that seems intent on cutting, no matter what. Previously, Chair Jerome Powell talked about the easing of financial conditions and the upward pressure it could put on consumer spending/inflation. This concern has been put on the back burner.

Stocks are sensing this and are rallying. This is potentially a recipe for investor sentiment – already frothy – to get frothier.

Thanks for reading!